Form 1041 QFT U S Income Tax Return for Qualified Funeral Trusts 2013

What is the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

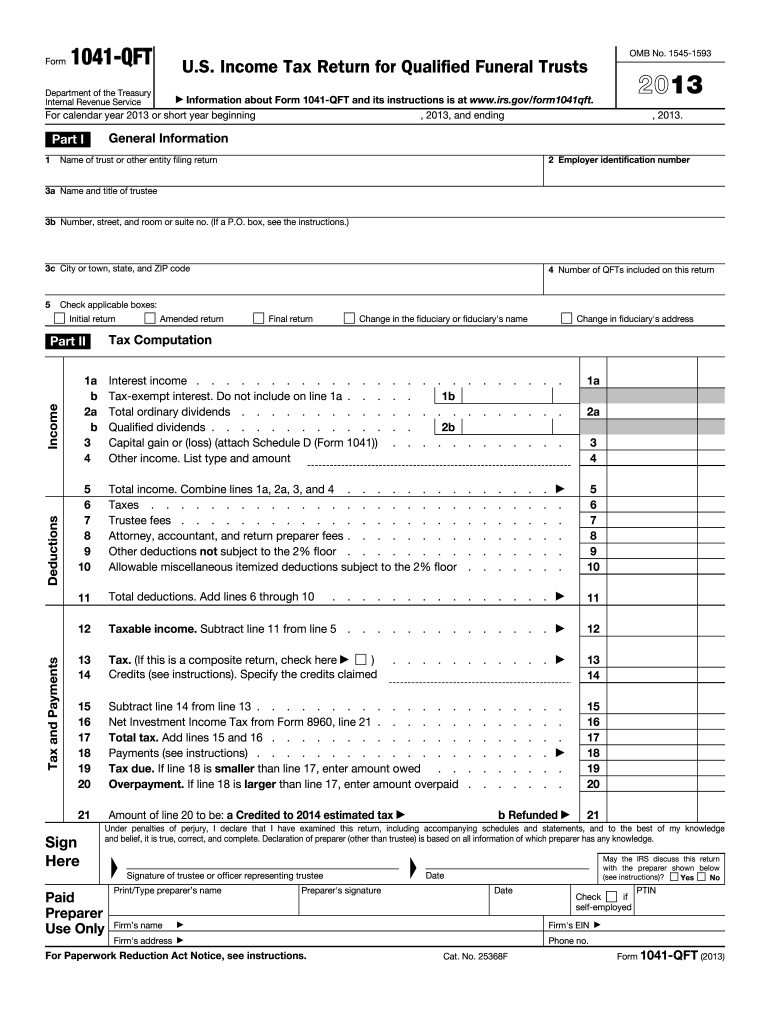

The Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts is a tax document specifically designed for reporting income generated by qualified funeral trusts. These trusts are established to manage funds for funeral expenses, providing a means for individuals to pre-pay their funeral costs while ensuring that the funds are used accordingly. The form must be filed annually by the trust, detailing income, deductions, and any taxes owed, ensuring compliance with IRS regulations.

How to use the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Using the Form 1041 QFT involves several steps to ensure accurate reporting of the trust's income and expenses. First, gather all necessary financial documents related to the trust, including income statements and expense receipts. Next, fill out the form with the required information, such as the trust’s name, Employer Identification Number (EIN), and details about income and deductions. Once completed, the form can be submitted electronically or by mail to the IRS, depending on the preferred filing method.

Steps to complete the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

Completing the Form 1041 QFT involves a systematic approach:

- Gather all relevant financial documents, including income and expense records.

- Enter the trust's identifying information, including name and EIN.

- Report all sources of income generated by the trust.

- List allowable deductions, such as funeral-related expenses.

- Calculate the total income and deductions to determine the taxable amount.

- Sign and date the form before submission.

Legal use of the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

The legal use of the Form 1041 QFT is crucial for compliance with federal tax regulations. Filing this form accurately ensures that the trust meets its obligations under the Internal Revenue Code. It is important to maintain thorough records of all transactions related to the trust, as these may be required for audits or inquiries by the IRS. Proper use of the form helps protect the trust from potential legal issues and penalties.

Filing Deadlines / Important Dates

The filing deadline for the Form 1041 QFT typically aligns with the tax year of the trust. Generally, the form must be filed by the 15th day of the fourth month following the end of the tax year. For trusts operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it is extended to the next business day. It is essential to adhere to these deadlines to avoid penalties.

Required Documents

To complete the Form 1041 QFT, several documents are necessary:

- Financial statements showing income generated by the trust.

- Receipts for funeral-related expenses.

- Trust agreement or documentation outlining the terms of the trust.

- Previous year's tax return, if applicable.

Having these documents ready will streamline the filing process and ensure all information is accurately reported.

Quick guide on how to complete 2017 form 1041 qft us income tax return for qualified funeral trusts

Effortlessly complete Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts on any device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Handle Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and electronically sign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts without hassle

- Find Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools provided specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2017 form 1041 qft us income tax return for qualified funeral trusts

Create this form in 5 minutes!

How to create an eSignature for the 2017 form 1041 qft us income tax return for qualified funeral trusts

How to create an eSignature for a PDF file online

How to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to create an electronic signature from your mobile device

How to generate an eSignature for a PDF file on iOS

How to create an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts?

The Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts is specifically designed for reporting income generated by qualified funeral trusts. This form helps trust administrators fulfill their tax obligations while ensuring compliance with IRS regulations. By using airSlate SignNow, you can easily manage this form and simplify the eSigning process.

-

What are the benefits of using airSlate SignNow for Form 1041 QFT U S Income Tax Returns?

Using airSlate SignNow for your Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts offers several benefits such as ease of use, secure document management, and quick eSigning features. Our platform streamlines the completion process, ensuring data accuracy and compliance with IRS requirements. Additionally, it saves time and reduces paperwork.

-

How does airSlate SignNow ensure the security of my Form 1041 QFT U S Income Tax Return?

airSlate SignNow prioritizes security, employing encryption and compliance protocols to protect sensitive information related to your Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts. We utilize secure servers and access controls to safeguard your data, ensuring that only authorized users can access it during the signing process.

-

What features are included in the airSlate SignNow platform?

airSlate SignNow includes a variety of features designed to facilitate the signing process for forms like the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts. Key features include customizable templates, document tracking, team collaboration tools, and integration with popular applications. These tools enhance productivity and streamline operations for tax professionals.

-

Is there a pricing plan available for using airSlate SignNow for tax forms?

Yes, airSlate SignNow offers flexible pricing plans suitable for both individual users and larger organizations needing to manage the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts. Our pricing is competitive and designed to provide excellent value with plans that scale based on the number of users and features needed. You can choose a plan that fits your specific needs.

-

Can I integrate airSlate SignNow with other software I use for tax preparation?

Absolutely! airSlate SignNow is designed to easily integrate with various software applications commonly used for tax preparation and management. This compatibility allows you to efficiently handle the Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts alongside your existing tools, enhancing your workflow and reducing manual entry.

-

How can airSlate SignNow help ensure compliance for my Form 1041 QFT U S Income Tax Return?

airSlate SignNow helps ensure compliance with tax regulations through automatic updates and legal compliance features built into our platform. By using our service for your Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts, you can stay informed on any changes to tax laws, minimizing the risk of errors and potential penalties.

Get more for Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- Verification of creditors matrix georgia form

- Georgia creditors form

- Verification of creditors matrix georgia 497303899 form

- Correction statement and agreement georgia form

- Georgia closing form

- Flood zone statement and authorization georgia form

- Name affidavit of buyer georgia form

- Georgia affidavit form

Find out other Form 1041 QFT U S Income Tax Return For Qualified Funeral Trusts

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors