Form 4797 2012

What is the Form 4797

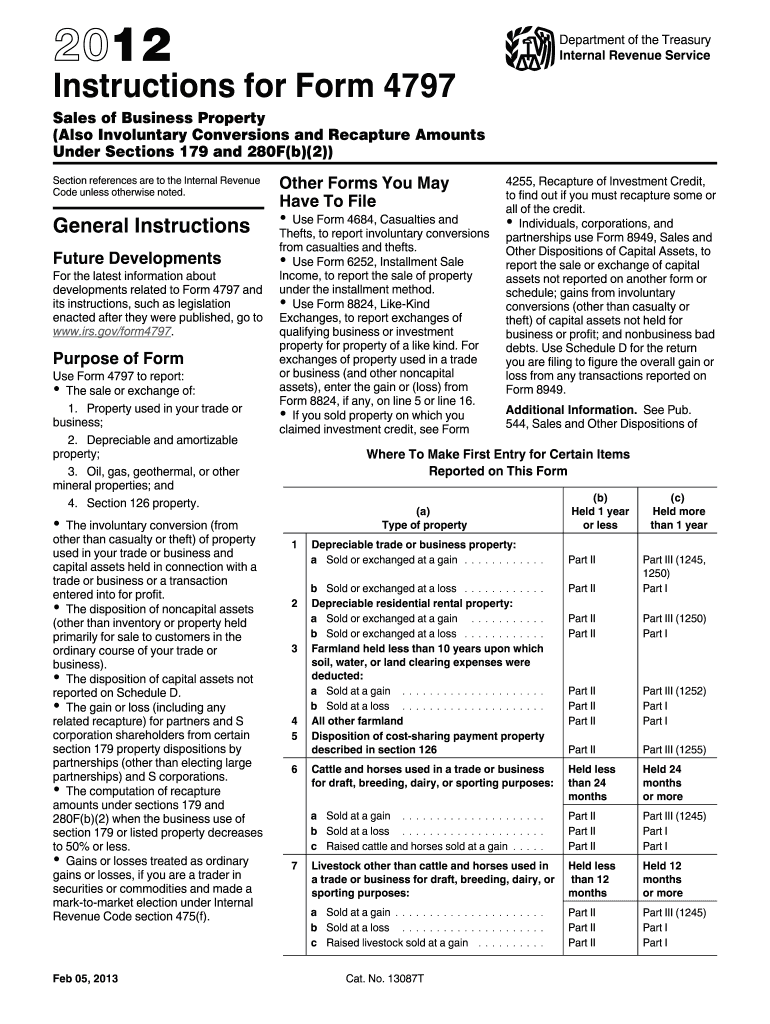

The Form 4797, also known as the Sales of Business Property form, is used by taxpayers in the United States to report the sale or exchange of business property. This form is essential for individuals or entities that have disposed of assets used in a trade or business, including real estate, equipment, and other tangible assets. The information reported on Form 4797 helps the IRS determine any gain or loss from these transactions, which can significantly impact a taxpayer's overall tax liability.

How to use the Form 4797

Using Form 4797 involves a few key steps. First, gather all necessary documentation related to the sale or exchange of business property, including purchase prices, sale prices, and any associated costs. Next, accurately fill out the form by detailing each transaction, including the type of property sold, the date of acquisition, and the date of sale. Finally, ensure that all calculations are correct, as they will determine the gain or loss reported on your tax return. It is advisable to consult with a tax professional if you have any uncertainties during this process.

Steps to complete the Form 4797

Completing Form 4797 requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- List each property sold or exchanged in Part I, including the description, date acquired, date sold, and sales price.

- Calculate the gain or loss for each property by subtracting the adjusted basis from the sales price.

- Complete Part II if you are reporting the sale of Section 1231 property, which includes real estate used in a trade or business.

- Finally, transfer the total gain or loss to your main tax return, typically Form 1040 or Form 1120, depending on your filing status.

Legal use of the Form 4797

Form 4797 is legally binding when completed accurately and submitted to the IRS. It must be filed in accordance with IRS guidelines to ensure compliance with tax laws. The form serves as an official record of the sale or exchange of business property, and any misrepresentation or failure to file can lead to penalties. It is crucial to maintain accurate records and documentation to support the information reported on the form, as the IRS may request this documentation during audits.

Filing Deadlines / Important Dates

The filing deadline for Form 4797 typically aligns with the due date for your income tax return. For most individual taxpayers, this is April 15 of the following year. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties and interest. It is essential to stay informed about any changes to filing dates, especially if you are filing for a business entity, as deadlines may vary.

Required Documents

To complete Form 4797, you will need several key documents, including:

- Sales contracts or agreements related to the property sold.

- Records of the original purchase price and any improvements made to the property.

- Documentation of any expenses incurred during the sale process, such as commissions or legal fees.

- Previous tax returns that may provide context for the property’s adjusted basis.

Examples of using the Form 4797

Form 4797 can be used in various scenarios, such as:

- A business selling a piece of equipment that has been fully depreciated.

- An individual selling a rental property that has been held for investment.

- A partnership dissolving and selling its assets, requiring each partner to report their share of the gain or loss.

These examples illustrate the form's applicability across different types of business transactions, emphasizing its importance in accurately reporting financial activities to the IRS.

Quick guide on how to complete form 4797 2012

Effortlessly Prepare Form 4797 on Any Device

Digital document management has gained traction among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents promptly and without delays. Manage Form 4797 on any platform using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to edit and eSign Form 4797 with ease

- Obtain Form 4797 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then click on the Done button to save your changes.

- Choose your delivery method for the form: by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 4797 and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 4797 2012

Create this form in 5 minutes!

How to create an eSignature for the form 4797 2012

How to create an eSignature for a PDF file in the online mode

How to create an eSignature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature straight from your smartphone

How to generate an eSignature for a PDF file on iOS devices

How to create an electronic signature for a PDF document on Android

People also ask

-

What is Form 4797 and why is it important?

Form 4797 is a tax form used to report the sale of business property and certain transactions involving capital assets. It's important because it helps businesses accurately report their gains and losses to the IRS, ensuring compliance and avoiding potential penalties. Utilizing airSlate SignNow for electronically signing Form 4797 can streamline this process.

-

How does airSlate SignNow simplify the signing of Form 4797?

airSlate SignNow simplifies the signing of Form 4797 by providing an intuitive interface for users to easily eSign documents online. Users can send the form to multiple signers and track the status in real time, ensuring that necessary approvals are obtained quickly. This makes the workflow more efficient and reduces paper clutter.

-

Can I store my completed Form 4797 with airSlate SignNow?

Yes, airSlate SignNow offers secure cloud storage for all your signed documents, including Form 4797. This feature allows you to easily access, organize, and manage your forms at any time, reducing the risk of losing important tax documentation. Additionally, your data is protected with top-notch security measures.

-

What are the pricing options for using airSlate SignNow to manage Form 4797?

airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals and larger teams. Each plan provides features such as unlimited document signing, templates, and integrations, allowing you to efficiently manage Form 4797 at a cost-effective price. A free trial is also available for users to test the services.

-

Does airSlate SignNow integrate with other accounting software for Form 4797?

Yes, airSlate SignNow integrates with leading accounting software, making it easy to manage Form 4797 alongside your financial records. This allows you to automate workflows, ensuring that your tax forms and related financial documents are seamlessly aligned. Popular integrations include QuickBooks, Xero, and others.

-

What are the benefits of using airSlate SignNow for tax documents like Form 4797?

Using airSlate SignNow for tax documents such as Form 4797 maximizes efficiency by reducing turnaround time for obtaining signatures. The platform enhances collaboration among team members and clients, allowing you to focus on important business activities. Additionally, you'll have a legally binding record of all transactions.

-

Is airSlate SignNow compliant with legal standards for signing Form 4797?

Absolutely, airSlate SignNow is compliant with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). This compliance ensures that your electronically signed Form 4797 holds the same legal standing as a traditional paper signature. You can sign confidently knowing your forms are valid.

Get more for Form 4797

- Non foreign affidavit under irc 1445 georgia form

- Owners or sellers affidavit of no liens georgia form

- Affidavit financial status 497303907 form

- Complex will with credit shelter marital trust for large estates georgia form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497303911 form

- Marital legal separation and property settlement agreement minor children no joint property or debts where divorce action filed 497303912 form

- Marital legal separation and property settlement agreement minor children no joint property or debts effective immediately 497303913 form

- Marital legal separation and property settlement agreement minor children parties may have joint property or debts where 497303914 form

Find out other Form 4797

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe