Schedule D Form 2012

What is the Schedule D Form

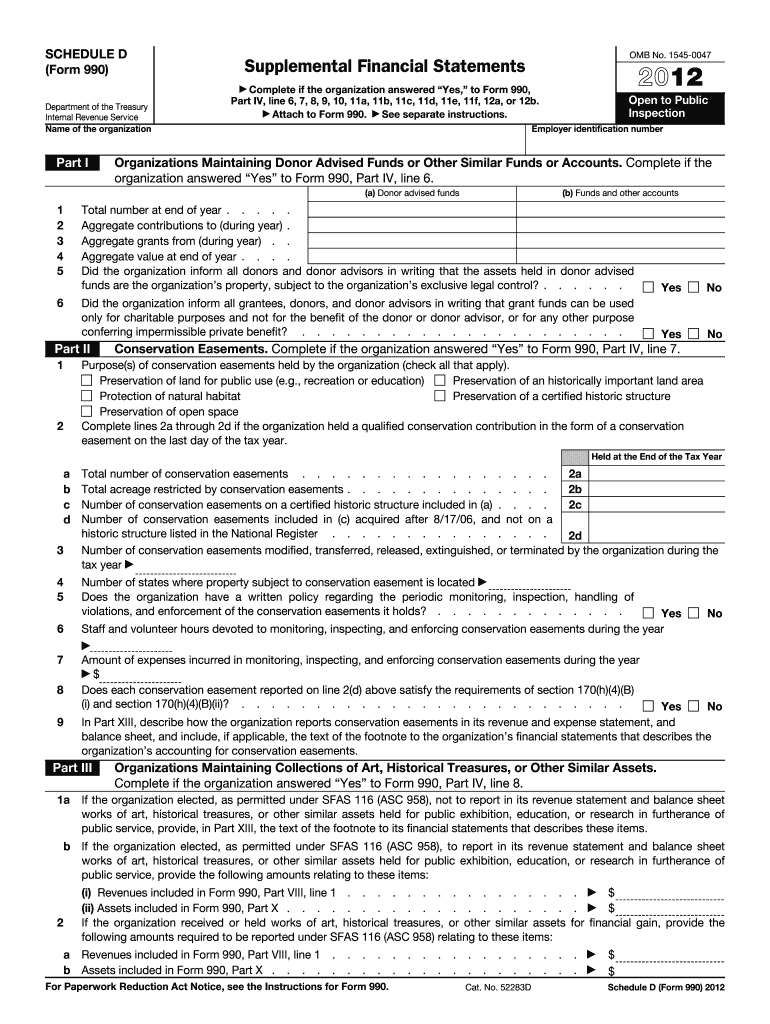

The Schedule D Form is a tax document used by individuals and businesses in the United States to report capital gains and losses from the sale of assets. This form is essential for calculating the overall tax liability related to these transactions. It provides a detailed account of each sale, including the date of acquisition, date of sale, proceeds from the sale, and the cost basis of the asset. Understanding how to properly fill out this form is crucial for ensuring compliance with IRS regulations.

How to use the Schedule D Form

Using the Schedule D Form involves several steps. First, gather all relevant information regarding your capital assets, including purchase and sale dates, amounts, and any associated costs. Next, fill out the form by categorizing your gains and losses into short-term and long-term sections. Short-term gains are typically taxed at ordinary income rates, while long-term gains may benefit from lower tax rates. Finally, ensure that all calculations are accurate and that the form is submitted along with your tax return.

Steps to complete the Schedule D Form

Completing the Schedule D Form requires careful attention to detail. Follow these steps:

- Collect all necessary information about your capital transactions.

- Determine whether each transaction results in a gain or a loss.

- Separate your transactions into short-term and long-term categories.

- Fill out the appropriate sections of the form, including the summary of your total gains and losses.

- Double-check your entries for accuracy before submission.

Legal use of the Schedule D Form

The Schedule D Form must be filled out in compliance with IRS regulations. It is legally binding and should be completed accurately to avoid penalties. Any discrepancies or inaccuracies can lead to audits or additional taxes owed. It is important to maintain records of all transactions reported on the form for at least three years, as the IRS may request documentation to verify the information provided.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule D Form typically align with the annual tax return deadlines. Generally, individual tax returns are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is advisable to check for any changes in deadlines or extensions that may apply to your specific situation.

Form Submission Methods (Online / Mail / In-Person)

The Schedule D Form can be submitted through various methods. Many taxpayers choose to file electronically, which can expedite processing times and reduce errors. Alternatively, the form can be printed and mailed to the IRS. In some cases, individuals may also have the option to submit the form in person at designated IRS offices. Each method has its own requirements and processing times, so it is important to choose the one that best fits your needs.

Quick guide on how to complete 2012 schedule d form 6954555

Complete Schedule D Form effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitution to conventional printed and signed papers, as you can obtain the correct format and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Schedule D Form on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The easiest way to amend and eSign Schedule D Form without effort

- Find Schedule D Form and select Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or conceal sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to submit your form, by email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tiring document searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule D Form and guarantee excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 schedule d form 6954555

Create this form in 5 minutes!

How to create an eSignature for the 2012 schedule d form 6954555

How to create an eSignature for your PDF online

How to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

How to generate an eSignature for a PDF on Android

People also ask

-

What is a Schedule D Form and why is it important?

The Schedule D Form is a crucial tax document used to report capital gains and losses from the sale of securities. Understanding how to properly fill out the Schedule D Form can help taxpayers accurately calculate their tax liability and ensure compliance with IRS regulations.

-

How can airSlate SignNow help me with the Schedule D Form?

airSlate SignNow streamlines the process of preparing and signing your Schedule D Form by enabling users to easily upload, edit, and eSign documents. This ensures that your Form is filled out correctly and submitted on time without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for the Schedule D Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including features tailored for managing forms like the Schedule D Form. With affordable options, businesses can choose a plan that fits their requirements without overspending.

-

Are there any integrations available for the Schedule D Form?

AirSlate SignNow integrates seamlessly with various accounting and tax software, which simplifies the handling of documents like the Schedule D Form. This integration allows for easy data transfer and ensures that your information remains consistent across platforms.

-

Can I send and receive the Schedule D Form through airSlate SignNow?

Absolutely! With airSlate SignNow, you can securely send and receive your Schedule D Form electronically. This feature modernizes your document handling process and speeds up collaboration with tax professionals.

-

What security measures does airSlate SignNow implement for the Schedule D Form?

airSlate SignNow takes security seriously by employing encryption and secure data storage to protect sensitive documents like the Schedule D Form. You can be confident that your information is safe while using our platform.

-

How quickly can I eSign and complete my Schedule D Form with airSlate SignNow?

Using airSlate SignNow, you can eSign and finalize your Schedule D Form quickly, often in just a few minutes. Our user-friendly interface makes it easy to complete your form efficiently, saving you valuable time.

Get more for Schedule D Form

Find out other Schedule D Form

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF