Irs Form 668 W C Do Printable 2003-2026

What is the IRS Form 668-A?

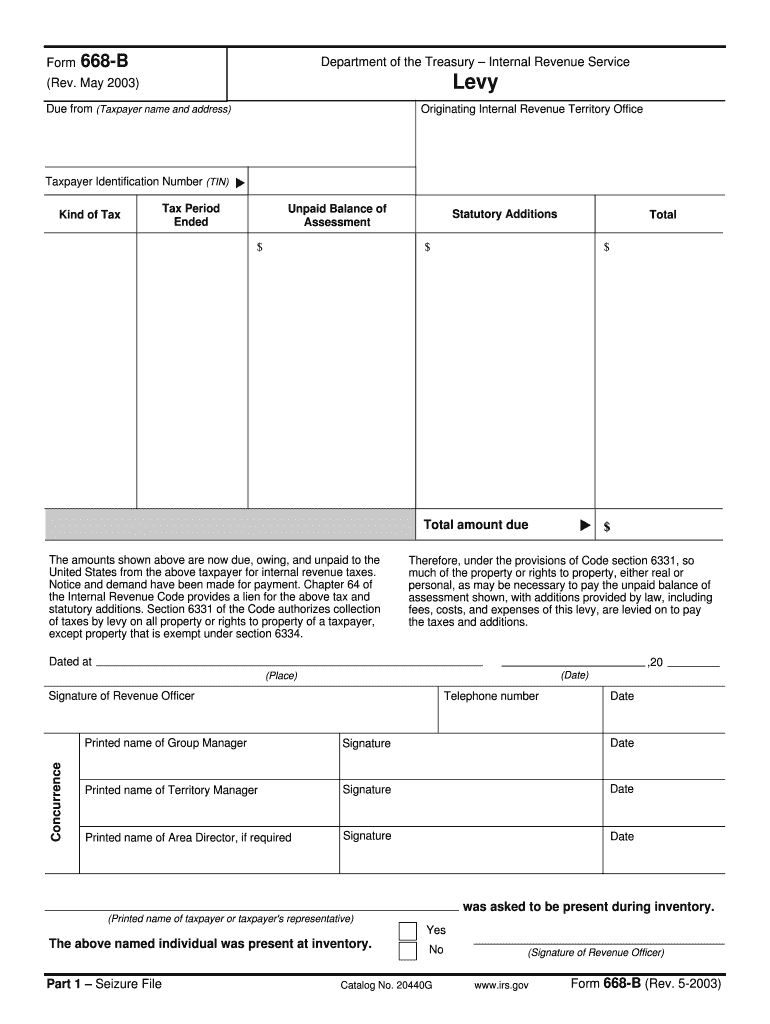

The IRS Form 668-A is a legal document used by the Internal Revenue Service (IRS) to notify taxpayers of a tax levy. This form serves as a seizure notice, informing individuals or businesses that the IRS has taken action to collect unpaid taxes by levying their assets. The form outlines the specifics of the levy, including the amount owed and the assets being targeted. Understanding this form is crucial for taxpayers facing tax collection actions.

Key elements of the IRS Form 668-A

The IRS Form 668-A contains several important elements that taxpayers should be aware of:

- Taxpayer Information: This includes the name, address, and taxpayer identification number of the individual or business.

- Details of the Levy: The form specifies the type of assets being seized, such as bank accounts, wages, or property.

- Amount Owed: It clearly states the total amount of tax liability that prompted the levy.

- Rights of the Taxpayer: The form outlines the taxpayer's rights, including the ability to appeal the levy or request a hearing.

Steps to complete the IRS Form 668-A

Completing the IRS Form 668-A involves a few key steps:

- Gather Required Information: Collect all necessary details, including your taxpayer identification number and information about the assets being levied.

- Fill Out the Form: Accurately complete all sections of the form, ensuring that all required fields are filled out.

- Review for Accuracy: Double-check the information for any errors or omissions before submitting.

- Submit the Form: Follow the appropriate submission methods as outlined by the IRS, which may include mailing the form or submitting it electronically if permitted.

Legal use of the IRS Form 668-A

The IRS Form 668-A is legally binding and must be used in compliance with IRS regulations. Taxpayers have the right to contest the levy by filing a request for a hearing or appealing the decision. It is essential to understand the legal implications of the form, as it can affect your financial situation and rights as a taxpayer. Consulting with a tax professional may be beneficial to navigate the complexities surrounding tax levies.

Form Submission Methods

Taxpayers can submit the IRS Form 668-A through various methods, depending on the IRS guidelines. Common submission methods include:

- Mail: Sending a physical copy of the completed form to the appropriate IRS address.

- Online Submission: If available, using the IRS e-file system to submit the form electronically.

- In-Person: Delivering the form directly to an IRS office, if necessary.

Penalties for Non-Compliance

Failing to comply with the IRS Form 668-A can result in serious consequences. Taxpayers who do not respond to the levy notice risk further collection actions, including additional penalties and interest on the owed amount. It is crucial to address the form promptly and seek resolution to avoid escalating financial issues.

Quick guide on how to complete irs form 668 a 2003 2018

Uncover the most efficient method to complete and sign your Irs Form 668 W C Do Printable

Are you still spending time preparing your official documents on paper instead of doing it online? airSlate SignNow provides a superior method to complete and sign your Irs Form 668 W C Do Printable and similar forms for public services. Our intelligent electronic signature solution equips you with everything necessary to handle paperwork swiftly and in compliance with official standards - robust PDF editing, management, protection, signing, and sharing tools all available within an easy-to-use interface.

Only a few steps are needed to complete and sign your Irs Form 668 W C Do Printable:

- Upload the editable template to the editor via the Get Form button.

- Verify what information you need to include in your Irs Form 668 W C Do Printable.

- Move between the fields using the Next option to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the blanks with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Mark what is signNow or Obscure areas that are no longer relevant.

- Click on Sign to create a legally binding electronic signature using any method you prefer.

- Add the Date next to your signature and finalize your work with the Done button.

Store your finished Irs Form 668 W C Do Printable in the Documents folder within your account, download it, or send it to your chosen cloud storage. Our solution also provides flexible file sharing options. There’s no need to print your forms when you need to submit them to the appropriate public office - you can do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

Find and fill out the correct irs form 668 a 2003 2018

FAQs

-

How can I fill out an IRS form 8379?

Form 8379, the Injured Spouse declaration, is used to ensure that a spouse’s share of a refund from a joint tax return is not used by the IRS as an offset to pay a tax obligation of the other spouse.Before you file this, make sure that you know the difference between this and the Innocent Spouse declaration, Form 8857. You use Form 8379 when your spouse owes money for a legally enforeceable tax debt (such as a student loan which is in default) for which you are not jointly liable. You use Form 8857 when you want to be released from tax liability for an understatement of tax that resulted from actions taken by your spouse of which you had no knowledge, and had no reason to know.As the other answers have specified, you follow the Instructions for Form 8379 (11/2016) on the IRS Web site to actually fill it out.

-

For taxes, does one have to fill out a federal IRS form and a state IRS form?

No, taxes are handled separately between state and federal governments in the United States.The IRS (Internal Revenue Service) is a federal, not state agency.You will be required to fill out the the necessary tax documentation for your federal income annually and submit them to the IRS by April 15th of that year. You can receive extensions for this; but you have to apply for those extensions.As far as state taxes go, 41 states require you to fill out an income tax return annually. They can either mail you those forms or they be downloaded from online. They are also available for free at various locations around the state.Nine states have no tax on personal income, so there is no need to fill out a state tax return unless you are a business owner.Reference:www.irs.gov

-

How do I fill out the IIFT 2018 application form?

Hi!IIFT MBA (IB) Application Form 2018 – The last date to submit the Application Form of IIFT 2018 has been extended. As per the initial notice, the last date to submit the application form was September 08, 2017. However, now the candidates may submit it untill September 15, 2017. The exam date for IIFT 2018 has also been shifted to December 03, 2017. The candidates will only be issued the admit card, if they will submit IIFT application form and fee in the prescribed format. Before filling the IIFT application form, the candidates must check the eligibility criteria because ineligible candidates will not be granted admission. The application fee for candidates is Rs. 1550, however, the candidates belonging to SC/STPWD category only need to pay Rs. 775. Check procedure to submit IIFT Application Form 2018, fee details and more information from the article below.Latest – Last date to submit IIFT application form extended until September 15, 2017.IIFT 2018 Application FormThe application form of IIFT MBA 2018 has only be released online, on http://tedu.iift.ac.in. The candidates must submit it before the laps of the deadline, which can be checked from the table below.Application form released onJuly 25, 2017Last date to submit Application form(for national candidates)September 08, 2017 September 15, 2017Last date to submit the application form(by Foreign National and NRI)February 15, 2018IIFT MBA IB entrance exam will be held onNovember 26, 2017 December 03, 2017IIFT 2018 Application FeeThe candidates should take note of the application fee before submitting the application form. The fee amount is as given below and along with it, the medium to submit the fee are also mentioned.Fee amount for IIFT 2018 Application Form is as given below:General/OBC candidatesRs 1550SC/ST/PH candidatesRs 775Foreign National/NRI/Children of NRI candidatesUS$ 80 (INR Rs. 4500)The medium to submit the application fee of IIFT 2018 is as below:Credit CardsDebit Cards (VISA/Master)Demand Draft (DD)Candidates who will submit the application fee via Demand Draft will be required to submit a DD, in favour of Indian Institute of Foreign Trade, payable at New Delhi.Procedure to Submit IIFT MBA Application Form 2018Thank you & Have a nice day! :)

-

How do I fill out the CAT 2018 application form?

The procedure for filling up the CAT Application form is very simple. I’ll try to explain it to you in simple words.I have provided a link below for CAT registration.See, first you have to register, then fill in details in the application form, upload images, pay the registration fee and finally submit the form.Now, to register online, you have to enter details such as your name, date of birth, email id, mobile number and choose your country. You must and must enter your own personal email id and mobile number, as you will receive latest updates on CAT exam through email and SMS only.Submit the registration details, after which an OTP will be sent to the registered email id and mobile number.Once the registration part is over, you will get the Login credentials.Next, you need to fill in your personal details, academic details, work experience details, etc.Upload scanned images of your photograph, and signature as per the specifications.Pay the registration fee, which is Rs. 950 for SC/ST/PWD category candidates and Rs. 1900 for all other categories by online mode (Credit Card/ Debit Card/ Net Banking).Final step - Submit the form and do not forget to take the print out of the application form. if not print out then atleast save it somewhere.CAT 2018 Registration (Started): Date, Fees, CAT 2018 Online Application iimcat.ac.in

-

Which IRS forms do US expats need to fill out?

That would depend on their personal situation, but should they actually have a full financial life in another country including investments, pensions, mortgages, insurance policies, a small business, multiple bank accounts…The reporting alone can be bankrupting, and that is before you get on to actual taxes that are punitive toward foreign finances owned by a US citizen and god help you if you make mistake because penalties appear designed to bankrupt you.US citizens globally are renouncing citizenship for good reason.This is extracted from a letter sent by the James Bopp law firm to Chairman Mark Meadows of the subcommittee of government operations regarding the difficulty faced by US citizens who try to live else where.“ FATCA is forcing Americans abroad into a set of circumstances where they must renounce their U.S. citizenship to survive.For example, suppose you have a married couple living in Washington DC. One works as a lobbyist for an NGO and has a defined benefits pensions. The other is self employed in a lobby firm, working under an LLC. According to the IRS filing requirements, it would take about 15 hours and $280 to complete their yearly filings. Should they under report income, any penalties would be a percentage of their unreported tax burden. The worst case is a 20% civil fraud penalty.Compare the same couple with one different fact. They moved to Australia because the NGO reassigned the wife to Sydney. The husband, likewise, moves his business overseas. They open a bank account, contribute to the mandatory Australian retirement fund, purchase a house with a mortgage and get a life insurance policy on both of them.These are now their new filing requirements:• Form 8938• Form 3520-A• Form 3520• Form 5471 (to be filed by the husbands new Australian corporation where he is self employed)• Form 720 Excise Tax.• FinCEN Form 114The burden that was 15 hours now goes up to• 57.2 hours for Form 720,• 54.20 hours for Form 3520,• 61.22 Hours for Form 3520-A.• 50 hours estimate for Form 5471For a total of 226.99 hours (according to the IRS’s own time estimates) not including time to file the FBAR.The penalties for innocent misfiling or non filings for the above foreign reporting forms for the couple are up to $50,000, per year. It is likely that the foreign income exclusion and foreign tax credit will negate any actual tax due to the IRS. So each year, there is a lurking $50,000 penalty for getting something technically wrong on a form, yet there would be no additional tax due to the US treasury.”

-

When dissolving an LLC do you need to fill out IRS Form 966?

The answer will be yes or no depending on how your entity is recognized for tax purposes. An LLC is not a recognized entity by the IRS. By default, a single-member LLC is organized for tax purposes as a sole proprietorship and a partnership for tax purposes if there is more than one member. However, you can make an election to be taxed as a C Corporation (i.e., an LLC for legal purposes that is taxed as a C Corporation for tax purposes).You must complete and file form 966 to dissolve your LLC if you have elected to be a C Corporation or a Cooperative (Coop) for tax purposes. S Corporations and tax-exempt non-profits are exempt from filing this form (see here).If you are organized for tax purposes as an S Corporation you would file your taxes via form 1120S for the last time and check the box indicating that your return is a “Final Return.” Same is true for a Partnership, but with form 1065.On a state and local level, best practice is to check with your state and local agencies for requirements.For digestible information and tools for understanding how the tax landscape affects your business, visit Financial Telepathy

-

How should I fill out the preference form for the IBPS PO 2018 to get a posting in an urban city?

When you get selected as bank officer of psb you will have to serve across the country. Banks exist not just in urban areas but also in semi urban and rural areas also. Imagine every employee in a bank got posting in urban areas as their wish as a result bank have to shut down all rural and semi urban branches as there is no people to serve. People in other areas deprived of banking service. This makes no sense. Being an officer you will be posted across the country and transferred every three years. You have little say of your wish. Every three year urban posting followed by three years rural and vice versa. If you want your career to grow choose Canara bank followed by union bank . These banks have better growth potentials and better promotion scope

Create this form in 5 minutes!

How to create an eSignature for the irs form 668 a 2003 2018

How to make an eSignature for the Irs Form 668 A 2003 2018 in the online mode

How to generate an eSignature for the Irs Form 668 A 2003 2018 in Chrome

How to create an electronic signature for putting it on the Irs Form 668 A 2003 2018 in Gmail

How to generate an electronic signature for the Irs Form 668 A 2003 2018 right from your smartphone

How to generate an eSignature for the Irs Form 668 A 2003 2018 on iOS

How to generate an electronic signature for the Irs Form 668 A 2003 2018 on Android devices

People also ask

-

What is the Irs Form 668 W C Do Printable used for?

The Irs Form 668 W C Do Printable is used by the IRS to notify individuals of a wage levy. This form is essential for employers to understand their obligations when dealing with wage garnishments and helps ensure compliance with federal tax laws.

-

How can I easily obtain the Irs Form 668 W C Do Printable?

You can easily obtain the Irs Form 668 W C Do Printable directly from the IRS website or through document management solutions like airSlate SignNow, which streamlines the process of accessing and filling out important tax forms.

-

Does airSlate SignNow support the electronic signing of Irs Form 668 W C Do Printable?

Yes, airSlate SignNow fully supports the electronic signing of the Irs Form 668 W C Do Printable. Our platform allows users to securely sign and send documents, making it easier to manage tax forms without the hassle of printing and scanning.

-

What are the pricing options for using airSlate SignNow for Irs Form 668 W C Do Printable?

airSlate SignNow offers various pricing plans to accommodate different business needs, starting from a free trial to affordable monthly subscriptions. This flexibility allows you to utilize features like eSigning and document templates for the Irs Form 668 W C Do Printable without breaking the bank.

-

Can I customize the Irs Form 668 W C Do Printable in airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize the Irs Form 668 W C Do Printable to fit your specific requirements. Our platform allows you to add fields, annotations, and branding, ensuring your document meets your business standards.

-

What integrations does airSlate SignNow offer for managing Irs Form 668 W C Do Printable?

airSlate SignNow integrates seamlessly with various business applications, including CRM and project management tools. This means you can easily manage and send the Irs Form 668 W C Do Printable alongside your other important documents within your existing workflow.

-

Is it secure to use airSlate SignNow for Irs Form 668 W C Do Printable?

Yes, airSlate SignNow is committed to security and compliance. When using our platform for the Irs Form 668 W C Do Printable, your data is protected with industry-leading encryption and secure cloud storage, ensuring your sensitive information remains confidential.

Get more for Irs Form 668 W C Do Printable

Find out other Irs Form 668 W C Do Printable

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF