R185 Form

What is the R185 Form

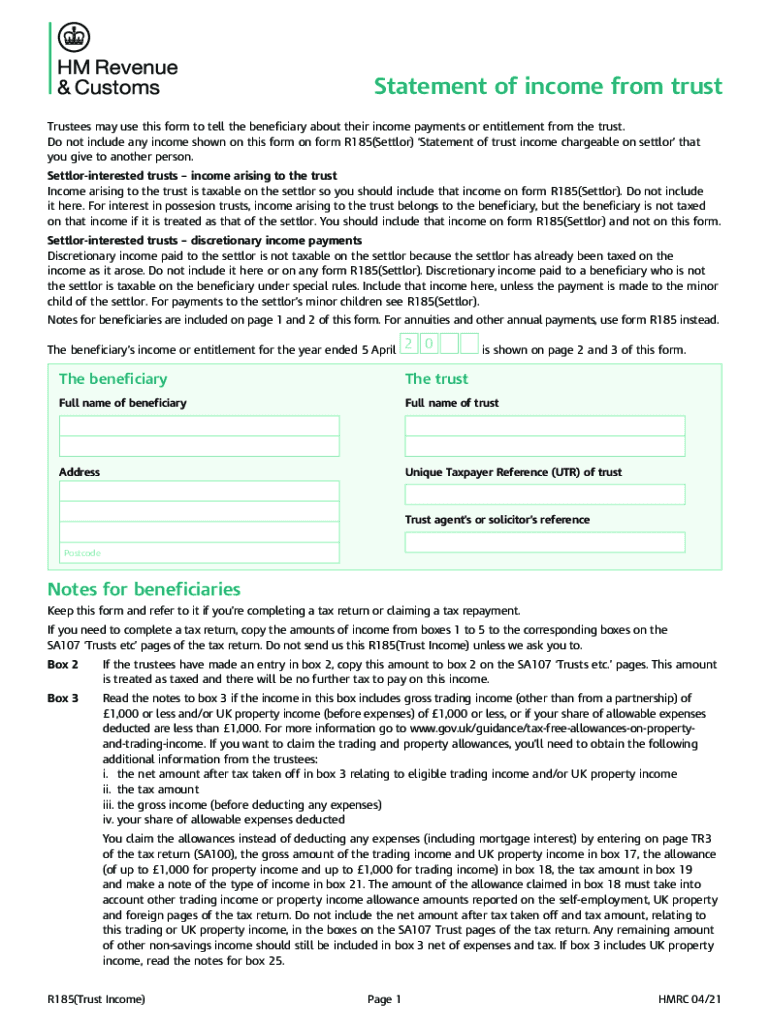

The R185 form, also known as the R185 trust income form, is a document used primarily in the United Kingdom to report income generated from trusts. This form is essential for beneficiaries of trusts, as it provides a statement of the income they have received during a tax year. The R185 form is crucial for tax purposes, ensuring that beneficiaries accurately report their income on their tax returns. While it is a UK-specific form, understanding its purpose is vital for individuals involved in trust income management.

How to Use the R185 Form

Using the R185 form involves several key steps to ensure accurate reporting of trust income. Beneficiaries should first obtain the form from the trust administrator or financial institution managing the trust. Once received, the form must be carefully filled out with accurate details regarding the income received. It is important to keep a copy of the completed form for personal records and to use it when filing tax returns. Understanding the information provided on the R185 form can help beneficiaries navigate their tax obligations effectively.

Steps to Complete the R185 Form

Completing the R185 form requires attention to detail. Here are the steps to follow:

- Obtain the R185 form from the trust administrator or download a blank version.

- Fill in your personal information, including your name and address.

- Indicate the trust's name and reference number.

- Report the total income received from the trust during the tax year.

- Sign and date the form to certify the information is correct.

After completing the form, ensure that you retain a copy for your records and submit it as required.

Legal Use of the R185 Form

The R185 form serves a legal purpose in the context of trust income reporting. It is essential for beneficiaries to use this form to comply with tax regulations. The information provided on the form must be accurate and truthful, as any discrepancies can lead to penalties or legal issues. By using the R185 form, beneficiaries can ensure they are fulfilling their legal obligations regarding income reporting and tax compliance.

Who Issues the R185 Form

The R185 form is typically issued by the trustee or the financial institution managing the trust. The trustee is responsible for providing beneficiaries with the necessary documentation regarding the income generated by the trust. It is important for beneficiaries to request this form if they have not received it automatically, as it is essential for accurate tax reporting.

Examples of Using the R185 Form

Beneficiaries may encounter various scenarios when using the R185 form. For instance, if an individual receives income from a family trust, they would use the R185 form to report that income on their tax return. Similarly, if a charitable trust distributes income to its beneficiaries, those individuals would also utilize the R185 form to ensure proper tax reporting. Understanding these examples helps clarify the practical application of the form in real-life situations.

Quick guide on how to complete r185 form

Effortlessly Prepare R185 Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage R185 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

How to Edit and Electronically Sign R185 Form with Ease

- Find R185 Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools available specifically for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Verify the information and click the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign R185 Form and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an r185 form?

The r185 form is a tax document used in the UK that helps individuals report their income from trust funds or income-producing investments. It's crucial to understand how to complete this form accurately to ensure compliance with tax regulations.

-

How does airSlate SignNow facilitate the signing of an r185 form?

airSlate SignNow streamlines the process of signing an r185 form by allowing users to electronically sign documents securely and efficiently. This eliminates the need for printing and mailing, saving time and reducing errors in the signing process.

-

Is there a cost associated with using airSlate SignNow for r185 form management?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing documents like the r185 form. You can choose a plan based on the volume of documents and features required.

-

What features does airSlate SignNow provide for processing an r185 form?

airSlate SignNow offers features such as customizable templates, automated workflows, and secure cloud storage, making it easier to manage the r185 form. These tools help ensure that all necessary fields are completed accurately and on time.

-

Can I integrate airSlate SignNow with other applications for handling the r185 form?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM and accounting software, to enhance the management of the r185 form. This integration helps streamline your processes and keep your data organized.

-

What benefits can I expect from using airSlate SignNow for my r185 form needs?

Using airSlate SignNow for your r185 form can signNowly improve efficiency and accuracy in document handling. The platform reduces the turnaround time for signing and increases compliance by providing a clear audit trail for all transactions.

-

Is it easy to create an r185 form with airSlate SignNow?

Yes, creating an r185 form with airSlate SignNow is very user-friendly. You can easily customize templates to fit your needs and start sending documents for eSignature in just a few clicks, even if you are not tech-savvy.

Get more for R185 Form

Find out other R185 Form

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation