Research Independent Contractor Form

What is the Research Independent Contractor

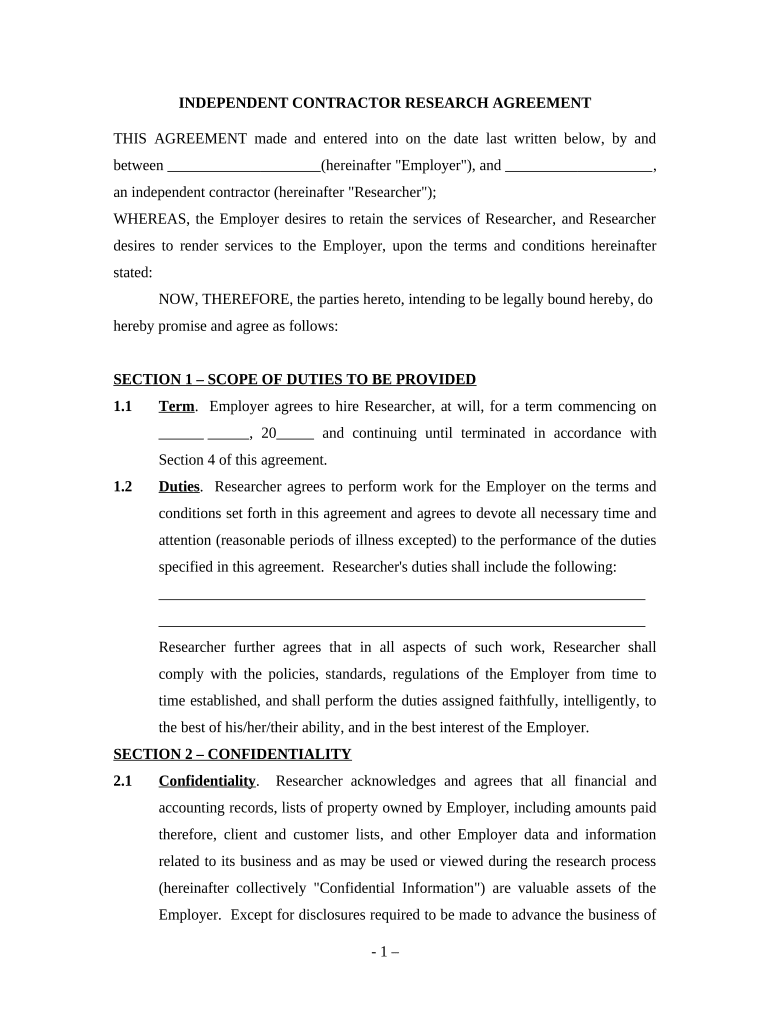

The research independent contractor form serves as a vital document used to establish the relationship between a business and an independent contractor engaged in research activities. This form outlines the terms of the contract, including the scope of work, payment details, and responsibilities of both parties. It is essential for ensuring clarity and legal protection for both the contractor and the hiring entity. Understanding this form is crucial for anyone involved in research projects, as it helps define the nature of the work and the expectations involved.

How to use the Research Independent Contractor

Using the research independent contractor form involves several key steps. First, both the contractor and the hiring entity should review the form to ensure all necessary information is included. This includes details such as the contractor's name, contact information, and the specific research services to be provided. After filling out the form, both parties must sign it to make it legally binding. Utilizing a digital platform for this process can streamline the experience, allowing for easy editing, signing, and sharing of the document.

Steps to complete the Research Independent Contractor

Completing the research independent contractor form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including contractor details and project specifics.

- Fill out the form accurately, ensuring all sections are completed.

- Review the document for clarity and completeness.

- Both parties should sign the form, either physically or electronically.

- Keep a copy for your records and provide one to the contractor.

Legal use of the Research Independent Contractor

The legal use of the research independent contractor form hinges on compliance with applicable laws and regulations. It is essential to ensure that the form meets the requirements set forth by the IRS and other governing bodies. This includes understanding the distinctions between independent contractors and employees, as misclassification can lead to penalties. By adhering to legal standards, both parties can protect themselves from potential disputes and ensure that the contract is enforceable in a court of law.

Key elements of the Research Independent Contractor

Several key elements must be included in the research independent contractor form to ensure its effectiveness and legality. These elements typically include:

- The names and contact information of both the contractor and the hiring entity.

- A detailed description of the research services to be provided.

- Payment terms, including rates and schedule.

- Confidentiality agreements, if applicable.

- Termination clauses and conditions for ending the contract.

IRS Guidelines

The IRS provides specific guidelines regarding independent contractors, which are crucial for the proper use of the research independent contractor form. Understanding these guidelines can help both parties navigate tax implications and ensure compliance. Key points include the classification of workers, reporting income, and the responsibilities of both the contractor and the employer. Familiarity with these guidelines is essential for avoiding potential tax issues and ensuring proper documentation.

Quick guide on how to complete research independent contractor

Accomplish Research Independent Contractor effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, enabling you to find the required form and store it securely online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without delays. Manage Research Independent Contractor on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

How to modify and electronically sign Research Independent Contractor effortlessly

- Obtain Research Independent Contractor and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you prefer to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Alter and electronically sign Research Independent Contractor and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the best way to research independent contractor services?

To effectively research independent contractor services, you should look for platforms like airSlate SignNow that offer exceptional e-signature and document management solutions. Consider reading customer reviews, comparing features, and evaluating pricing to identify the best options available for your needs. Additionally, take advantage of free trials to assess usability.

-

How can airSlate SignNow help my business with independent contractors?

airSlate SignNow streamlines the process of managing independent contractors by providing a secure and user-friendly platform for sending and signing documents. This solution simplifies contract management, reduces turnaround times, and ensures compliance, making it easier to work collaboratively with independent contractors.

-

What features should I look for when researching independent contractor solutions?

When researching independent contractor solutions, prioritize key features such as customizable templates, audit trails, and mobile access. airSlate SignNow offers robust features that enhance document security, streamline workflows, and improve communication with your independent contractors. These elements are crucial for a seamless experience.

-

Is there a cost-effective way to eSign contracts with independent contractors?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to various business sizes, making eSigning contracts with independent contractors affordable. With plans designed to suit both small businesses and larger organizations, you can easily choose an option that fits your budget while gaining access to a comprehensive suite of eSigning features.

-

Can I integrate airSlate SignNow with other tools I use for independent contracting?

Absolutely! airSlate SignNow seamlessly integrates with various platforms like Google Workspace, Microsoft Office, and CRM tools, enhancing your workflow when working with independent contractors. By integrating these tools, you can maintain better organization and improve communication, creating a more efficient contracting process.

-

How does using airSlate SignNow benefit the hiring process for independent contractors?

Using airSlate SignNow streamlines the hiring process for independent contractors by enabling quick and secure eSigning of contracts, reducing the time spent on paperwork. This efficiency allows you to focus on the hiring strategy instead of administrative tasks, ultimately attracting top independent talent for your business.

-

What security measures does airSlate SignNow have for independent contractor documents?

airSlate SignNow prioritizes document security with features such as encryption, multi-factor authentication, and secure storage. These measures ensure that the documents shared with independent contractors remain confidential and protected, giving you peace of mind while managing sensitive information.

Get more for Research Independent Contractor

- Boe 555 eft form

- State of california form llc 47 2006

- Abc 702 department of alcoholic beverage control state of abc ca form

- Boe 502 a p1 rev 11 07 10 2010 form

- Cpnc form

- Personal history and financial record louisiana irp dpsweb dps louisiana form

- Veterinary clinical academic renewal certification of appointment form

- Bcal 5003 915 child care center licensee designee michigan form

Find out other Research Independent Contractor

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile

- Sign Oregon Lease Termination Letter Easy

- How To Sign Missouri Lease Renewal

- Sign Colorado Notice of Intent to Vacate Online

- How Can I Sign Florida Notice of Intent to Vacate

- How Do I Sign Michigan Notice of Intent to Vacate

- Sign Arizona Pet Addendum to Lease Agreement Later

- How To Sign Pennsylvania Notice to Quit

- Sign Connecticut Pet Addendum to Lease Agreement Now

- Sign Florida Pet Addendum to Lease Agreement Simple

- Can I Sign Hawaii Pet Addendum to Lease Agreement

- Sign Louisiana Pet Addendum to Lease Agreement Free

- Sign Pennsylvania Pet Addendum to Lease Agreement Computer

- Sign Rhode Island Vacation Rental Short Term Lease Agreement Safe

- Sign South Carolina Vacation Rental Short Term Lease Agreement Now

- How Do I Sign Georgia Escrow Agreement

- Can I Sign Georgia Assignment of Mortgage

- Sign Kentucky Escrow Agreement Simple