R185 Trust Income Form

What is the R185 Trust Income

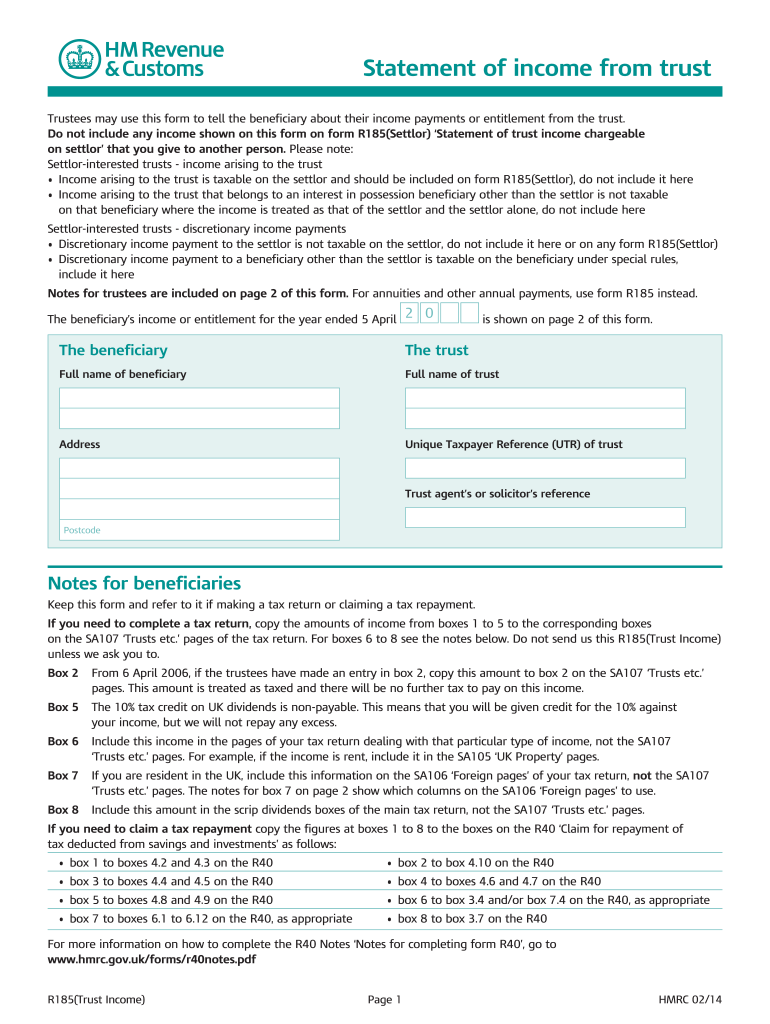

The R185 Trust Income form is a document used in the United States to report income generated from a trust. This form is essential for beneficiaries who receive income distributions from a trust, as it provides necessary details about the income they need to report on their personal tax returns. Understanding the R185 Trust Income is crucial for ensuring compliance with tax regulations and accurately reporting income to the IRS.

Steps to complete the R185 Trust Income

Completing the R185 Trust Income form involves several key steps to ensure accuracy and compliance. The process generally includes:

- Gather necessary information: Collect details about the trust, including its name, tax identification number, and the income received.

- Fill out the form: Enter the required information accurately, including the beneficiary's details and the amounts distributed.

- Review for accuracy: Double-check all entries to ensure there are no errors that could lead to tax complications.

- Submit the form: Depending on the requirements, submit the completed form either electronically or via mail.

Legal use of the R185 Trust Income

The R185 Trust Income form must be used in compliance with federal and state tax laws. It serves as a legal document that beneficiaries use to report income received from trusts. Proper use of the form ensures that beneficiaries meet their tax obligations and avoid potential penalties. Trust administrators should ensure that the form is completed correctly and provided to beneficiaries in a timely manner to facilitate accurate tax reporting.

IRS Guidelines

The IRS has specific guidelines regarding the use of the R185 Trust Income form. Beneficiaries must report the income shown on the form on their tax returns, typically on Form 1040. The IRS requires that the trust provide a copy of the R185 form to both the beneficiary and the IRS. It is essential for beneficiaries to retain a copy of the form for their records, as it serves as proof of income received from the trust.

Required Documents

To complete the R185 Trust Income form, certain documents are necessary. These may include:

- The trust agreement, which outlines the terms of the trust.

- Financial statements from the trust, detailing income and distributions.

- Personal identification information for the beneficiary, such as Social Security numbers.

Having these documents on hand will facilitate a smoother completion process and ensure all required information is accurately reported.

Form Submission Methods

Beneficiaries can submit the R185 Trust Income form through various methods, depending on the trust's requirements and preferences. Common submission methods include:

- Online submission: Many trusts allow for electronic filing, which can expedite the process.

- Mail: Completed forms can be sent via postal service to the appropriate tax authority.

- In-person submission: Some beneficiaries may choose to deliver the form directly to the trust administrator or tax office.

Choosing the right submission method can help ensure timely processing and compliance with tax regulations.

Quick guide on how to complete r185 trust income

Effortlessly Prepare R185 Trust Income on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage R185 Trust Income on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and Electronically Sign R185 Trust Income with Ease

- Find R185 Trust Income and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you would like to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign R185 Trust Income to ensure excellent communication during every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process of how to complete r185 trust income using airSlate SignNow?

To complete R185 trust income forms using airSlate SignNow, you first create the document template with the necessary fields. Then, invite the required parties to sign electronically. Our platform streamlines the process, ensuring compliance and accuracy in your submissions.

-

Are there any costs associated with using airSlate SignNow for how to complete r185 trust income?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Subscribing to our service provides you with features that enhance the ease of how to complete r185 trust income effectively and securely.

-

What features does airSlate SignNow offer for completing R185 forms?

Our platform includes customizable templates, electronic signatures, real-time tracking, and compliance guarantees, all of which simplify how to complete r185 trust income. These features reduce errors and save time for your business.

-

How does airSlate SignNow benefit users when completing R185 trust income forms?

Using airSlate SignNow allows users to expedite the completion of R185 trust income forms while ensuring accuracy and compliance. Additionally, the platform’s user-friendly interface makes it easy for anyone to learn how to complete r185 trust income without extensive training.

-

Can I integrate airSlate SignNow with other tools when completing R185 forms?

Yes, airSlate SignNow integrates seamlessly with various software tools, streamlining the entire process of how to complete r185 trust income. This connectivity enhances your workflow, reducing redundancies and improving overall efficiency.

-

Is it secure to use airSlate SignNow for how to complete r185 trust income?

Definitely, airSlate SignNow employs high-level encryption and adheres to strict compliance standards, ensuring that your information remains secure while you complete R185 trust income forms. Our commitment to security means you can focus on your business with peace of mind.

-

How do I get started with airSlate SignNow and learn how to complete r185 trust income?

Getting started is easy! Simply sign up for an account on our website. We offer tutorials and customer support to guide you through the process of how to complete r185 trust income efficiently and effectively.

Get more for R185 Trust Income

Find out other R185 Trust Income

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form

- Can I eSign Hawaii Courts Document

- Can I eSign Nebraska Police Form

- Can I eSign Nebraska Courts PDF

- How Can I eSign North Carolina Courts Presentation

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form