INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT Form

What is the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

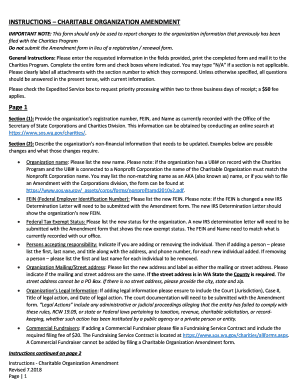

The Instructions Charitable Organization Amendment is a specific form designed to facilitate the amendment process for charitable organizations in the United States. This form allows organizations to update their operational guidelines, governance structure, or other critical elements as required by state or federal regulations. The amendment process is essential for ensuring that charitable organizations remain compliant with legal standards and can continue their mission effectively.

How to use the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

Using the Instructions Charitable Organization Amendment involves several steps to ensure proper completion and submission. First, organizations must gather the necessary information about the amendments they wish to make. This includes details about the current governing documents and the proposed changes. Once this information is compiled, organizations can fill out the form accurately, ensuring that all required fields are completed. Finally, the completed form should be submitted to the appropriate state authority or governing body as specified in the instructions.

Steps to complete the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

Completing the Instructions Charitable Organization Amendment requires careful attention to detail. The following steps outline the process:

- Review the current governing documents of the organization.

- Identify the specific changes that need to be made.

- Fill out the amendment form, ensuring all information is accurate and complete.

- Gather any supporting documents that may be required.

- Submit the completed form and any additional documents to the relevant state authority.

- Retain a copy of the submitted form for your records.

Legal use of the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

The legal use of the Instructions Charitable Organization Amendment is crucial for maintaining compliance with state and federal laws. Charitable organizations must ensure that any amendments made are in accordance with the legal requirements set forth by the IRS and state regulations. This includes adhering to guidelines regarding governance, financial reporting, and operational changes. Failure to comply with these legal standards can result in penalties or loss of tax-exempt status.

Required Documents

To complete the Instructions Charitable Organization Amendment, several documents may be required. These typically include:

- The current governing documents of the organization, such as articles of incorporation or bylaws.

- Any previous amendments made to the governing documents.

- Supporting documentation that justifies the need for the amendment.

- Proof of approval from the board of directors or members, if applicable.

Form Submission Methods

The Instructions Charitable Organization Amendment can be submitted through various methods, depending on the requirements of the state authority. Common submission methods include:

- Online submission through the state’s official website.

- Mailing the completed form to the designated office.

- In-person submission at the local or state office.

Quick guide on how to complete instructions charitable organization amendment

Effortlessly Prepare INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources needed to create, edit, and electronically sign your documents quickly without delays. Manage INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT with Ease

- Find INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Edit and electronically sign INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT and ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT for replacing Board members?

The INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT for replacing Board members involves specific steps which must be followed diligently. Typically, this includes notifying current board members, drafting an amendment to the governing documents, and obtaining the necessary approvals. Ensuring that the amendment is properly documented and eSigned through airSlate SignNow can streamline this process.

-

How does airSlate SignNow facilitate the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT process?

airSlate SignNow simplifies the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT process by providing an easy-to-use interface for document creation and electronic signatures. Users can quickly generate amendment documents and send them out for eSigning, ensuring that all necessary parties can review and approve changes efficiently. This reduces time spent on administrative tasks and increases compliance.

-

What costs are associated with using airSlate SignNow for my INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT?

Using airSlate SignNow for your INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT is cost-effective, with flexible pricing plans tailored to various needs. The subscription fees are typically lower than traditional legal services, making it an attractive option for charitable organizations. You can select a plan based on the volume of documents you anticipate needing to amend and eSign.

-

What features does airSlate SignNow offer for managing INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT?

airSlate SignNow includes several features tailored for managing the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT effectively. Key features such as customizable templates, automated workflows, and secure eSignature options enable users to manage revisions seamlessly. The platform also offers tracking and reminders to ensure no deadlines are missed.

-

Can I collaborate with my team on the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT through airSlate SignNow?

Absolutely! airSlate SignNow allows for real-time collaboration among team members working on the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT. Team members can comment, make edits, and review the amendments simultaneously, making it easier to signNow consensus and finalize documents efficiently.

-

Is airSlate SignNow compliant with the legal requirements for INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT?

Yes, airSlate SignNow is compliant with all relevant e-signature laws, such as the ESIGN Act and UETA, ensuring that your INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT is legally binding. The platform employs top-notch security protocols to protect sensitive information, making it a trustworthy tool for charitable organizations to manage their amendments securely.

-

What integrations does airSlate SignNow offer that support INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT?

airSlate SignNow integrates with various platforms that can assist with the INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT, such as Google Workspace, Salesforce, and Microsoft Office. These integrations enable users to import data, streamline workflows, and enhance productivity when drafting and eSigning amendments. This cohesive ecosystem makes managing documents more efficient.

Get more for INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

- Ani at kita rsbsa enrollment form 607697154

- Statutory declaration form 609676777

- Cost of canadian passport form

- Temperature log for refrigerator form

- Dss ea 240 form

- Wwwmichigangovtaxes 2368 principal residence exemption pre affidavit michigan form

- Form i 765ws worksheet form i 765ws worksheet

- Form i 765 application for employment authorization uscis fill

Find out other INSTRUCTIONS CHARITABLE ORGANIZATION AMENDMENT

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word