Www Uslegalforms Com387101 Zero Income FormZero Income Form Fill and Sign Printable Template Online

Understanding the zero income statement in Ohio

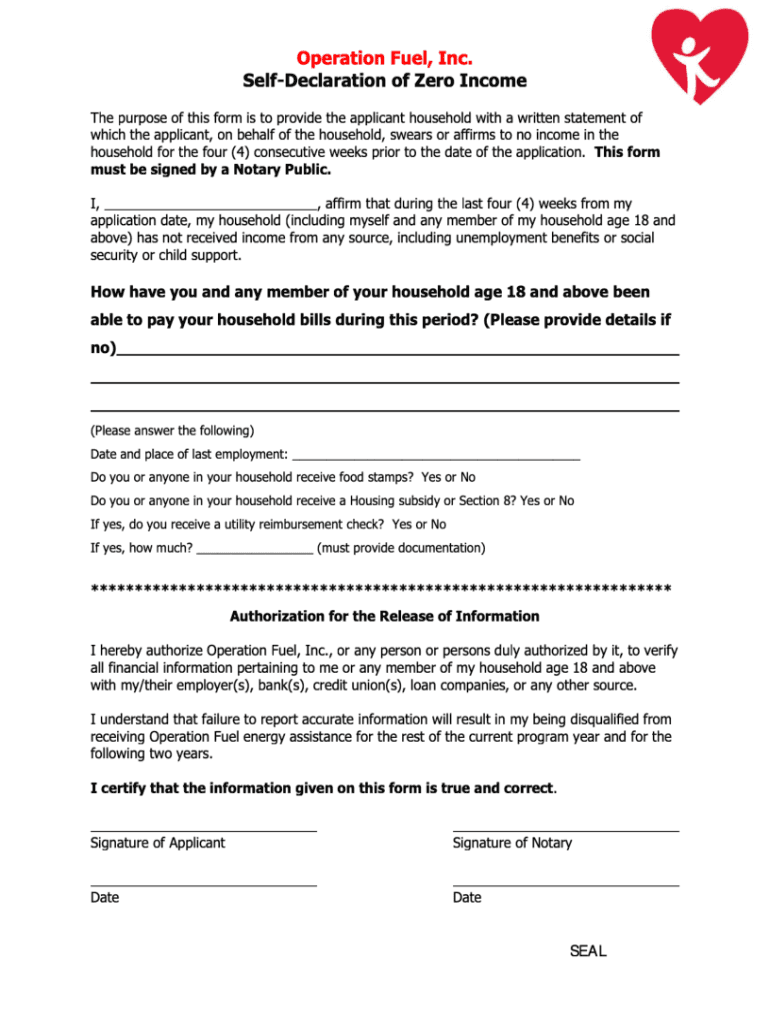

The zero income statement, often referred to as the zero income verification form in Ohio, is a crucial document for individuals who do not have any income to report. This form is typically required for various applications, including government assistance programs, housing applications, and financial aid. It serves as a formal declaration of an individual's financial status, indicating that they currently have no income. This statement is essential for ensuring that applicants are accurately assessed for eligibility for various support services.

Steps to complete the zero income statement in Ohio

Completing the zero income statement in Ohio involves several straightforward steps. First, gather all necessary personal information, including your full name, address, and Social Security number. Next, clearly indicate that you have no income by checking the appropriate box or writing a statement in the designated section. It's important to provide any additional information that may be required, such as the reason for having no income. Once completed, review the form for accuracy before signing and dating it. Finally, submit the form according to the instructions provided, whether online, by mail, or in person.

Legal use of the zero income statement in Ohio

The zero income statement has legal significance in Ohio, as it is often required by agencies and organizations to verify an individual's financial status. When submitting this form, it is important to ensure that the information provided is accurate and truthful. Misrepresentation of income can lead to penalties, including disqualification from assistance programs or legal repercussions. Therefore, understanding the legal implications of this document is vital for anyone completing it.

Eligibility criteria for the zero income statement in Ohio

To be eligible to submit a zero income statement in Ohio, individuals must demonstrate that they have no income during the specified reporting period. This may apply to various circumstances, such as being unemployed, a student, or a caregiver. Eligibility criteria can vary depending on the specific program or agency requesting the form, so it is essential to check the requirements for each situation. Providing accurate documentation and explanations can help support the eligibility claim.

Common scenarios for using the zero income statement in Ohio

There are several common scenarios in which individuals may need to use the zero income statement in Ohio. For instance, those applying for public assistance programs, such as food stamps or Medicaid, may be required to submit this form to demonstrate their financial need. Additionally, students applying for financial aid or housing assistance may need to provide a zero income statement to qualify for support. Understanding these scenarios can help individuals prepare the necessary documentation and ensure compliance with application requirements.

Submitting the zero income statement in Ohio

Submitting the zero income statement in Ohio can be done through various methods, depending on the requirements of the requesting agency. Many organizations allow for online submissions, making it convenient for applicants. Alternatively, individuals may need to print the form and submit it by mail or deliver it in person. It is important to follow the specific submission guidelines provided by the agency to ensure that the form is processed correctly and in a timely manner.

Quick guide on how to complete wwwuslegalformscom387101 zero income formzero income form fill and sign printable template online

Complete Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the right form and securely store it online. airSlate SignNow offers you all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online across all platforms using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to modify and eSign Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online without hassle

- Find Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online and ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a zero income statement in Ohio?

A zero income statement in Ohio is a specific financial document used by individuals or businesses to report no income for a given tax year. This can be essential for tax compliance, especially when applying for various permits or licenses. Utilizing airSlate SignNow can simplify the process of preparing and submitting this document securely.

-

How can airSlate SignNow help with a zero income statement in Ohio?

airSlate SignNow provides an easy-to-use platform for drafting, signing, and sharing a zero income statement in Ohio quickly. The digital solution streamlines the entire process, ensuring your documents are legally binding and easily accessible. With features like templates and eSignature, it enhances efficiency and accuracy.

-

Are there any costs associated with generating a zero income statement in Ohio using airSlate SignNow?

AirSlate SignNow offers various pricing plans, with the possibility of creating a zero income statement in Ohio at an affordable rate. The pricing structure is transparent, and you can start with a free trial to explore features for drafting your statement. Investing in this solution can save you time and effort in document management.

-

What are the key features of airSlate SignNow for creating a zero income statement in Ohio?

Key features of airSlate SignNow include an intuitive editor, customizable templates, and secure eSignature options, which are essential for creating a zero income statement in Ohio. These tools not only make the document creation process easier but also enhance collaboration and allow for real-time updates. Plus, all documents are securely stored and easy to retrieve when needed.

-

Is it easy to share my zero income statement in Ohio using airSlate SignNow?

Yes, airSlate SignNow makes it extremely easy to share your zero income statement in Ohio. You can send documents directly via email or generate secure links for sharing with stakeholders. The platform ensures that your information remains confidential while providing recipients with a seamless review and signing experience.

-

Can I integrate airSlate SignNow with other software for my zero income statement in Ohio?

Absolutely! airSlate SignNow offers integrations with various software solutions, allowing you to streamline the process of creating a zero income statement in Ohio. Whether you use CRM systems, cloud storage solutions, or productivity tools, you can easily connect and synchronize your work for enhanced productivity.

-

What are the benefits of using airSlate SignNow for my zero income statement in Ohio compared to traditional methods?

Using airSlate SignNow for your zero income statement in Ohio offers numerous benefits over traditional methods, including speed, accessibility, and cost-effectiveness. The digital platform eliminates paper clutter and reduces the time spent on document processing, making it easier for you to meet compliance deadlines. Furthermore, automated updates ensure you’re always working with the most current information.

Get more for Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online

- Revenuenebraskagovaboutlegal informationfiduciary income tax nebraska department of revenue

- 2022 form 8027 employers annual information return of tip income and allocated tips

- R 1048 121 louisiana department of revenue form

- 2022 form 8879 pe e file authorization for form 1065

- Revstatelaushome page louisiana department of revenue form

- 2022 form 1041 es estimated income tax for estates and trusts

- Wwwsignnowcomfill and sign pdf form113628rita tax ohio fill out and sign printable pdf template

- Irs 8959dsa fill and sign printable template online us legal forms

Find out other Www uslegalforms com387101 zero income formZero Income Form Fill And Sign Printable Template Online

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online