Instructions for Schedule K 1 Form 1041 for A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions for Schedule K 1 Form 1041 Fo 2022

Understanding Schedule K-1 Form 1041

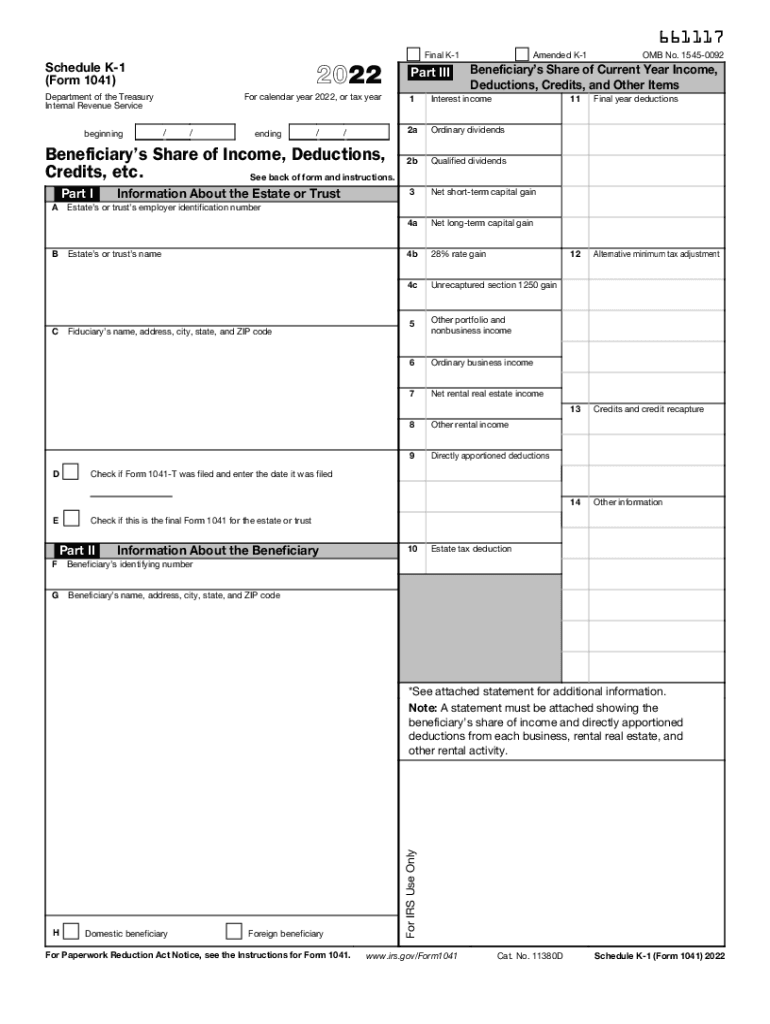

The Schedule K-1 Form 1041 is used to report income, deductions, and credits from estates and trusts. This form is essential for beneficiaries who receive distributions, as it provides detailed information necessary for filing individual tax returns. The IRS requires fiduciaries to issue this form to beneficiaries, ensuring transparency in the reporting of income generated by the estate or trust.

Steps to Complete Schedule K-1 Form 1041

Completing the Schedule K-1 Form 1041 involves several key steps:

- Gather necessary financial information related to the estate or trust.

- Fill out the form accurately, ensuring all income, deductions, and credits are reported.

- Provide the beneficiary's information, including their name, address, and tax identification number.

- Distribute the completed form to all beneficiaries by the IRS deadline.

Each step is crucial to ensure compliance with tax regulations and to provide beneficiaries with the information needed for their tax filings.

Legal Use of Schedule K-1 Form 1041

The Schedule K-1 Form 1041 holds legal significance as it serves as an official document for reporting income to the IRS. It is essential for beneficiaries to include the information from this form when filing their individual tax returns. Failure to report the income accurately can lead to penalties and interest charges. Therefore, understanding the legal implications of this form is vital for both fiduciaries and beneficiaries.

Filing Deadlines for Schedule K-1 Form 1041

Filing deadlines for the Schedule K-1 Form 1041 align with the tax return deadlines for estates and trusts. Generally, the form must be issued to beneficiaries by the due date of the estate's or trust's income tax return, which is typically April 15 for calendar year filers. If the estate or trust files for an extension, the K-1 must still be distributed by the extended due date.

Required Documents for Schedule K-1 Form 1041

To complete the Schedule K-1 Form 1041 accurately, certain documents are required:

- Financial statements of the estate or trust, including income statements and balance sheets.

- Records of distributions made to beneficiaries.

- Documentation of any deductions or credits applicable to the estate or trust.

Having these documents ready will facilitate a smoother completion process and ensure compliance with IRS requirements.

IRS Guidelines for Schedule K-1 Form 1041

The IRS provides specific guidelines for completing and filing the Schedule K-1 Form 1041. These guidelines outline the necessary information to be reported, the format of the form, and the responsibilities of fiduciaries. Adhering to these guidelines is crucial for ensuring that the form is accepted by the IRS and that beneficiaries receive accurate information for their tax filings.

Examples of Schedule K-1 Form 1041 Usage

Understanding how the Schedule K-1 Form 1041 is used can clarify its importance:

- A beneficiary receiving income from a trust must report this income on their individual tax return using the information provided on the K-1.

- Trustees must provide K-1 forms to all beneficiaries to ensure they can accurately report their share of the trust's income.

These examples illustrate the practical application of the form and its role in tax compliance for both beneficiaries and fiduciaries.

Quick guide on how to complete instructions for schedule k 1 form 1041 for a2021 schedule k 1 form 1041 irs tax formsinstructions for schedule k 1 form 1041

Complete Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo effortlessly on any device

Online document management has surged in popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hold-ups. Manage Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo effortlessly

- Obtain Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the information and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you select. Modify and eSign Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for schedule k 1 form 1041 for a2021 schedule k 1 form 1041 irs tax formsinstructions for schedule k 1 form 1041

Create this form in 5 minutes!

People also ask

-

What is a k1 form and why is it important?

A k1 form is a tax document used to report income, deductions, and credits from partnerships, S corporations, estates, and trusts to their beneficiaries. Understanding how to properly fill out a k1 form is crucial for ensuring accurate tax reporting and compliance. With airSlate SignNow, you can securely sign and send k1 forms online with ease, streamlining your documentation process.

-

How can airSlate SignNow help me with my k1 form?

AirSlate SignNow simplifies the process of handling k1 forms by allowing you to create customizable templates, send them for eSignature, and track the signing process in real-time. This contributes to faster completion of your k1 form, reducing the administrative burden on your team. Plus, it's a cost-effective solution for managing all your document workflows.

-

Is there a free trial for using airSlate SignNow to manage my k1 forms?

Yes, airSlate SignNow offers a free trial that allows you to explore its features and tools for managing your k1 forms without any commitment. This is a great opportunity to see how easily you can generate, sign, and manage k1 forms electronically. Sign up now to take advantage of this offer and streamline your document processes.

-

What features does airSlate SignNow offer for k1 forms?

AirSlate SignNow provides a variety of features that enhance the efficiency of processing k1 forms, such as customizable templates, advanced eSignature capabilities, document tracking, and automated reminders. These features help ensure that your k1 form workflows are completed quickly and securely. All in all, it adds signNow value to your documentation processes.

-

Are there integrations available for k1 form workflows?

Yes, airSlate SignNow seamlessly integrates with numerous applications and software platforms, including popular accounting and management tools that might be useful for managing k1 forms. This enhances collaboration and efficiency by allowing data to flow smoothly between systems. Check our integration page to see compatible apps for your specific needs.

-

How secure is airSlate SignNow for handling sensitive k1 forms?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols, secure data storage, and compliance with industry standards to protect your sensitive information, including k1 forms. You can confidently manage your document workflows, knowing that your data is secure and protected.

-

What are the pricing options for using airSlate SignNow for k1 forms?

AirSlate SignNow offers flexible pricing plans tailored to various business needs, making it easy to choose a plan that suits your usage for k1 forms. Our pricing is competitive and designed to provide excellent value, especially for teams that frequently handle such documents. Visit our pricing page to learn more about the available options.

Get more for Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo

- Buyers notice of intent to vacate and surrender property to seller under contract for deed new hampshire form

- General notice of default for contract for deed new hampshire form

- Nh rights form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497318503 form

- New hampshire seller form

- Notice of default for past due payments in connection with contract for deed new hampshire form

- Final notice of default for past due payments in connection with contract for deed new hampshire form

- Assignment of contract for deed by seller new hampshire form

Find out other Instructions For Schedule K 1 Form 1041 For A2021 Schedule K 1 Form 1041 IRS Tax FormsInstructions For Schedule K 1 Form 1041 Fo

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document