Form 13615 2022

What is the Form 13615

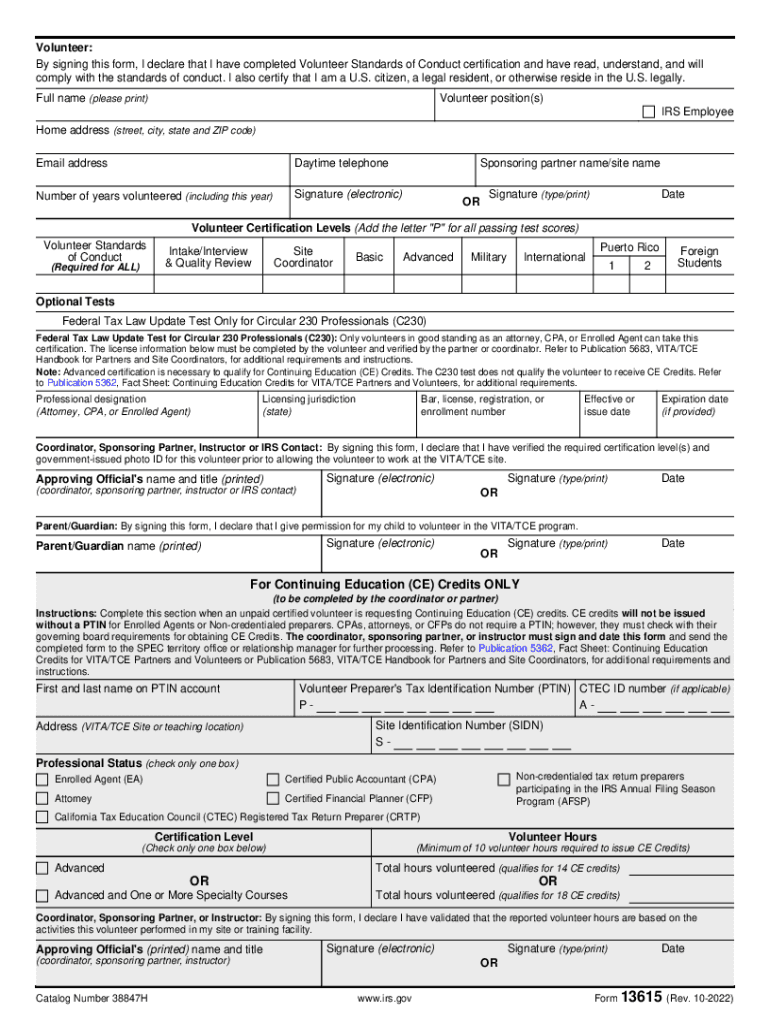

The Form 13615, also known as the IRS Volunteer Agreement, is a crucial document used in the Volunteer Income Tax Assistance (VITA) program. This form establishes the agreement between volunteers and the IRS, ensuring that volunteers understand their responsibilities and the guidelines they must follow while assisting taxpayers. It is essential for maintaining compliance with IRS regulations and ensuring that volunteers are properly trained and authorized to provide tax assistance.

How to use the Form 13615

Using the Form 13615 involves several key steps. First, volunteers must complete the form accurately, providing all required information, including personal details and the scope of their volunteer work. After filling out the form, it must be signed by both the volunteer and an authorized representative of the VITA program. This signed agreement confirms the volunteer's commitment to adhere to the program's standards and ethical guidelines, ensuring a trustworthy environment for taxpayers seeking assistance.

Steps to complete the Form 13615

Completing the Form 13615 involves a systematic approach:

- Gather necessary personal information, including name, address, and Social Security number.

- Review the responsibilities outlined in the form to ensure understanding of the role.

- Fill in all required sections accurately, paying close attention to detail.

- Sign the form, indicating your agreement to the terms and conditions.

- Submit the completed form to the designated VITA coordinator for processing.

Legal use of the Form 13615

The legal use of the Form 13615 is governed by IRS guidelines, which stipulate that volunteers must adhere to specific ethical standards and confidentiality requirements when assisting taxpayers. This form serves as a binding agreement that protects both the volunteer and the IRS by ensuring that volunteers are aware of their legal obligations. Compliance with this agreement is essential for maintaining the integrity of the VITA program and safeguarding taxpayer information.

Eligibility Criteria

Eligibility to participate as a volunteer under the VITA program and use the Form 13615 generally requires individuals to meet certain criteria. Volunteers must be at least eighteen years old and possess a basic understanding of tax laws and filing procedures. Additionally, they should be willing to undergo training provided by the IRS or affiliated organizations. Completing the Form 13615 is a necessary step for all eligible volunteers to formalize their role in the program.

Form Submission Methods

The Form 13615 can be submitted through various methods, depending on the specific requirements of the VITA program. Typically, volunteers can submit the form in person to their VITA coordinator, ensuring immediate processing. Some programs may also allow for electronic submission, where volunteers can send a scanned copy of the signed document via email. It is important for volunteers to confirm the preferred submission method with their local VITA site to ensure compliance with program protocols.

Quick guide on how to complete form 13615

Complete Form 13615 effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the proper format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Form 13615 on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-centered process today.

How to alter and eSign Form 13615 with ease

- Find Form 13615 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choosing. Modify and eSign Form 13615 and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13615

Create this form in 5 minutes!

People also ask

-

What is Form 13615 and how does it relate to airSlate SignNow?

Form 13615 is a crucial document that confirms taxpayer eligibility for the Volunteer Income Tax Assistance (VITA) program. With airSlate SignNow, you can easily eSign and send Form 13615 securely, making the process more efficient for tax providers and clients alike.

-

How can airSlate SignNow help with completing Form 13615?

airSlate SignNow simplifies the process of completing Form 13615 by providing templates and an intuitive interface. Users can fill out the form electronically, ensuring that all necessary fields are completed accurately and signed promptly for faster processing.

-

What are the pricing plans for using airSlate SignNow for Form 13615?

airSlate SignNow offers flexible pricing plans to cater to different business needs. Whether you're a small business or a larger organization, our plans ensure you can manage Form 13615 efficiently without inflated costs.

-

Is airSlate SignNow compliant with regulations when handling Form 13615?

Yes, airSlate SignNow is designed with compliance in mind, ensuring that all data, including information submitted on Form 13615, is handled securely and in accordance with relevant regulations. Our platform prioritizes data protection to safeguard sensitive taxpayer information.

-

Can I integrate airSlate SignNow with other software for managing Form 13615?

Absolutely! airSlate SignNow offers robust integrations with various CRM and accounting software, allowing you to manage Form 13615 alongside other documents seamlessly. This integration helps streamline your workflow, ensuring that all relevant information is easily accessible.

-

What features does airSlate SignNow offer for sending Form 13615?

airSlate SignNow provides a wide range of features for sending Form 13615, including customizable templates, bulk sending capabilities, and real-time tracking of document status. These features facilitate efficient document management and enhance user experience during tax season.

-

How can airSlate SignNow improve the efficiency of processing Form 13615?

By using airSlate SignNow, you can dramatically reduce the time spent on processing Form 13615. Our eSigning solution eliminates the need for physical paperwork, allowing for quicker turnaround times and more effective communication with clients during the tax preparation process.

Get more for Form 13615

- Written revocation of will north dakota form

- Last will and testament for other persons north dakota form

- Notice to beneficiaries of being named in will north dakota form

- Estate planning questionnaire and worksheets north dakota form

- Document locator and personal information package including burial information form north dakota

- Demand to produce copy of will from heir to executor or person in possession of will north dakota form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497317900 form

- Bill of sale of automobile and odometer statement nebraska form

Find out other Form 13615

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT