About Form 8863, Education Credits American Opportunity1040 American Opportunity and Lifetime Learning CreditsInstructions for F 2022

Overview of Form 8863 and Education Credits

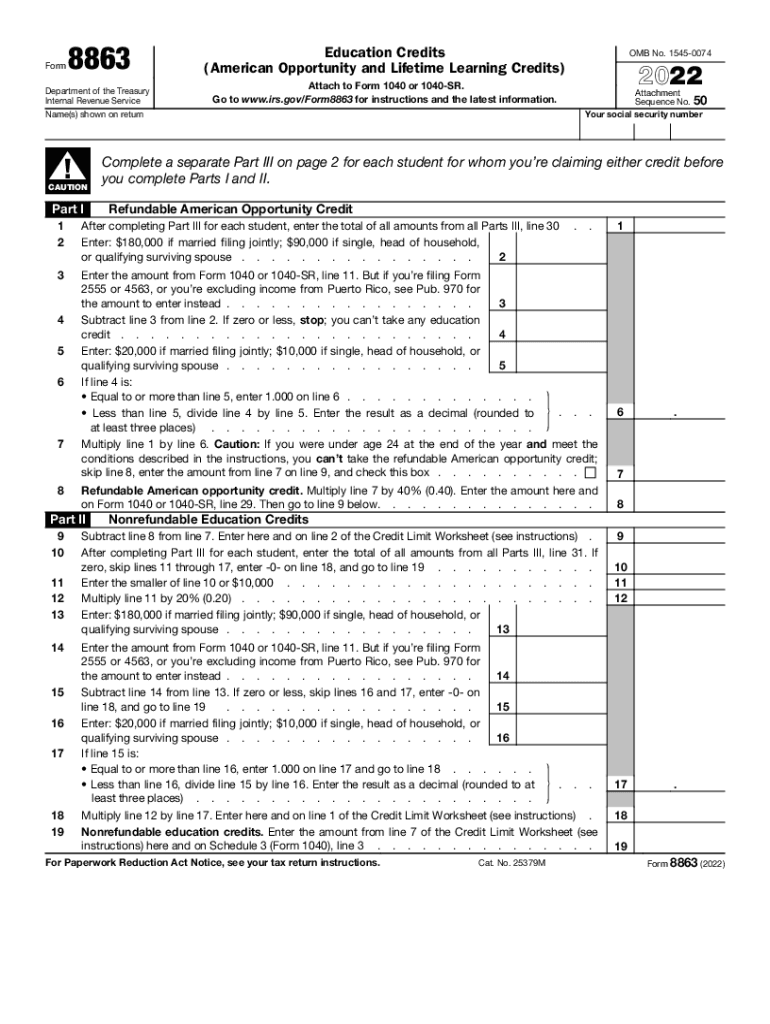

The Form 8863 is essential for taxpayers seeking to claim education credits, specifically the American Opportunity Credit and the Lifetime Learning Credit. These credits can significantly reduce the amount of tax owed, making education more affordable. The American Opportunity Credit allows eligible students to claim up to $2,500 per student for qualified education expenses during the first four years of higher education. The Lifetime Learning Credit offers up to $2,000 per tax return for qualified tuition and related expenses for students enrolled in eligible educational institutions.

Steps to Complete Form 8863

Completing Form 8863 involves several key steps:

- Gather necessary documents, including Form 1098-T from educational institutions, which reports tuition payments.

- Determine eligibility for the credits based on income and enrollment status.

- Fill out the form, ensuring to provide accurate information regarding the student and the educational expenses incurred.

- Calculate the credits using the provided worksheets in the form instructions.

- Attach Form 8863 to your federal tax return when filing.

Eligibility Criteria for Education Credits

To qualify for the education credits on Form 8863, taxpayers must meet specific eligibility criteria:

- The student must be enrolled at least half-time in a degree program.

- Qualified expenses must be incurred for tuition, fees, and course materials.

- Income limits apply; for example, the American Opportunity Credit phases out for modified adjusted gross incomes above certain thresholds.

- Students must not have previously claimed the American Opportunity Credit for more than four tax years.

Required Documents for Filing

When completing Form 8863, it is crucial to have the following documents on hand:

- Form 1098-T: This form provides information about qualified tuition and related expenses.

- Receipts: Keep receipts for any additional expenses that qualify, such as books and supplies.

- Tax returns: Previous year’s tax returns can help ensure accurate reporting.

IRS Guidelines for Form 8863

The IRS provides specific guidelines for completing Form 8863, which include:

- Instructions on how to calculate the credits accurately.

- Details on what constitutes qualified expenses.

- Information on how to report the credits on your tax return.

Filing Deadlines for Tax Year 2021

For tax filing 2021, the deadline to submit Form 8863 is the same as the federal tax return deadline, typically April 15 of the following year. However, if you file for an extension, you may have additional time to submit your tax return and any accompanying forms, including Form 8863.

Quick guide on how to complete about form 8863 education credits american opportunity1040 american opportunity and lifetime learning creditsinstructions for

Accomplish About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F effortlessly

- Find About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Select important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and has the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Decide how you want to send your form, whether by email, text message (SMS), sharing link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, tedious form navigation, or errors that require reprinting copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Modify and eSign About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F and ensure superior communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 8863 education credits american opportunity1040 american opportunity and lifetime learning creditsinstructions for

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for tax filing 2021?

airSlate SignNow provides a range of features perfect for tax filing 2021, including eSignature capabilities, document templates, and automated workflows. These tools simplify the process of collecting necessary signatures and ensure that all documents are compliant with current tax laws. Additionally, our solution allows for easy collaboration among team members, making tax preparation more efficient.

-

How does airSlate SignNow enhance the tax filing 2021 process?

Using airSlate SignNow can signNowly enhance the tax filing 2021 process by streamlining document management and signatures. With our secure platform, you can quickly send documents for signing and receive them back instantly, saving you valuable time. This efficiency helps ensure that your tax filings are completed accurately and on time.

-

Is airSlate SignNow cost-effective for small businesses during tax filing 2021?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses navigating tax filing 2021. We offer various pricing plans that cater to different business sizes and needs. This flexibility allows small businesses to access powerful eSignature tools without breaking the bank.

-

Can airSlate SignNow integrate with other tools for tax filing 2021?

Absolutely! airSlate SignNow integrates seamlessly with numerous tools and platforms commonly used for tax filing 2021, including CRM software, cloud storage, and accounting tools. These integrations help centralize your documents and streamline workflows, making the entire tax preparation process more manageable.

-

What types of documents can I eSign for tax filing 2021 using airSlate SignNow?

You can eSign a variety of documents for tax filing 2021 using airSlate SignNow, including W-2 forms, 1099 forms, and tax preparation checklists. Our platform supports various document formats, ensuring that you can handle all your tax-related paperwork efficiently. This versatility contributes to a smoother and faster tax filing experience.

-

What security measures does airSlate SignNow implement for tax filing 2021?

Security is a top priority at airSlate SignNow, especially during tax filing 2021. We employ advanced encryption protocols and secure data storage to protect your sensitive tax documents. Our platform complies with major security standards, ensuring that your information remains confidential and safe throughout the filing process.

-

How can airSlate SignNow improve compliance during tax filing 2021?

airSlate SignNow improves compliance during tax filing 2021 by providing features that help track document history and signatures. Our audit trail ensures that every step of the signing process is documented, reducing the risk of errors and ensuring that your filings meet legal requirements. This traceability adds an extra layer of assurance for your tax preparation.

Get more for About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F

- Notice of assignment of contract for deed new hampshire form

- Contract for sale and purchase of real estate with no broker for residential home sale agreement new hampshire form

- Buyers home inspection checklist new hampshire form

- Sellers information for appraiser provided to buyer new hampshire

- Subcontractors agreement new hampshire form

- Option to purchase addendum to residential lease lease or rent to own new hampshire form

- New hampshire prenuptial premarital agreement with financial statements new hampshire form

- Girl scout gold award project proposal form

Find out other About Form 8863, Education Credits American Opportunity1040 American Opportunity And Lifetime Learning CreditsInstructions For F

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form