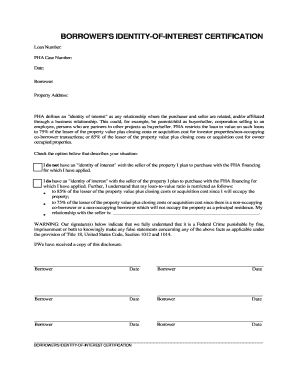

Fha Identity of Interest Form

What is the FHA Identity of Interest Form

The FHA Identity of Interest form is a document used in the context of Federal Housing Administration (FHA) loans. It is designed to disclose any potential conflicts of interest when a borrower is involved with a property transaction. This form is particularly important for ensuring transparency in transactions where a borrower has a vested interest in the property, such as familial relationships or business partnerships. By completing this form, borrowers help lenders assess the risk associated with the loan application, ensuring compliance with FHA regulations.

Steps to Complete the FHA Identity of Interest Form

Completing the FHA Identity of Interest form involves several key steps:

- Gather necessary information about the property and the parties involved.

- Clearly state the nature of the relationship between the borrower and the property.

- Provide accurate details regarding any financial interests in the property.

- Sign and date the form to certify the information provided is true and accurate.

It's essential to ensure all information is complete and correct, as inaccuracies can lead to delays in the loan approval process.

Legal Use of the FHA Identity of Interest Form

The FHA Identity of Interest form serves a legal purpose in the loan application process. It helps lenders comply with FHA guidelines by ensuring that any potential conflicts of interest are disclosed. This form is legally binding, meaning that the information provided must be truthful and complete. Failure to disclose relevant relationships can result in penalties, including loan denial or legal repercussions. Therefore, it is crucial for borrowers to understand the importance of this form in maintaining the integrity of the lending process.

Key Elements of the FHA Identity of Interest Form

Several key elements are essential when filling out the FHA Identity of Interest form:

- Borrower Information: Full names and contact details of all borrowers.

- Property Details: Address and description of the property in question.

- Relationship Disclosure: Clear explanation of the relationship between the borrower and the property.

- Signature: Required signatures of all parties involved, affirming the accuracy of the information.

Including all these elements ensures that the form is valid and meets the requirements set forth by the FHA.

How to Obtain the FHA Identity of Interest Form

The FHA Identity of Interest form can typically be obtained from several sources:

- Lender's Office: Most lenders provide this form as part of their loan application package.

- FHA Website: The Federal Housing Administration may offer downloadable versions of the form.

- Real Estate Agents: Agents involved in the transaction often have access to the necessary forms.

It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Disclosure Requirements

When completing the FHA Identity of Interest form, borrowers must adhere to specific disclosure requirements. This includes fully disclosing any relationships that may influence the transaction, such as familial ties, business partnerships, or other affiliations. The form is designed to prevent conflicts of interest that could affect the loan's approval process. Accurate and complete disclosures are critical, as they help maintain transparency and trust in the lending process.

Quick guide on how to complete fha identity of interest form

Complete Fha Identity Of Interest Form effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an ideal sustainable alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Fha Identity Of Interest Form across any platform with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Fha Identity Of Interest Form without hassle

- Locate Fha Identity Of Interest Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form hunting, or errors that necessitate printing out new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Fha Identity Of Interest Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the FHA identity of interest form?

The FHA identity of interest form is a document used in FHA loans to disclose any connections between the appraiser and the buyer or seller. This form ensures transparency in transactions and helps prevent conflicts of interest. Utilizing airSlate SignNow, you can easily send and eSign this form, streamlining the documentation process.

-

How can I complete the FHA identity of interest form using airSlate SignNow?

To complete the FHA identity of interest form with airSlate SignNow, simply upload the document to our platform. You can then add eSignature fields, drag and drop required fields, and send it directly to recipients for signing. This makes the entire process quick and efficient, ensuring you stay compliant with FHA requirements.

-

Is airSlate SignNow a cost-effective solution for managing FHA identity of interest forms?

Yes, airSlate SignNow is a highly cost-effective solution for managing FHA identity of interest forms and other documents. Our competitive pricing plans ensure that businesses of all sizes can access premium eSignature solutions without breaking the bank. Plus, the ease of use means you can save on additional administrative costs.

-

What features does airSlate SignNow offer for eSigning the FHA identity of interest form?

airSlate SignNow offers a variety of features for eSigning the FHA identity of interest form, including customizable templates, bulk sending, and real-time tracking. These features ensure that you can manage your documents efficiently and receive signed forms quickly. Additionally, you can integrate with other tools to enhance your workflow.

-

Are there any benefits to using airSlate SignNow for FHA identity of interest forms?

Using airSlate SignNow for FHA identity of interest forms provides several benefits, including speed, security, and ease of use. Your documents are stored securely, and the platform ensures compliance with legal standards for eSigning. Additionally, you can access your signed documents anytime, streamlining your processes.

-

Can I integrate airSlate SignNow with other software for handling FHA identity of interest forms?

Absolutely! airSlate SignNow allows seamless integration with various software applications to help you manage FHA identity of interest forms more efficiently. Whether you use CRM systems, cloud storage, or project management tools, our integrations help streamline your workflow and enhance productivity.

-

How secure is the signing process for the FHA identity of interest form with airSlate SignNow?

The signing process for the FHA identity of interest form with airSlate SignNow is highly secure, incorporating multiple layers of encryption and compliance with industry standards. Your documents are protected against unauthorized access, ensuring that sensitive information remains confidential. We prioritize the security of your data at all times.

Get more for Fha Identity Of Interest Form

Find out other Fha Identity Of Interest Form

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy