TSC Online CT Gov 2022

What is the TSC Online CT Gov

The TSC Online CT Gov is an online platform provided by the Connecticut Department of Revenue Services (DRS) that allows taxpayers to manage their tax-related activities efficiently. This service enables users to access various forms, including the CT tax form, check their tax status, and make payments electronically. The platform is designed to streamline the filing process and enhance user experience by providing a centralized location for all tax-related needs.

Steps to Complete the TSC Online CT Gov

Completing your CT tax form through the TSC Online CT Gov involves several straightforward steps:

- Visit the TSC Online CT Gov website and create an account if you do not already have one.

- Log in to your account and navigate to the tax forms section.

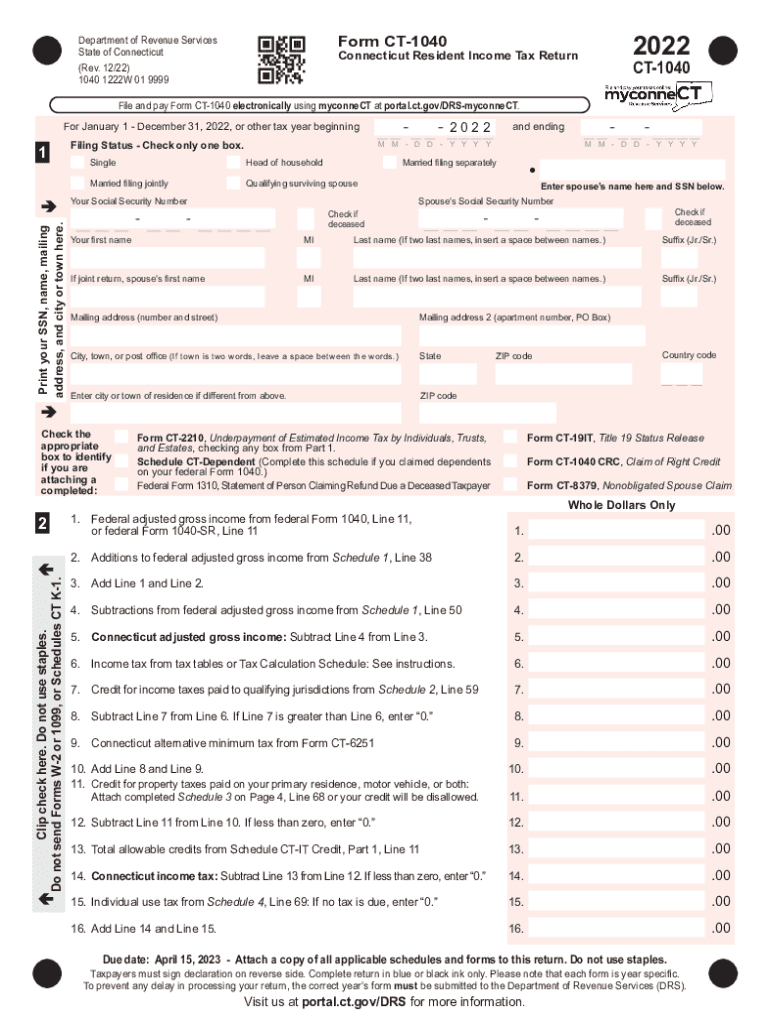

- Select the appropriate CT tax form, such as the CT-1040, and download it or fill it out online.

- Provide all required information, ensuring accuracy to avoid delays.

- Review your completed form for any errors or omissions.

- Submit your form electronically or print it for mailing, depending on your preference.

Required Documents

When filling out the CT tax form, certain documents are essential to ensure accurate reporting. These may include:

- Your W-2 forms from employers, which detail your annual earnings.

- Any 1099 forms received for additional income.

- Documentation for deductions or credits you plan to claim, such as receipts for medical expenses or educational costs.

- Previous year’s tax return, which can provide useful reference points.

Filing Deadlines / Important Dates

Being aware of filing deadlines is crucial for avoiding penalties. For the CT tax form, the general deadline is typically April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be mindful of any extensions or specific deadlines related to particular forms or circumstances.

Legal Use of the TSC Online CT Gov

The TSC Online CT Gov is legally recognized for submitting tax forms electronically, provided that users comply with federal and state regulations regarding electronic signatures and submissions. The platform adheres to the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that electronically signed documents are legally binding. This compliance is crucial for maintaining the integrity of your submissions.

Penalties for Non-Compliance

Failure to comply with tax filing requirements can lead to various penalties, including fines and interest on unpaid taxes. The Connecticut Department of Revenue Services may impose additional penalties for late filings or inaccuracies. It is essential to stay informed about your filing obligations to avoid these consequences.

Quick guide on how to complete tsc online ctgov

Complete TSC Online CT gov seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage TSC Online CT gov on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to alter and eSign TSC Online CT gov effortlessly

- Obtain TSC Online CT gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to preserve your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Alter and eSign TSC Online CT gov and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tsc online ctgov

Create this form in 5 minutes!

How to create an eSignature for the tsc online ctgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a CT tax form and why is it important?

A CT tax form is an official document used for reporting income and calculating taxes owed in Connecticut. Understanding and properly completing your CT tax form is crucial to ensure compliance with state tax laws and avoid penalties. Using a digital solution like airSlate SignNow can simplify the submission of your CT tax form.

-

How can airSlate SignNow help with completing my CT tax form?

airSlate SignNow streamlines the process of filling out your CT tax form by providing a user-friendly platform that allows you to complete and eSign documents electronically. This eliminates the hassle of printing and mailing forms, saving you time and effort. Plus, you can collaborate with tax professionals directly within the platform.

-

Is there a cost associated with using airSlate SignNow for CT tax forms?

Yes, airSlate SignNow offers affordable pricing plans tailored to meet various business needs. The cost is competitive compared to other document signing solutions, especially when considering the efficiency gained in managing your CT tax form. You can explore different subscription options on our website.

-

Can I integrate airSlate SignNow with other software for my CT tax form?

Absolutely! airSlate SignNow easily integrates with popular accounting and tax preparation software, allowing for seamless management of your CT tax form. This integration ensures that all your financial data is readily available, further simplifying the tax filing process.

-

What features does airSlate SignNow offer for managing CT tax forms?

airSlate SignNow provides powerful features such as customizable templates, electronic signatures, and secure document storage for your CT tax form. These tools make it easy to prepare and manage your tax documents efficiently. The platform also supports multiple file formats, ensuring compatibility with various tax forms.

-

How secure is my information when using airSlate SignNow for my CT tax form?

Security is a top priority at airSlate SignNow. When you use our platform to manage your CT tax form, your documents are protected with industry-leading encryption and secure cloud storage. We also provide clear audit trails, giving you peace of mind about the handling of sensitive information.

-

Can I track the status of my CT tax form in airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your CT tax form in real time. You will receive notifications for every step in the signing process, ensuring you never miss important deadlines. This feature helps you stay organized and informed about your tax filings.

Get more for TSC Online CT gov

- Lease purchase agreements package south dakota form

- Satisfaction cancellation or release of mortgage package south dakota form

- Premarital agreements package south dakota form

- Painting contractor package south dakota form

- Framing contractor package south dakota form

- Foundation contractor package south dakota form

- Plumbing contractor package south dakota form

- Brick mason contractor package south dakota form

Find out other TSC Online CT gov

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement