Publication or ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 2021

What is the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

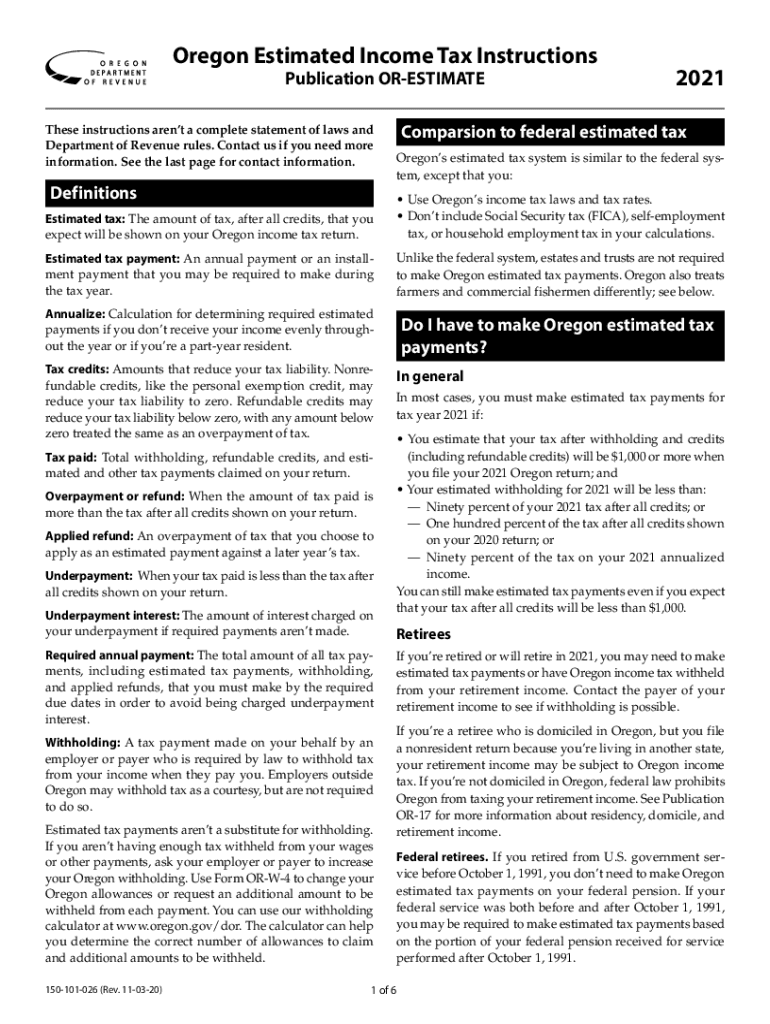

The Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 is a crucial document for individuals and businesses in Oregon who are required to estimate and pay their state income taxes. This publication provides detailed guidelines on how to calculate estimated tax payments, ensuring compliance with Oregon tax laws. It outlines the necessary steps for determining tax liability based on income projections and provides essential information about payment schedules and methods.

Steps to complete the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

Completing the Publication OR ESTIMATE requires several key steps:

- Gather financial information, including income sources and deductions.

- Review the instructions provided in the publication to understand the calculation methods.

- Use the provided worksheets to estimate your annual income and tax liability.

- Determine your payment schedule based on your estimated tax amount.

- Submit your estimated tax payments according to the guidelines specified in the publication.

How to obtain the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

The Publication OR ESTIMATE can be obtained through various channels:

- Visit the Oregon Department of Revenue website, where the publication is available for download.

- Request a physical copy by contacting the Oregon Department of Revenue directly.

- Access local tax offices or libraries that may have printed copies available for public use.

Legal use of the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

This publication serves as an official guideline for taxpayers in Oregon, and its instructions must be followed to ensure legal compliance with state tax regulations. Proper completion and submission of the estimated tax payments as outlined in the publication can help avoid penalties and interest for underpayment or late payment of taxes.

Key elements of the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

Key elements of this publication include:

- Detailed instructions on how to calculate estimated taxes based on expected income.

- Information on payment due dates and methods.

- Worksheets and examples to assist taxpayers in completing their estimates accurately.

- Guidance on how to adjust estimates if income changes throughout the year.

Filing Deadlines / Important Dates

Understanding the filing deadlines is essential for compliance. The Publication OR ESTIMATE outlines specific due dates for estimated tax payments, typically occurring quarterly. Taxpayers should mark these dates on their calendars to ensure timely submissions and avoid penalties.

Quick guide on how to complete 2021 publication or estimate oregon estimated income tax instructions 150 101 026

Prepare Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 effortlessly on any device

Virtual document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 without hassle

- Obtain Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 and hit Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark signNow parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form retrieval, or mistakes requiring new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Modify and eSign Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 publication or estimate oregon estimated income tax instructions 150 101 026

Create this form in 5 minutes!

How to create an eSignature for the 2021 publication or estimate oregon estimated income tax instructions 150 101 026

The way to generate an electronic signature for your PDF file in the online mode

The way to generate an electronic signature for your PDF file in Chrome

The way to make an e-signature for putting it on PDFs in Gmail

The way to create an electronic signature straight from your smartphone

The best way to make an electronic signature for a PDF file on iOS devices

The way to create an electronic signature for a PDF document on Android

People also ask

-

What is the purpose of Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026?

Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026, provides essential guidelines for taxpayers in Oregon regarding estimated income tax obligations. It helps individuals calculate, report, and pay their estimated income taxes accurately and on time.

-

How can airSlate SignNow assist with the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026?

airSlate SignNow can simplify the process of submitting tax documents related to Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026 by enabling users to eSign and send documents securely. This feature ensures that your tax documents are processed efficiently and are legally binding.

-

What features does airSlate SignNow offer that relate to tax documentation?

AirSlate SignNow offers features such as document templates, eSigning, and secure cloud storage, which are particularly useful for managing and submitting tax documentation as per Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026. These features ensure a streamlined workflow for tax preparation and filing.

-

Is airSlate SignNow cost-effective for managing taxes?

Yes, airSlate SignNow is a cost-effective solution for managing taxes, especially when dealing with Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026. The platform offers flexible pricing plans that cater to businesses of all sizes, ensuring that you only pay for what you need.

-

Can airSlate SignNow integrate with accounting software for tax purposes?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage your finances and comply with Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026. This integration helps streamline data sharing and reduces the chance of errors during tax processes.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents provides numerous benefits, such as time savings, reduced paper usage, and enhanced security. Specifically for Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026, eSigning documents allows for quicker processing and reduces the hassle of physical paperwork.

-

Who can benefit from the Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026?

Individuals and businesses in Oregon needing to report estimated income taxes can benefit from Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026. This publication is crucial for anyone who receives income that isn't subject to withholding, ensuring compliance with state tax laws.

Get more for Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

Find out other Publication OR ESTIMATE, Oregon Estimated Income Tax Instructions, 150 101 026

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter

- How Do I Sign Tennessee Legal Separation Agreement

- Sign Virginia Insurance Memorandum Of Understanding Easy