Www Oregon Govdorforms2021 Publication or ESTIMATE, Oregon Estimated Income Tax 2022

Understanding the Oregon Estimated Income Tax Form

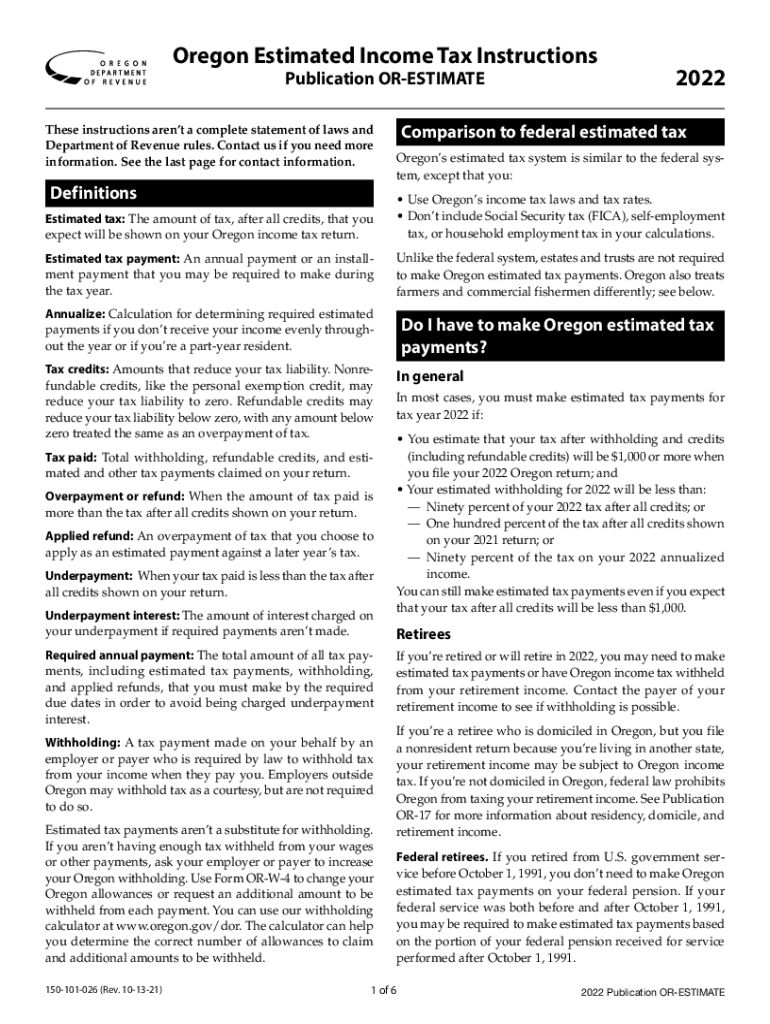

The Oregon estimated tax form for 2022 is essential for individuals and businesses that expect to owe tax of $500 or more when filing their income tax returns. This form allows taxpayers to pay estimated taxes on income that is not subject to withholding, such as self-employment income, rental income, or interest and dividends. Properly completing this form ensures compliance with state tax laws and helps avoid penalties associated with underpayment.

Steps to Complete the Oregon Estimated Tax Form

Completing the Oregon estimated tax form involves several key steps:

- Gather necessary financial information, including income sources and deductions.

- Calculate your expected annual income and tax liabilities using the Oregon tax rates.

- Determine the amount of estimated tax you need to pay for the year.

- Fill out the Oregon estimated tax form accurately, ensuring all calculations are correct.

- Choose your payment method, whether online, by mail, or in person.

Filing Deadlines and Important Dates

It is crucial to be aware of the filing deadlines associated with the Oregon estimated tax form. Generally, estimated tax payments are due quarterly. The specific deadlines for 2022 are:

- First quarter: April 15

- Second quarter: June 15

- Third quarter: September 15

- Fourth quarter: January 15 of the following year

Missing these deadlines can result in penalties and interest on unpaid amounts.

Required Documents for Filing

To complete the Oregon estimated tax form, you will need several documents, including:

- Previous year’s tax return for reference

- Income statements such as W-2s and 1099s

- Records of any deductions or credits you plan to claim

- Any relevant financial documents that support your income estimates

Having these documents on hand will streamline the process and help ensure accuracy.

Penalties for Non-Compliance

Failing to file or pay estimated taxes can lead to significant penalties. Oregon imposes penalties for underpayment, which may include:

- A penalty of up to 20% of the unpaid tax amount

- Interest on the unpaid tax, which accrues daily

- Potential legal action for persistent non-compliance

Understanding these consequences emphasizes the importance of timely and accurate filing.

Digital vs. Paper Version of the Form

Taxpayers can choose between submitting the Oregon estimated tax form digitally or via paper. The digital version offers several advantages:

- Faster processing times

- Immediate confirmation of submission

- Reduced risk of lost or misplaced documents

However, some individuals may prefer the paper version for its tangible nature. Regardless of the method chosen, ensuring that the form is completed correctly is paramount.

Quick guide on how to complete wwworegongovdorforms2021 publication or estimate oregon estimated income tax

Complete Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax without hassle

- Locate Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax and click Get Form to begin.

- Utilize the tools provided to finalize your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, either via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwworegongovdorforms2021 publication or estimate oregon estimated income tax

Create this form in 5 minutes!

How to create an eSignature for the wwworegongovdorforms2021 publication or estimate oregon estimated income tax

The way to create an e-signature for your PDF file online

The way to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

The way to create an e-signature right from your mobile device

The best way to generate an electronic signature for a PDF file on iOS

The way to create an e-signature for a PDF on Android devices

People also ask

-

What is the Oregon estimated tax form for 2022?

The Oregon estimated tax form for 2022 is a document used by residents and businesses to calculate and submit estimated tax payments. This form helps taxpayers ensure they meet their state tax obligations throughout the year, rather than waiting until the end of the tax year.

-

How can I access the Oregon estimated tax form for 2022?

You can access the Oregon estimated tax form for 2022 directly through the Oregon Department of Revenue's website or through tax preparation software that includes state tax forms. Additionally, airSlate SignNow allows you to eSign these documents conveniently once completed.

-

What are the benefits of using airSlate SignNow for my Oregon estimated tax form 2022?

Using airSlate SignNow for your Oregon estimated tax form 2022 offers a seamless and efficient way to complete and sign your documents electronically. Our platform is user-friendly, cost-effective, and saves you time by reducing paperwork and streamlining your tax filing process.

-

Is there a fee to use airSlate SignNow for the Oregon estimated tax form 2022?

Yes, airSlate SignNow has a subscription fee that provides access to a variety of features, including eSigning your Oregon estimated tax form for 2022. However, the investment can save you money by streamlining your document processes and potentially avoiding late fees on tax payments.

-

Can I integrate airSlate SignNow with other accounting software for my Oregon estimated tax form 2022?

Yes, airSlate SignNow offers integrations with popular accounting software, making it easy to manage your Oregon estimated tax form 2022 alongside your financial records. This ensures accurate data transfer and seamless workflows between your finance and tax document management.

-

What features does airSlate SignNow offer for completing the Oregon estimated tax form 2022?

airSlate SignNow provides features such as customizable templates, file storage, and electronic signatures that simplify filling out the Oregon estimated tax form for 2022. Additionally, you can track the status of your document in real-time, ensuring a smooth and efficient process.

-

How secure is airSlate SignNow for signing my Oregon estimated tax form 2022?

Security is a top priority at airSlate SignNow. When you sign your Oregon estimated tax form for 2022, our platform uses advanced encryption methods to protect your data and ensure your documents are safe and compliant with industry standards.

Get more for Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax

Find out other Www oregon govdorforms2021 Publication OR ESTIMATE, Oregon Estimated Income Tax

- How Can I eSign Washington Police Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation