1040 Nr Schedule Oi Form 2021

What is the 1040 NR Schedule OI Form

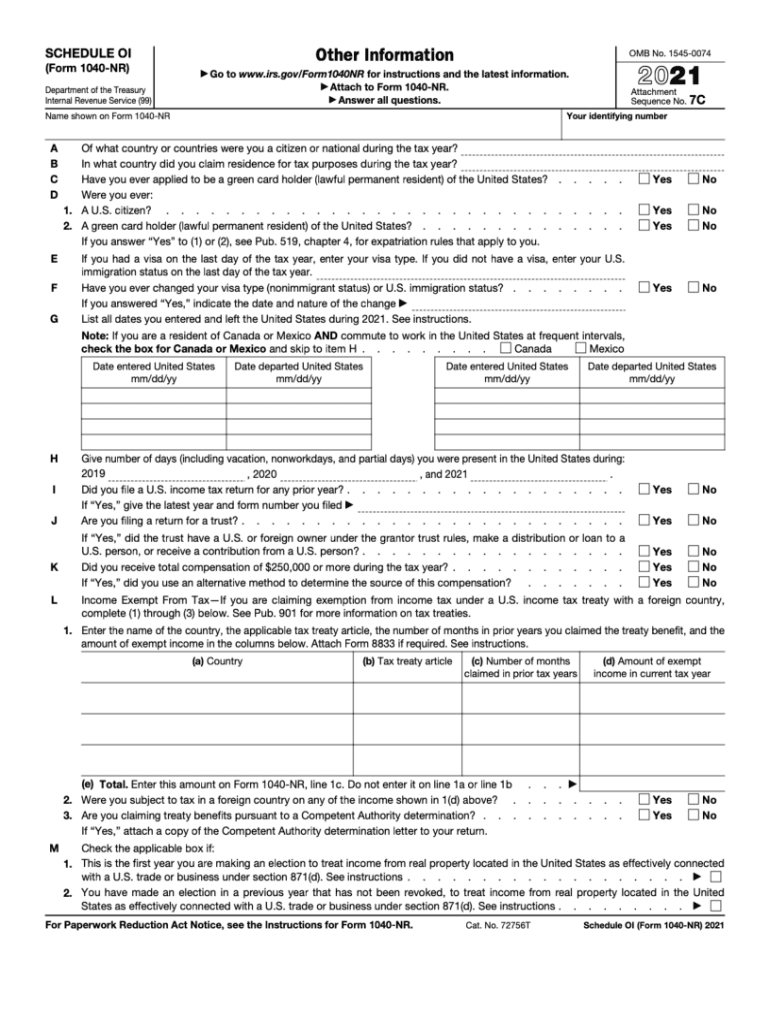

The 1040 NR Schedule OI form, officially known as the Other Information form, is an essential document for non-resident aliens filing their taxes in the United States. This form provides the Internal Revenue Service (IRS) with critical information regarding the taxpayer's residency status, type of income, and eligibility for specific tax benefits or exemptions. It is a supplementary form that accompanies the 2021 IRS 1040NR and is designed to capture details that are not included in the main tax return. Proper completion of the Schedule OI is crucial for ensuring compliance with U.S. tax laws and for determining the correct tax obligations.

How to Use the 1040 NR Schedule OI Form

Using the 1040 NR Schedule OI form involves several steps to ensure all required information is accurately reported. First, gather all relevant documents, including your 1040NR and any supporting tax documents. Next, carefully read the instructions provided by the IRS for the Schedule OI to understand what information is necessary. Fill out the form by providing details such as your visa type, the purpose of your stay in the U.S., and any applicable tax treaty benefits. After completing the form, review it for accuracy and ensure it is signed before submission with your 1040NR.

Steps to Complete the 1040 NR Schedule OI Form

Completing the 1040 NR Schedule OI form requires attention to detail. Here are the steps to follow:

- Obtain the 1040 NR Schedule OI form from the IRS website or through tax preparation software.

- Read the instructions carefully to understand the information required.

- Fill in your personal details, including your name, address, and taxpayer identification number.

- Provide information about your residency status and the type of income you received.

- Include any tax treaty benefits you may be eligible for, along with supporting documentation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submitting it with your 1040NR.

Legal Use of the 1040 NR Schedule OI Form

The legal use of the 1040 NR Schedule OI form is critical for compliance with U.S. tax regulations. This form must be completed accurately to provide the IRS with necessary information regarding a non-resident alien's tax obligations. Failure to submit a properly filled Schedule OI can lead to delays in processing your tax return, potential penalties, or even audits. It is essential to ensure that all information provided is truthful and complete, as discrepancies can have legal ramifications.

IRS Guidelines for the 1040 NR Schedule OI Form

The IRS provides specific guidelines for completing the 1040 NR Schedule OI form. Taxpayers must adhere to these guidelines to ensure compliance and avoid issues. Key points include:

- Ensure all sections of the form are filled out completely.

- Provide accurate information regarding residency status and income sources.

- Attach any necessary supporting documents, such as tax treaty statements.

- File the form by the tax deadline to avoid penalties.

Filing Deadlines for the 1040 NR Schedule OI Form

Filing deadlines for the 1040 NR Schedule OI form align with the overall tax filing deadlines for non-resident aliens. Typically, the deadline for filing the 2021 IRS 1040NR and accompanying forms is April 15 of the following year. However, if you are a non-resident alien who is not a U.S. citizen, you may qualify for an automatic extension until June 15. It is crucial to check for any updates or changes to these deadlines annually to ensure timely filing.

Quick guide on how to complete 1040 nr schedule oi form

Complete 1040 Nr Schedule Oi Form effortlessly on any device

Online document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage 1040 Nr Schedule Oi Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign 1040 Nr Schedule Oi Form with ease

- Locate 1040 Nr Schedule Oi Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the files or obscure sensitive details using tools provided by airSlate SignNow specifically for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from a device of your choosing. Alter and eSign 1040 Nr Schedule Oi Form while ensuring exceptional communication at any stage of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1040 nr schedule oi form

Create this form in 5 minutes!

People also ask

-

What is the 2021 IRS 1040NR form?

The 2021 IRS 1040NR form is a tax return for non-resident aliens in the United States. This form allows non-residents to report their U.S. income, deductions, and tax credits. It is essential for compliance with U.S. tax laws and ensuring correct tax obligations are fulfilled.

-

How can airSlate SignNow assist with the 2021 IRS 1040NR process?

airSlate SignNow provides a seamless solution for eSigning and sending the 2021 IRS 1040NR form and other related documents. Our platform ensures secure transactions and easy document management, allowing you to complete your tax paperwork efficiently. Experience hassle-free document handling with our user-friendly interface.

-

What are the costs associated with using airSlate SignNow for the 2021 IRS 1040NR?

airSlate SignNow offers competitive pricing plans suitable for various business needs, including those dealing with the 2021 IRS 1040NR form. With flexible subscription options, you can choose a plan that fits your volume of documents and signing requirements. Our cost-effective solution ensures you get value without compromising on features.

-

Are there any key features of airSlate SignNow that benefit the handling of the 2021 IRS 1040NR?

Yes, airSlate SignNow includes features such as automated workflows, document templates, and secure cloud storage which are specifically beneficial when managing the 2021 IRS 1040NR form. These tools simplify the process, reduce errors, and enhance collaboration among users. Furthermore, the integration capabilities with other accounting software streamline your tax preparation needs.

-

Can I integrate airSlate SignNow with other software for the 2021 IRS 1040NR filing?

Absolutely! airSlate SignNow offers various integrations with popular accounting and tax software that can help you manage the 2021 IRS 1040NR filing process more effectively. These integrations allow for seamless data transfer and document management, ensuring a smoother overall experience. Enjoy the convenience of managing all your tax documents in one place.

-

What customer support options are available for assistance with the 2021 IRS 1040NR form?

airSlate SignNow provides comprehensive customer support to assist users with queries related to the 2021 IRS 1040NR and other documents. Our support team is available via live chat, email, and phone to help you navigate any technical issues or questions you may have. We prioritize customer satisfaction and are here to ensure your experience is smooth and successful.

-

How does airSlate SignNow ensure the security of my 2021 IRS 1040NR documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like the 2021 IRS 1040NR. We utilize advanced encryption protocols and secure data storage solutions to protect your information. Our compliance with industry standards ensures that your documents are safe and secure throughout the signing process.

Get more for 1040 Nr Schedule Oi Form

Find out other 1040 Nr Schedule Oi Form

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast

- eSignature South Dakota Apartment lease agreement template Free

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy