Form 1040 NR, U S Nonresident Alien Income Tax Return 2024-2026

What is the Form 1040 NR, U S Nonresident Alien Income Tax Return

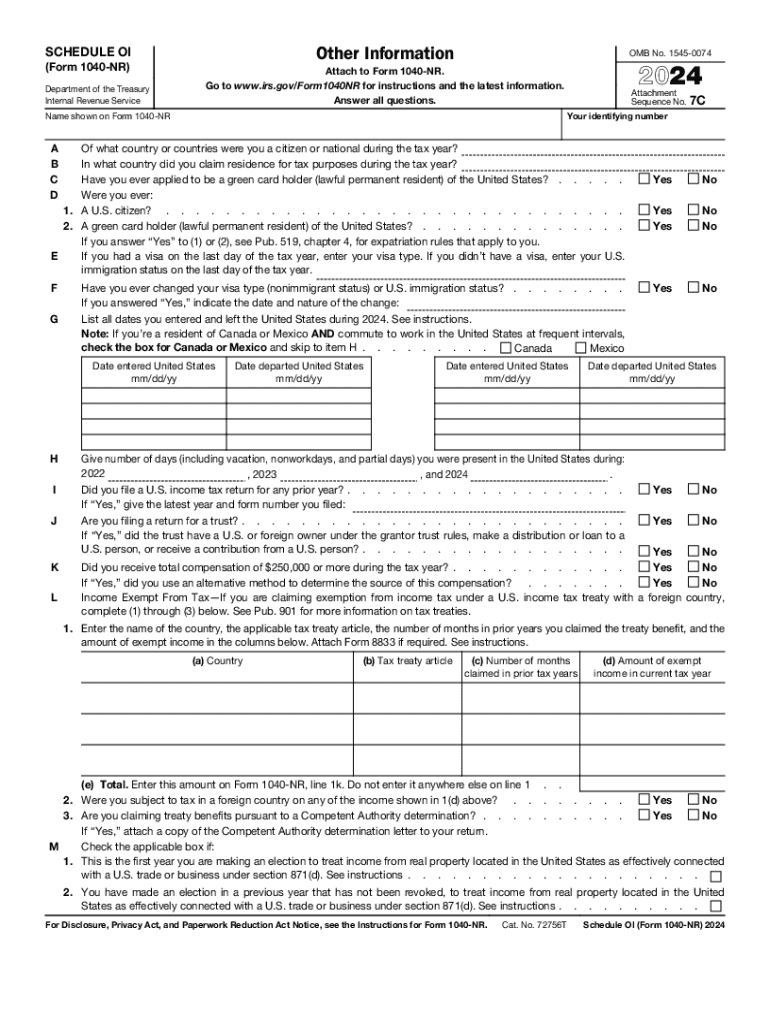

The IRS 1040 NR form is specifically designed for nonresident aliens who need to report their income earned in the United States. This form is essential for individuals who do not meet the criteria for resident alien status but have U.S.-sourced income. The 1040 NR allows these taxpayers to calculate their tax liability and claim any applicable deductions or credits. Understanding this form is crucial for compliance with U.S. tax laws and ensuring accurate reporting of income.

Steps to complete the Form 1040 NR, U S Nonresident Alien Income Tax Return

Completing the IRS 1040 NR form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Determine your filing status and eligibility to use the 1040 NR.

- Fill out personal information, including your name, address, and taxpayer identification number.

- Report your income, ensuring to include only U.S.-sourced income.

- Claim deductions and credits available to nonresident aliens, if applicable.

- Calculate your tax liability based on the income reported.

- Review the form for accuracy before submission.

Key elements of the Form 1040 NR, U S Nonresident Alien Income Tax Return

The IRS 1040 NR form includes several important sections that taxpayers must complete:

- Personal Information: This section captures basic details such as your name, address, and identification number.

- Income Reporting: Here, you will list all U.S.-sourced income, including wages, dividends, and rental income.

- Deductions and Credits: Nonresident aliens may claim specific deductions, such as state taxes paid and certain expenses.

- Tax Calculation: This section helps determine the amount of tax owed based on the income reported.

Filing Deadlines / Important Dates

It is essential for nonresident aliens to be aware of the filing deadlines associated with the IRS 1040 NR form. Typically, the due date for filing is April 15 for income earned in the previous calendar year. However, if you are a nonresident alien who is not employed in the U.S., you may have until June 15 to file. Extensions may be available, but it is crucial to understand the implications of late filing and potential penalties.

Required Documents

To successfully complete the IRS 1040 NR form, several documents are necessary:

- Form W-2 or 1099 to report income earned in the U.S.

- Passport or other identification to verify your identity.

- Any relevant tax documents from your home country that may affect your U.S. tax obligations.

- Records of any deductions or credits you plan to claim.

IRS Guidelines

The IRS provides specific guidelines for completing the 1040 NR form. These guidelines include instructions on who qualifies as a nonresident alien, how to report income, and what deductions are permissible. It is important to refer to the latest IRS publications and instructions to ensure compliance with current tax laws. Staying informed about updates can help avoid mistakes and potential penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr u s nonresident alien income tax return 771104606

Create this form in 5 minutes!

How to create an eSignature for the form 1040 nr u s nonresident alien income tax return 771104606

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS 1040 NR form?

The IRS 1040 NR form is a tax return form used by non-resident aliens to report their income to the Internal Revenue Service. It is essential for individuals who earn income in the United States but do not qualify as residents for tax purposes. Understanding how to fill out the IRS 1040 NR form correctly is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with the IRS 1040 NR form?

airSlate SignNow provides an efficient platform for electronically signing and sending the IRS 1040 NR form. With its user-friendly interface, you can easily upload your completed form, gather signatures, and ensure secure document delivery. This streamlines the process, making tax filing less stressful.

-

What are the pricing options for using airSlate SignNow for the IRS 1040 NR form?

airSlate SignNow offers various pricing plans to suit different needs, including a free trial for new users. The plans are designed to be cost-effective, allowing you to choose the features that best fit your requirements for managing documents like the IRS 1040 NR form. Check the website for the latest pricing details.

-

Is airSlate SignNow compliant with IRS regulations for the IRS 1040 NR form?

Yes, airSlate SignNow is compliant with IRS regulations, ensuring that your electronic signatures on the IRS 1040 NR form are legally binding. The platform uses advanced security measures to protect your sensitive information, giving you peace of mind while filing your taxes. Always verify that your documents meet IRS standards.

-

Can I integrate airSlate SignNow with other software for the IRS 1040 NR form?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to manage your IRS 1040 NR form alongside your other business tools. Whether you use accounting software or document management systems, you can streamline your workflow and enhance productivity.

-

What features does airSlate SignNow offer for managing the IRS 1040 NR form?

airSlate SignNow includes features such as customizable templates, automated reminders, and secure cloud storage, all of which are beneficial for managing the IRS 1040 NR form. These tools help you stay organized and ensure that you never miss a deadline. The platform is designed to simplify the document signing process.

-

How does airSlate SignNow ensure the security of my IRS 1040 NR form?

Security is a top priority for airSlate SignNow. The platform employs encryption and secure access protocols to protect your IRS 1040 NR form and other sensitive documents. You can trust that your information is safe while using our services, allowing you to focus on your tax filing.

Get more for Form 1040 NR, U S Nonresident Alien Income Tax Return

Find out other Form 1040 NR, U S Nonresident Alien Income Tax Return

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template