Form 1040 NR Department of the TreasuryInternal Revenue Service U S 2022

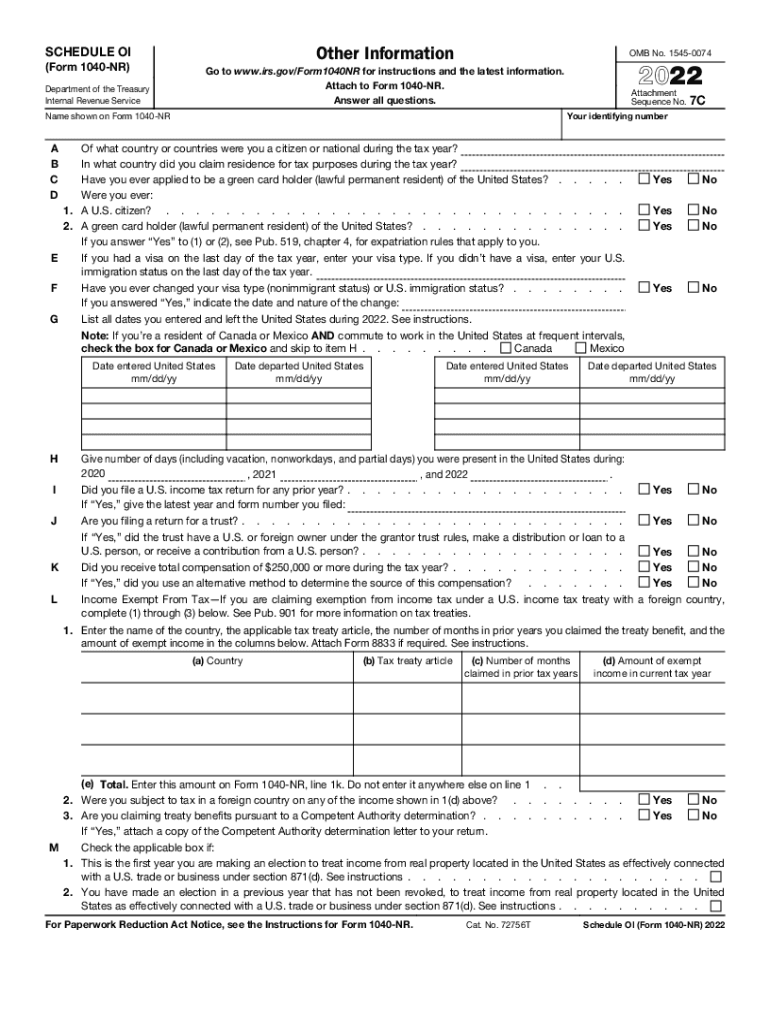

What is the IRS 1040 NR Form?

The IRS 1040 NR form, officially known as the U.S. Nonresident Alien Income Tax Return, is designed for non-U.S. residents who earn income in the United States. This form allows individuals to report their income and calculate their tax liability. It is essential for nonresident aliens to file this form to comply with U.S. tax laws and ensure accurate reporting of their earnings. The form is part of the Department of the Treasury's requirements and is crucial for maintaining compliance with the Internal Revenue Service (IRS).

Steps to Complete the IRS 1040 NR Form

Completing the IRS 1040 NR form involves several key steps:

- Gather necessary documents, including income statements, tax identification numbers, and any relevant deductions.

- Fill out personal information, including your name, address, and filing status.

- Report your income from U.S. sources, ensuring you include all applicable earnings.

- Claim any eligible deductions and credits specific to nonresident aliens.

- Calculate your total tax liability based on the income reported.

- Sign and date the form, confirming that the information provided is accurate.

Legal Use of the IRS 1040 NR Form

The IRS 1040 NR form is legally binding when completed and submitted according to IRS guidelines. It is important to ensure that all information is accurate and truthful, as providing false information can result in penalties. The form must be filed by the appropriate deadlines to avoid additional charges or interest on unpaid taxes. Nonresident aliens must also comply with specific tax treaties that may affect their filing requirements and tax liabilities.

Filing Deadlines / Important Dates

Filing deadlines for the IRS 1040 NR form are crucial for compliance. Typically, the form must be submitted by April 15 of the following tax year. However, if you are a nonresident alien who is not in the U.S. on that date, you may have a different deadline. It is essential to check the IRS website or consult a tax professional for the most accurate and up-to-date information regarding specific filing dates and any extensions that may apply.

Required Documents for the IRS 1040 NR Form

To complete the IRS 1040 NR form accurately, certain documents are required:

- Form W-2 from employers, if applicable.

- Form 1099 for other income sources.

- Tax identification number (TIN) or Social Security number (SSN).

- Records of any deductions or credits claimed.

- Documentation of any applicable tax treaties.

Form Submission Methods

The IRS 1040 NR form can be submitted in several ways. Taxpayers have the option to file electronically using approved software or through a tax professional. Alternatively, the form can be mailed to the appropriate IRS address. It is important to ensure that the form is sent to the correct location to avoid delays in processing. If filing by mail, consider using certified mail for tracking purposes.

Quick guide on how to complete form 1040 nr department of the treasuryinternal revenue service us

Complete Form 1040 NR Department Of The TreasuryInternal Revenue Service U S effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an excellent eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents swiftly without any delays. Manage Form 1040 NR Department Of The TreasuryInternal Revenue Service U S on any device using the airSlate SignNow apps for Android or iOS and streamline any document-based process today.

How to alter and electronically sign Form 1040 NR Department Of The TreasuryInternal Revenue Service U S with ease

- Locate Form 1040 NR Department Of The TreasuryInternal Revenue Service U S and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors requiring new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 1040 NR Department Of The TreasuryInternal Revenue Service U S, ensuring exceptional communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 nr department of the treasuryinternal revenue service us

Create this form in 5 minutes!

People also ask

-

What is the IRS 1040 NR form and who needs to file it?

The IRS 1040 NR form is a tax return specifically for non-resident aliens in the United States. Individuals who have income from U.S. sources and do not meet the criteria to file as residents must use this form. It's essential for ensuring compliance with U.S. tax laws for non-residents.

-

How can I eSign my IRS 1040 NR form using airSlate SignNow?

You can easily eSign your IRS 1040 NR form with airSlate SignNow by uploading the document to our platform. Once uploaded, you can add your signature and other necessary information quickly and securely. This streamlines the tax filing process and ensures your document is accurately completed.

-

Is there a cost associated with using airSlate SignNow for the IRS 1040 NR form?

Yes, airSlate SignNow offers various pricing plans, including a free trial to explore the features. The pricing is designed to be cost-effective, providing value for individuals and businesses looking to manage documents like the IRS 1040 NR form efficiently. You can choose a plan that best fits your needs.

-

What features does airSlate SignNow offer for handling the IRS 1040 NR form?

airSlate SignNow provides a user-friendly interface that allows for easy document uploads, eSigning, and tracking of the IRS 1040 NR form status. Additional features include templates, customizable workflows, and secure cloud storage. These tools simplify the management of your tax documents.

-

Can airSlate SignNow integrate with other software for filing the IRS 1040 NR form?

Yes, airSlate SignNow integrates seamlessly with various applications, including accounting and tax preparation software. This integration allows for a streamlined process when preparing and eSigning your IRS 1040 NR form. By connecting your tools, you can save time and reduce errors.

-

What are the benefits of using airSlate SignNow for the IRS 1040 NR form?

Using airSlate SignNow for your IRS 1040 NR form offers signNow benefits, such as the ability to eSign documents quickly and securely. It reduces the need for physical paperwork, making tax filing more efficient and eco-friendly. Additionally, the platform ensures compliance with legal standards for eSignatures.

-

Is my information secure when using airSlate SignNow for the IRS 1040 NR form?

Absolutely! airSlate SignNow prioritizes your security by employing advanced encryption and compliance with data protection regulations. When you handle your IRS 1040 NR form through our platform, you can trust that your sensitive information remains confidential and protected.

Get more for Form 1040 NR Department Of The TreasuryInternal Revenue Service U S

- Notice of assignment to living trust nevada form

- Revocation of living trust nevada form

- Letter to lienholder to notify of trust nevada form

- Nevada timber sale contract nevada form

- Nevada forest products timber sale contract nevada form

- Assumption agreement of deed of trust and release of original mortgagors nevada form

- Nevada foreign document form

- Emancipation removal of disability of minority package nevada form

Find out other Form 1040 NR Department Of The TreasuryInternal Revenue Service U S

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe