State of Arkansas Tax Forms and Instructions" Keyword Found 2021

What is the State Of Arkansas Tax Forms And Instructions

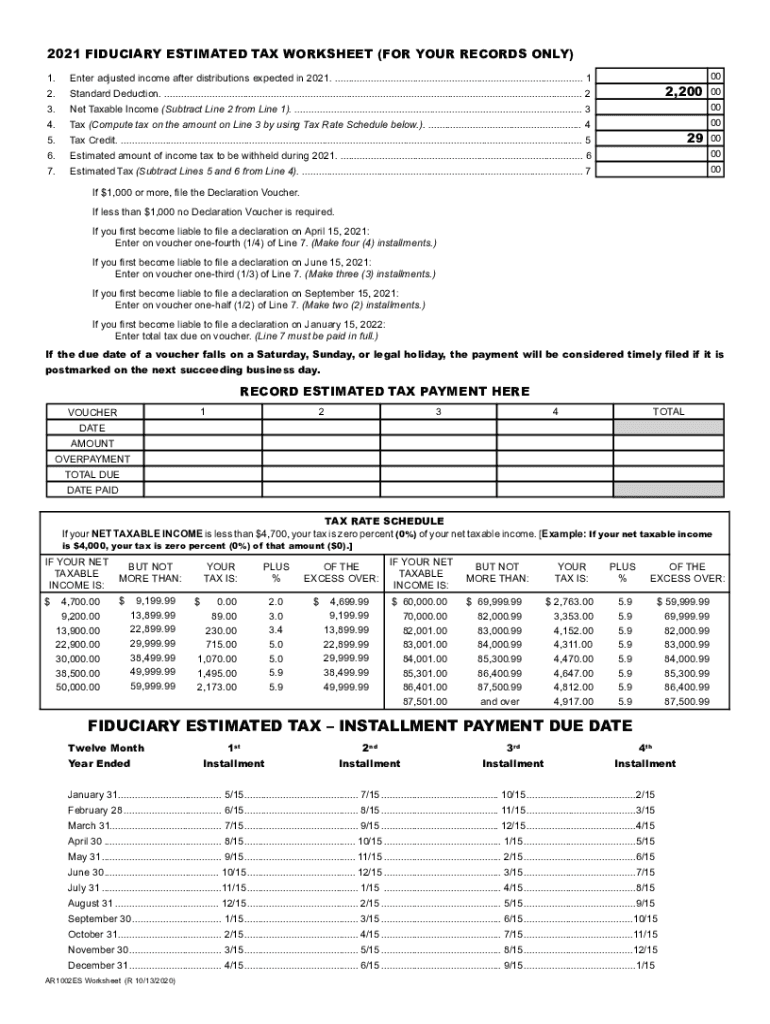

The State of Arkansas tax forms and instructions are essential documents that taxpayers must complete to report their income, claim deductions, and calculate their tax liabilities. These forms vary based on the type of income, the taxpayer's status, and specific deductions or credits being claimed. Understanding the purpose and requirements of each form is crucial for accurate tax filing.

Steps to complete the State Of Arkansas Tax Forms And Instructions

Completing the State of Arkansas tax forms involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and other income statements.

- Choose the appropriate tax form based on your income type and filing status.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the State Of Arkansas Tax Forms And Instructions

To ensure the legal validity of the State of Arkansas tax forms, it is important to comply with specific regulations governing electronic signatures and document submissions. Utilizing a reliable electronic signature platform can help meet these legal requirements, providing a secure and compliant way to sign and submit tax forms.

Filing Deadlines / Important Dates

Taxpayers in Arkansas should be aware of key filing deadlines to avoid penalties. Typically, individual income tax returns are due on April 15 each year. Extensions may be available, but they must be requested before the original deadline. It is important to check for any changes in deadlines that may occur due to state legislation or other factors.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their State of Arkansas tax forms. These include:

- Online Submission: Many forms can be filed electronically through the Arkansas Department of Finance and Administration's website.

- Mail: Completed forms can be sent to the appropriate address as specified in the instructions.

- In-Person: Taxpayers may also choose to submit their forms in person at designated state offices.

Who Issues the Form

The Arkansas Department of Finance and Administration is responsible for issuing state tax forms and providing the necessary instructions for taxpayers. This agency ensures that forms are updated annually to reflect any changes in tax laws or regulations.

Quick guide on how to complete state of arkansas tax forms and instructionsampquot keyword found

Easily Prepare State Of Arkansas Tax Forms And Instructions" Keyword Found on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all necessary tools to swiftly create, modify, and eSign your documents without any delays. Manage State Of Arkansas Tax Forms And Instructions" Keyword Found on any platform through airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to Edit and eSign State Of Arkansas Tax Forms And Instructions" Keyword Found Effortlessly

- Obtain State Of Arkansas Tax Forms And Instructions" Keyword Found and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign State Of Arkansas Tax Forms And Instructions" Keyword Found to ensure outstanding communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state of arkansas tax forms and instructionsampquot keyword found

Create this form in 5 minutes!

People also ask

-

What are the State Of Arkansas Tax Forms And Instructions available through airSlate SignNow?

airSlate SignNow provides access to all necessary State Of Arkansas Tax Forms And Instructions, making the filing process simpler and more efficient. Our platform ensures that you have the latest versions of these forms, enabling you to stay compliant with state tax regulations.

-

How much does it cost to use airSlate SignNow for State Of Arkansas Tax Forms And Instructions?

The pricing for airSlate SignNow varies based on the plan you choose, with options available to cater to different budgets. Regardless of the plan, you can efficiently access and manage your State Of Arkansas Tax Forms And Instructions at a cost-effective rate, ensuring great value for your business.

-

Can I integrate airSlate SignNow with other tools for managing State Of Arkansas Tax Forms And Instructions?

Yes, airSlate SignNow offers seamless integration with numerous third-party applications, including popular accounting and business management software. This integration allows you to streamline your workflow for handling State Of Arkansas Tax Forms And Instructions and enhances document management efficiency.

-

What features does airSlate SignNow offer for handling State Of Arkansas Tax Forms And Instructions?

airSlate SignNow is equipped with several powerful features for managing State Of Arkansas Tax Forms And Instructions, including eSignature capabilities, real-time document tracking, and secure cloud storage. These features simplify the signing and submission process while ensuring that your documents are kept safe and organized.

-

Is there customer support available for questions about State Of Arkansas Tax Forms And Instructions?

Absolutely! Our dedicated customer support team is here to assist you with any inquiries regarding State Of Arkansas Tax Forms And Instructions. Whether you need help navigating the platform or understanding specific forms, our representatives are ready to provide the guidance you need.

-

How does airSlate SignNow improve the efficiency of submitting State Of Arkansas Tax Forms And Instructions?

Using airSlate SignNow signNowly reduces the time spent on submitting State Of Arkansas Tax Forms And Instructions by enabling you to eSign documents instantly and track their submission status. This efficiency allows businesses to focus more on their operations rather than getting bogged down in paperwork.

-

Are State Of Arkansas Tax Forms And Instructions easy to fill out on airSlate SignNow?

Yes, airSlate SignNow is designed with user-friendliness in mind, allowing you to fill out State Of Arkansas Tax Forms And Instructions easily and quickly. Our intuitive interface guides you through each step, ensuring that you can complete your forms without hassle.

Get more for State Of Arkansas Tax Forms And Instructions" Keyword Found

Find out other State Of Arkansas Tax Forms And Instructions" Keyword Found

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure