STATE of ARKANSAS Fiduciary Estimated Tax Declarat 2025-2026

What is the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

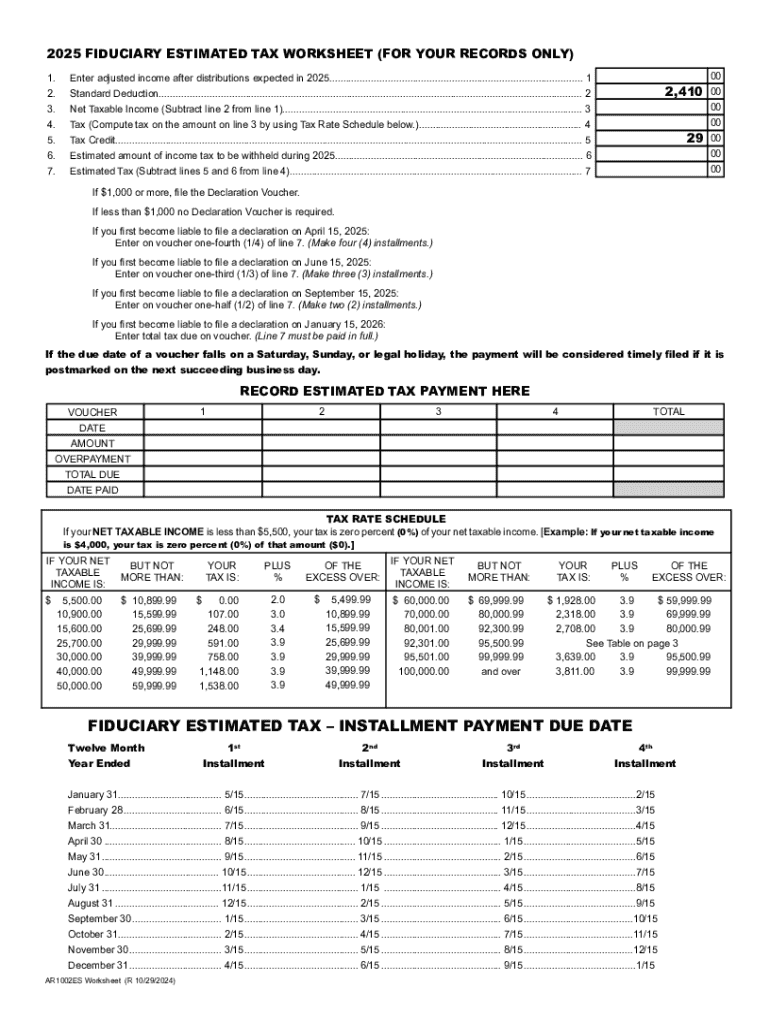

The STATE OF ARKANSAS Fiduciary Estimated Tax Declaration is a tax form designed for fiduciaries managing estates or trusts. This form allows fiduciaries to report and pay estimated taxes on income generated by the estate or trust. It is essential for ensuring compliance with Arkansas state tax laws and helps prevent penalties associated with underpayment of taxes. By submitting this declaration, fiduciaries can estimate their tax liabilities for the year and make timely payments to the state.

How to use the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

Using the STATE OF ARKANSAS Fiduciary Estimated Tax Declaration involves several steps. First, fiduciaries need to gather all relevant financial information regarding the estate or trust, including income sources and deductions. Next, they should complete the form accurately, ensuring all required fields are filled out. After calculating the estimated tax liability, fiduciaries can submit the form along with any necessary payments to the Arkansas Department of Finance and Administration. This process helps maintain compliance and avoid potential penalties.

Steps to complete the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

Completing the STATE OF ARKANSAS Fiduciary Estimated Tax Declaration requires careful attention to detail. Follow these steps:

- Gather financial documents related to the estate or trust.

- Calculate the total income expected for the year.

- Determine allowable deductions to arrive at the taxable income.

- Use the appropriate tax rate to estimate the tax liability.

- Fill out the form with accurate information, including the fiduciary's details.

- Review the completed form for any errors or omissions.

- Submit the form and payment by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the STATE OF ARKANSAS Fiduciary Estimated Tax Declaration are crucial for compliance. Typically, fiduciaries must submit their estimated tax payments in four installments throughout the year. The due dates usually align with the federal tax deadlines, making it essential to stay informed about any changes. Missing these deadlines can result in penalties and interest on unpaid taxes, so it is advisable to mark these dates on the calendar and prepare in advance.

Key elements of the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

Several key elements are essential when completing the STATE OF ARKANSAS Fiduciary Estimated Tax Declaration. These include:

- The fiduciary's name and contact information.

- The name of the estate or trust.

- Estimated income for the year.

- Allowable deductions.

- Calculated estimated tax liability.

- Payment information, if applicable.

Ensuring accuracy in these elements is vital for a successful submission and to avoid any potential issues with the Arkansas tax authorities.

Legal use of the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

The legal use of the STATE OF ARKANSAS Fiduciary Estimated Tax Declaration is governed by Arkansas state tax laws. Fiduciaries are legally required to file this form if the estate or trust is expected to owe taxes. Failure to file or pay estimated taxes can lead to legal consequences, including fines and penalties. It is important for fiduciaries to understand their obligations and ensure compliance with all applicable laws to protect both the estate and their personal liability.

Create this form in 5 minutes or less

Find and fill out the correct state of arkansas fiduciary estimated tax declarat

Create this form in 5 minutes!

How to create an eSignature for the state of arkansas fiduciary estimated tax declarat

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat?

The STATE OF ARKANSAS Fiduciary Estimated Tax Declarat is a form used by fiduciaries to report estimated tax payments for estates and trusts. This form helps ensure compliance with Arkansas tax laws and allows fiduciaries to manage their tax obligations effectively.

-

How can airSlate SignNow help with the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat. Our user-friendly interface simplifies the process, ensuring that fiduciaries can complete their tax declarations quickly and efficiently.

-

What are the pricing options for using airSlate SignNow for tax declarations?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat. Our plans are cost-effective, ensuring that you get the best value while managing your document signing and tax declaration processes.

-

Are there any features specifically designed for tax documents in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for tax documents, including templates for the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat. These features help users save time and reduce errors, making tax filing more efficient.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various accounting and tax management software, allowing you to seamlessly manage the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat alongside your other financial documents. This integration enhances workflow efficiency and accuracy.

-

What benefits does airSlate SignNow provide for fiduciaries?

Using airSlate SignNow for the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat offers numerous benefits, including reduced paperwork, faster processing times, and enhanced security for sensitive information. Our platform ensures that fiduciaries can focus on their core responsibilities without the hassle of traditional document handling.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the STATE OF ARKANSAS Fiduciary Estimated Tax Declarat. You can trust that your sensitive information is safe while using our platform.

Get more for STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

Find out other STATE OF ARKANSAS Fiduciary Estimated Tax Declarat

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed