Instructions 83 B Form 2021

What is the IRS Form 83-B?

The IRS Form 83-B, also known as the 83-B election form, is a crucial document for individuals who receive restricted property, such as stock options or shares, as part of their compensation. This form allows taxpayers to elect to include the value of the property in their income in the year it is transferred, rather than waiting until the restrictions lapse. This election can significantly impact the tax treatment of the property and is particularly beneficial in scenarios where the property is expected to appreciate in value.

How to Obtain the IRS Form 83-B

To download the IRS Form 83-B, you can visit the official IRS website or access it through various tax preparation software. The form is available as a fillable PDF, making it easy to complete electronically. Ensure you have the most recent version of the form to comply with current tax regulations. Once downloaded, you can print it for your records or fill it out digitally, depending on your preference.

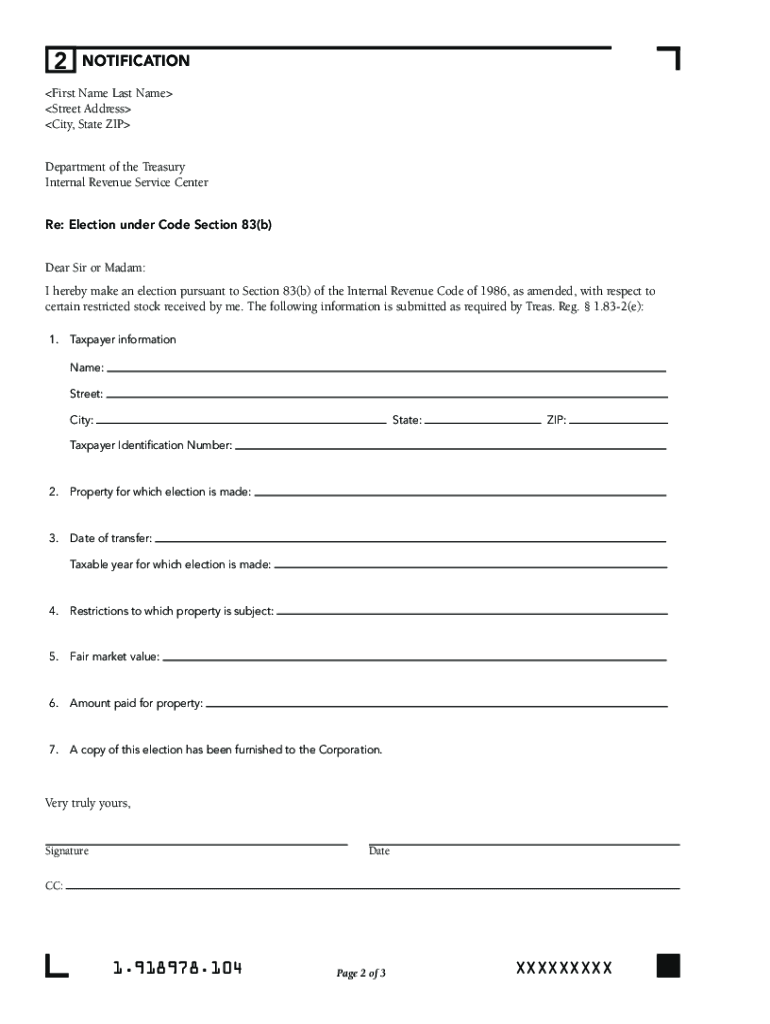

Steps to Complete the IRS Form 83-B

Completing the IRS Form 83-B involves several straightforward steps:

- Enter your name, address, and taxpayer identification number (TIN).

- Provide details about the property you are electing to include in your income, including a description and the date of transfer.

- Indicate the fair market value of the property at the time of transfer.

- Sign and date the form to validate your election.

It is essential to ensure accuracy, as any mistakes may lead to complications with your tax filings.

Legal Use of the IRS Form 83-B

The IRS Form 83-B is legally binding once signed and submitted to the IRS. It must be filed within thirty days of the property transfer to be valid. This election is particularly important for taxpayers who wish to avoid higher tax liabilities in the future as the value of the property increases. Understanding the legal implications of this form can help taxpayers make informed decisions regarding their compensation packages.

Filing Deadlines for the IRS Form 83-B

The deadline for filing the IRS Form 83-B is thirty days from the date of the property transfer. Missing this deadline can result in the loss of the election, which may lead to unfavorable tax consequences. It is advisable to keep track of important dates and ensure that the form is submitted on time to the appropriate IRS office.

Form Submission Methods

The IRS Form 83-B can be submitted in several ways. Taxpayers can mail the completed form to the appropriate IRS office or file it electronically if using compatible tax software. It is important to retain a copy of the submitted form for personal records, as it may be needed for future reference or during tax audits.

Quick guide on how to complete instructions 83 b form

Complete Instructions 83 B Form effortlessly on any gadget

Digital document management has gained signNow traction among businesses and individuals. It offers a wonderful environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely keep it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage Instructions 83 B Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

Ways to modify and eSign Instructions 83 B Form with ease

- Find Instructions 83 B Form and click Get Form to commence.

- Use the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Alter and eSign Instructions 83 B Form and ensure effective communication at every stage of the document creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions 83 b form

Create this form in 5 minutes!

People also ask

-

What is the IRS Form 83b and why do I need it?

The IRS Form 83b allows individuals to report the receipt of property in connection with the performance of services. By completing the IRS form 83b download, you can elect to include the fair market value of the property as income at the time of transfer, potentially saving you taxes later.

-

How can I download the IRS Form 83b?

You can easily obtain the IRS Form 83b download directly from the IRS website or through our platform. By utilizing airSlate SignNow, you can quickly access and fill out the form digitally, ensuring that the process is efficient and user-friendly.

-

What are the benefits of using airSlate SignNow for the IRS Form 83b download?

Using airSlate SignNow for the IRS Form 83b download streamlines the signing process. Our platform allows users to eSign documents electronically, which saves time and eliminates the hassle of printing and scanning.

-

Is there a cost associated with downloading the IRS Form 83b through airSlate SignNow?

While the IRS Form 83b itself is free to download, airSlate SignNow offers subscription plans that provide additional features for managing your documents. With our affordable pricing, you can simplify your document processes and enjoy seamless eSigning capabilities.

-

Can I integrate airSlate SignNow with other software for managing IRS forms?

Yes, airSlate SignNow can be easily integrated with various software applications, allowing you to manage your IRS forms more effectively. This integration enhances your workflow by automating document routing and eSigning, including for IRS Form 83b downloads.

-

How do I ensure the security of my IRS Form 83b when using airSlate SignNow?

Your security is our priority. When you use airSlate SignNow for your IRS Form 83b download, all documents are encrypted and securely stored. We comply with stringent data protection regulations to keep your sensitive information safe.

-

What should I do if I have questions about completing the IRS Form 83b?

If you have questions about completing the IRS Form 83b, airSlate SignNow's customer support team is available to help. We provide resources and guidance to assist you in filling out the form accurately and efficiently.

Get more for Instructions 83 B Form

- Distance time graph worksheet form

- Tony robbins ultimate relationship pdf form

- Georgia dismissal with prejudice form

- Riyadh zip code map form

- Download application form dr cv raman university

- Nevada request for waiver of penalty andor interest form 668626077

- Consumer use return introduced graduated penalty and interest rates form

- Nevada department of taxationaffidavit of purchase form

Find out other Instructions 83 B Form

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free