Instructions for Completing IRS Section 83b Form Fidelity 2010

Instructions for Completing the IRS 83b Election Form

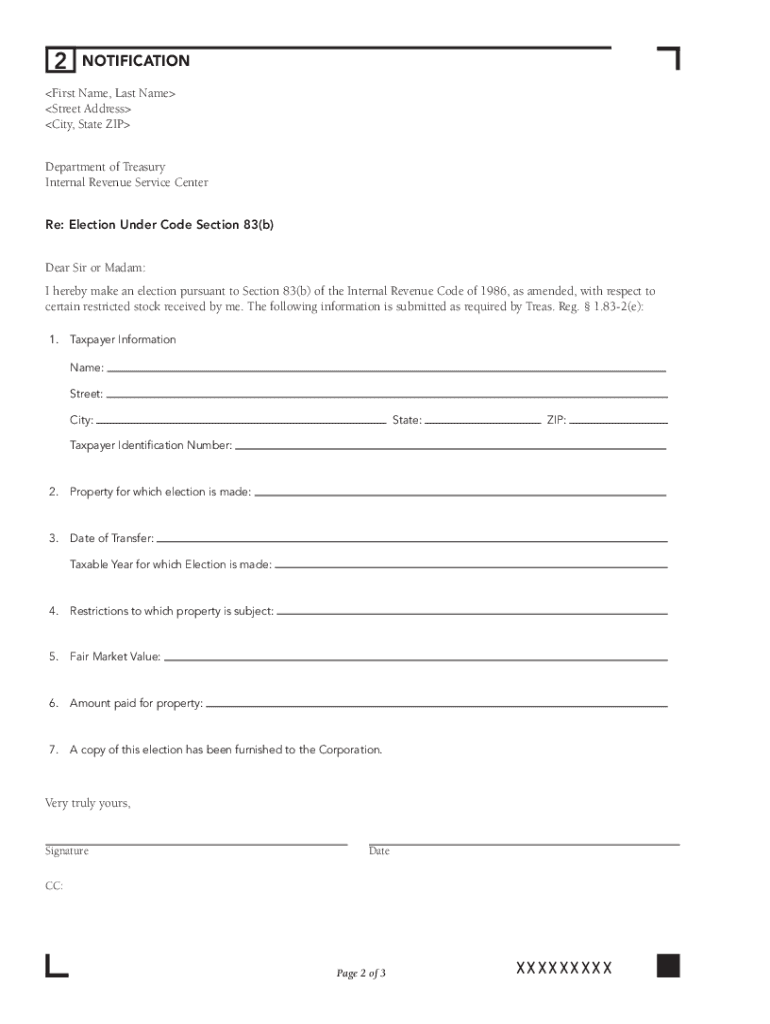

The IRS 83b election form allows individuals to elect to include the value of property received in connection with the performance of services in their gross income. To complete the form accurately, follow these steps:

- Provide your name, address, and taxpayer identification number.

- Detail the property received, including the date of transfer and the fair market value at that time.

- State the amount of income you are electing to include.

- Sign and date the form to certify its accuracy.

Filing Deadlines for the IRS 83b Election Form

Timely filing of the IRS 83b election form is crucial. The deadline is typically within thirty days of the property transfer. Missing this deadline may result in the loss of the election, leading to unfavorable tax consequences. It is essential to keep track of these dates to ensure compliance.

Required Documents for the IRS 83b Election Form

When completing the IRS 83b election form, you may need to gather the following documents:

- Proof of the property transfer, such as a stock certificate or agreement.

- Any relevant correspondence from your employer regarding the property received.

- Documentation supporting the fair market value of the property at the time of transfer.

Form Submission Methods for the IRS 83b Election Form

The IRS 83b election form can be submitted in several ways:

- By mail: Send the completed form to the appropriate IRS address based on your location.

- Electronically: If your tax software supports e-filing, you may be able to include the election with your tax return.

- In-person: You can also deliver the form directly to your local IRS office.

Key Elements of the IRS 83b Election Form

Understanding the key elements of the IRS 83b election form is vital for proper completion:

- Taxpayer information: Accurate identification details are necessary.

- Property details: Clear descriptions of the property received must be included.

- Election statement: A declaration of the election must be present, stating the intent to include the property value in gross income.

Legal Use of the IRS 83b Election Form

The IRS 83b election form is legally binding when completed correctly. It allows taxpayers to elect immediate taxation on property received, which can be beneficial in certain situations. Ensure compliance with IRS regulations to avoid penalties and maintain the legality of the election.

Quick guide on how to complete instructions for completing irs section 83b form fidelity

Complete Instructions For Completing IRS Section 83b Form Fidelity effortlessly on any device

Online document administration has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents quickly without delays. Manage Instructions For Completing IRS Section 83b Form Fidelity from any device using airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to edit and eSign Instructions For Completing IRS Section 83b Form Fidelity with ease

- Find Instructions For Completing IRS Section 83b Form Fidelity and click Get Form to begin.

- Utilize the tools provided to finish your document.

- Highlight key portions of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you would like to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Instructions For Completing IRS Section 83b Form Fidelity and ensure seamless communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for completing irs section 83b form fidelity

FAQs

-

How do you file an election 83(b) form/statement to the IRS for a foreign founder that has no SSN? Do we have to somehow register these founders with the IRS before they are granted restricted stock?

Okay, I'm going to answer my own question here now that I know the answer.First of all, foreigners technically don't need to file an 83(b) since they are not liable for US taxes. If there is no chance that those foreign founders will ever live in the US during the vesting period, you can safely forego the 83(b)However, you should file the 83(b) anyways by putting "Applied for" in the field where the 83(b) election asks for the SSN/Taxpayer Identification Number. Technically, you don't even need to apply for an SSN/TIN until the founder actually needs it (i.e. they move to the US to work for the startup there). All you need to defend the 83(b) election in the case a founder becomes subject to US taxes is the stamped/signNowd 83(b) election back from the IRS. You can just hold on to that in case you ever need it and whenever you do happen to file for an SSN/TIN, you simply include it with your SSN/TIN filing. So, in summary, you should:1) File the 83(b) election for everyone within 30-days of the equity/options grant, always, placing "applied for" in the space where you'd normally put the SSN/TIN2) Hold onto the IRS stamped/signNowd 83(b) election form that you get back from the IRS. 3) If the founder ever does apply for a US SSN/TIN during the vesting period, include the stamped/signNowd 83(b) election among all the paperwork being submitted.Disclaimer: I'm not an attorney, but I got this advice directly from one of Silicon Valley startup lawyers that was very highly upvoted here: Who are some of the best startup lawyers in Silicon Valley?

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How do I take admission in a B.Tech without taking the JEE Mains?

Admissions into B.Tech courses offered by engineering colleges in India is based on JEE Mains score and 12th percentile. Different private and government universities have already started B Tech admission 2019 procedure. However many reputed Private Colleges in India and colleges not affiliated with the Government colleges conduct state/region wise exams for admission or have their eligibility criterion set for admission.1. State Sponsored Colleges: These colleges have their state entrance exams for entry in such colleges. These colleges follow a particular eligibility criterion2. Private Colleges: These colleges either take admission on the basis of 10+2 score of the candidate or their respective entrance exam score. These colleges generally require students with Physics and Mathematics as compulsory subjects with minimum score requirement in each subject, as prescribed by them.3. Direct Admission: This lateral entry is introduced for students who want direct admission in 2nd year of their Bachelor’s course. However, there is an eligibility criterion for the same.Students should give as many entrance exams, to widen their possibility. College preference should always be based on certain factors like placement, faculty etc.

-

The company I work for is taking taxes out of my paycheck but has not asked me to complete any paperwork or fill out any forms since day one. How are they paying taxes without my SSN?

WHOA! You may have a BIG problem. When you started, are you certain you did not fill in a W-4 form? Are you certain that your employer doesn’t have your SS#? If that’s the case, I would be alarmed. Do you have paycheck stubs showing how they calculated your withholding? ( BTW you are entitled to those under the law, and if you are not receiving them, I would demand them….)If your employer is just giving you random checks with no calculation of your wages and withholdings, you have a rogue employer. They probably aren’t payin in what they purport to withhold from you.

-

How do I get an interview for a visa B to the US together with my girlfriend? Do we both completely fill out separate applications, or is there another way?

You will need to fill out separate application forms. Even infants need to have separate application forms.You then pay the fees and schedule an interview from the time slots available. You can do this for yourself and your girlfriend and then you can go for your interview.

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing irs section 83b form fidelity

How to make an eSignature for your Instructions For Completing Irs Section 83b Form Fidelity in the online mode

How to create an electronic signature for the Instructions For Completing Irs Section 83b Form Fidelity in Google Chrome

How to create an electronic signature for putting it on the Instructions For Completing Irs Section 83b Form Fidelity in Gmail

How to create an electronic signature for the Instructions For Completing Irs Section 83b Form Fidelity from your smart phone

How to generate an eSignature for the Instructions For Completing Irs Section 83b Form Fidelity on iOS

How to create an eSignature for the Instructions For Completing Irs Section 83b Form Fidelity on Android OS

People also ask

-

What is the IRS Form 83b and why do I need it?

The IRS Form 83b is a tax election form that allows you to report income related to restricted property. By filing this form, you can recognize income at the time of grant rather than at vesting, potentially leading to signNow tax savings. It's essential for individuals receiving stock options or other equity compensation.

-

How can airSlate SignNow help me with filing the IRS Form 83b?

airSlate SignNow streamlines the process of signing and submitting your IRS Form 83b electronically. With our easy-to-use platform, you can prepare, sign, and send documents securely, ensuring that your filing is done accurately and on time. Our service simplifies the logistics, allowing you to focus on your business.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of features essential for eSigning documents, including templates, mobile compatibility, and automated workflows. Our platform facilitates the signing of important documents, like the IRS Form 83b, with added security and compliance. This ensures your sensitive information is protected throughout the process.

-

Is there a cost associated with using airSlate SignNow for the IRS Form 83b?

Yes, airSlate SignNow operates on a subscription model with various pricing options tailored to meet different business needs. Our pricing is competitive, providing a cost-effective solution for electronically signing documents like the IRS Form 83b. Investing in our eSigning solution can save you time and reduce the hassle of manual paper processes.

-

Can I integrate airSlate SignNow with other software I use?

Absolutely! airSlate SignNow offers seamless integrations with popular software tools, enabling you to incorporate eSigning of documents, such as the IRS Form 83b, into your existing workflows. This feature improves efficiency and enhances productivity by allowing you to manage all your document processes in one place.

-

How secure is airSlate SignNow for sensitive documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and follow strict compliance measures, ensuring that documents like the IRS Form 83b are protected from unauthorized access. You can confidently sign and manage your sensitive documents, knowing that they're in safe hands.

-

Can I access airSlate SignNow on mobile devices?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access, sign, and send the IRS Form 83b on-the-go. Our mobile application ensures that you can manage your documents conveniently, regardless of your location. This flexibility is perfect for busy professionals who need to stay productive.

Get more for Instructions For Completing IRS Section 83b Form Fidelity

- Hawaii forest products timber sale contract hawaii form

- Assumption agreement of mortgage and release of original mortgagors hawaii form

- Hawaii foreign judgment enrollment hawaii form

- Hawaii estate 497304583 form

- Hawaii eviction form

- Real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential house 497304585 form

- Hawaii annual file form

- Sample notices resolutions stock ledger and certificate hawaii form

Find out other Instructions For Completing IRS Section 83b Form Fidelity

- Electronic signature Delaware Junior Employment Offer Letter Later

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy