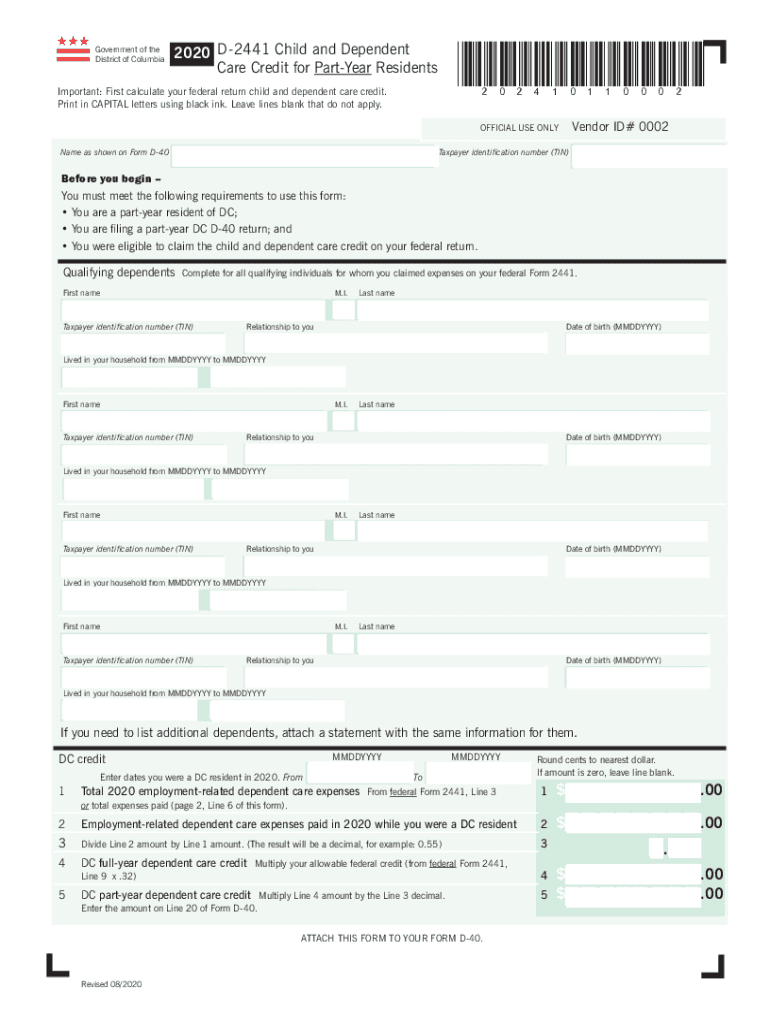

WA D 2441 2020

What is the 2441 form?

The 2441 form, officially known as Form 2441, is a tax document used by taxpayers in the United States to claim the Child and Dependent Care Expenses Credit. This form is essential for individuals who pay for child care or care for dependents while they work or look for work. The credit can help reduce the overall tax liability, making it a valuable resource for eligible taxpayers.

Steps to complete the 2441 form

Completing the 2441 form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information regarding your dependents and the care expenses incurred. This includes the names, addresses, and taxpayer identification numbers of your dependents, as well as the details of the care provider. Next, fill out the form by entering the required information in the designated sections. Be sure to calculate the credit accurately based on your expenses and the applicable limits. Finally, review the completed form for any errors before submitting it with your tax return.

Legal use of the 2441 form

The 2441 form is legally recognized as a valid document for claiming tax credits related to child and dependent care expenses. To ensure compliance, it is crucial to follow IRS guidelines when completing the form. This includes providing accurate information and retaining supporting documentation, such as receipts for care expenses. Failure to comply with these regulations may result in penalties or denial of the credit.

Required Documents

To complete the 2441 form, several documents are necessary. These include:

- Taxpayer identification numbers for you and your dependents.

- Details of the care provider, including their name, address, and taxpayer identification number.

- Receipts or statements that document the child and dependent care expenses incurred during the tax year.

Having these documents organized and readily available will facilitate a smoother completion process.

Filing Deadlines / Important Dates

When filing the 2441 form, it is important to be aware of the deadlines associated with your tax return. Typically, individual tax returns are due on April fifteenth of each year. If you require additional time, you may file for an extension, but it is essential to ensure that the 2441 form is submitted alongside your tax return by the extended deadline to avoid penalties.

Examples of using the 2441 form

There are various scenarios in which taxpayers might use the 2441 form. For instance, a working parent who pays for daycare services while employed can claim the credit. Similarly, a caregiver who incurs expenses for looking after a disabled spouse may also be eligible. Understanding these examples can help taxpayers recognize their eligibility and the potential benefits of filing the form.

Quick guide on how to complete wa d 2441

Complete WA D 2441 effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly without delays. Manage WA D 2441 on any platform with airSlate SignNow's Android or iOS applications and simplify any document-focused process today.

The easiest way to modify and eSign WA D 2441 without hassle

- Find WA D 2441 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign WA D 2441 and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wa d 2441

Create this form in 5 minutes!

How to create an eSignature for the wa d 2441

How to generate an e-signature for your PDF online

How to generate an e-signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

How to make an e-signature straight from your smartphone

The best way to create an electronic signature for a PDF on iOS

How to make an e-signature for a PDF document on Android

People also ask

-

What is a 2441 form, and why is it important?

The 2441 form is used for reporting tax information on childcare expenses. It's important for taxpayers who wish to claim credit for childcare costs, ensuring they maximize their deductions and comply with IRS regulations.

-

How does airSlate SignNow help with the 2441 form?

airSlate SignNow streamlines the process of signing and submitting the 2441 form by providing an easy-to-use digital platform. You can quickly eSign documents and send them securely, saving time and reducing paperwork.

-

Are there any costs associated with using airSlate SignNow for the 2441 form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, making it a cost-effective solution for managing documents like the 2441 form. You can choose a plan that fits your requirements and budget.

-

What features does airSlate SignNow provide for managing the 2441 form?

airSlate SignNow offers features such as eSignature capabilities, document templates, and secure cloud storage for your 2441 form. These tools simplify the document management process and enhance collaboration.

-

Is airSlate SignNow user-friendly for new users handling the 2441 form?

Absolutely! airSlate SignNow is designed with user experience in mind, making it simple for new users to upload, fill out, and eSign documents like the 2441 form without hassle. Comprehensive support resources are also available.

-

Can I integrate airSlate SignNow with other software for processing the 2441 form?

Yes, airSlate SignNow supports integrations with popular software solutions. This allows you to seamlessly connect and manage your 2441 form alongside other applications you may use for accounting or document management.

-

What are the benefits of using airSlate SignNow for the 2441 form?

Using airSlate SignNow for the 2441 form provides several benefits, including faster processing times, reduced paper waste, and improved accuracy in documentation. These advantages help you stay organized and compliant while saving valuable time.

Get more for WA D 2441

- Missouri form 4757

- Report of injury wc 1 edi missouri department of labor labor mo form

- Safety shoe reimbursement form

- Council tax reduction form

- Residential leasing agreement forms

- Get dk foreign nemkonto for citizens registration form

- Replacement window order form ecoshield window s

- Activity hazard analysis aha form

Find out other WA D 2441

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement