RECENT ACCOUNTING of AMOUNT DUE and UNPAID INDIVIDUAL Form

What is the recent accounting of amount due and unpaid individual

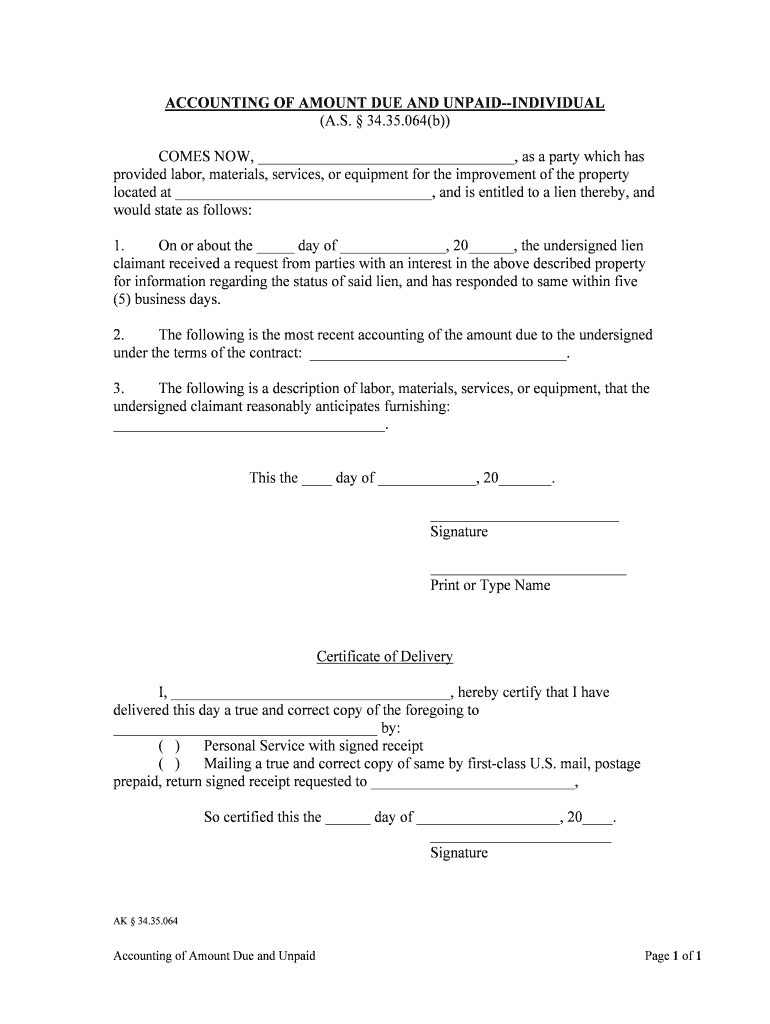

The recent accounting of amount due and unpaid individual form is a crucial document used to track and report outstanding debts owed by individuals. This form serves as an official record that outlines the amounts due, the nature of the debts, and any relevant payment terms. It is particularly important for businesses and organizations that need to maintain accurate financial records and ensure compliance with accounting standards.

This form typically includes essential details such as the debtor's name, contact information, the total amount owed, and any previous payment attempts. By providing a clear overview of the outstanding amounts, it helps both creditors and debtors understand their financial obligations and facilitates communication regarding payment arrangements.

How to use the recent accounting of amount due and unpaid individual

Steps to complete the recent accounting of amount due and unpaid individual

Completing the recent accounting of amount due and unpaid individual form requires attention to detail. Follow these steps to ensure accuracy:

- Collect all necessary information about the debtor, including their full name and contact details.

- Identify the total amount due, including any interest or fees that may apply.

- Fill out the form, ensuring that all fields are completed accurately.

- Double-check the information for errors or omissions.

- Provide the form to the debtor, either by email or physical delivery.

- Retain a copy of the completed form for your records.

Key elements of the recent accounting of amount due and unpaid individual

- Debtor Information: Full name, address, and contact details of the individual owing the debt.

- Debt Details: A clear breakdown of the amount owed, including any applicable fees or interest.

- Payment Terms: Information regarding the due date and any payment arrangements.

- Signature Line: A space for the debtor to acknowledge receipt of the form and the debt.

Legal use of the recent accounting of amount due and unpaid individual

Quick guide on how to complete recent accounting of amount due and unpaid individual

Easily Prepare RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the features necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Simplest Way to Edit and Electronically Sign RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL with Ease

- Locate RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL and click Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark pertinent sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Complete button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invitation link, or download it to your computer.

No more worrying about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow satisfies your document management needs in just a few clicks from any device you prefer. Edit and electronically sign RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for conducting a RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL with airSlate SignNow?

To conduct a RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL, you can start by uploading relevant documents to airSlate SignNow. Our platform allows you to track outstanding invoices and facilitate eSignature workflows, streamlining the entire process. You'll gain insights into payment statuses, making it easier to manage dues effectively.

-

How does airSlate SignNow ensure the accuracy of the RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL?

airSlate SignNow maintains accuracy through automated data syncing and secure document management features. By digitizing your invoicing process, we help reduce human errors in the RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL. Our platform also provides real-time updates to keep track of changes and outstanding amounts effortlessly.

-

What features does airSlate SignNow offer for handling RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL?

Our platform includes features like customizable templates for invoices and reminders, automated document routing, and eSignature capabilities. With these tools, you can streamline your RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL tasks while ensuring compliance and efficiency. These features are designed to save you time and enhance productivity.

-

Is airSlate SignNow a cost-effective solution for managing RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL?

Yes, airSlate SignNow offers various pricing plans tailored to suit different business sizes and needs, making it a cost-effective solution for managing RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL. Our plans include essential features at competitive rates, ensuring you maximize your ROI. Plus, you can scale your plan as your business grows.

-

Can I integrate airSlate SignNow with other accounting or ERP software for RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL?

Absolutely! airSlate SignNow supports integrations with various accounting and ERP systems, enabling seamless data transfer for RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL. This means you can synchronize invoices and payment statuses across platforms, ensuring a comprehensive overview of finances without manual entry.

-

How secure is the data during the RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL process with airSlate SignNow?

Security is paramount at airSlate SignNow. We employ top-of-the-line encryption protocols and secure cloud storage to protect your data during the RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL process. Regular security audits ensure our platform meets compliance standards, giving you peace of mind while managing sensitive information.

-

What benefits can businesses expect from using airSlate SignNow for RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL?

Businesses can expect increased efficiency, reduced processing times, and enhanced compliance when using airSlate SignNow for RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL. Our user-friendly interface allows teams to quickly manage outstanding amounts, track workflows, and ensure that no document is left unsigned. This leads to improved cash flow and a better financial overview.

Get more for RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL

- Use this form as part of the ambetter from mhs claim dispute process to dispute the decision made during the request for

- College enrollment form

- Commerce employment form

- Notification of claim form pacific cross binsuranceb

- Mv 9w ga form

- Rule 60 b motion example ohio form

- Permit pin form

- Holmes county sheriffs office e911 mapping and addressing form

Find out other RECENT ACCOUNTING OF AMOUNT DUE AND UNPAID INDIVIDUAL

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy

- eSign Louisiana Notice of Rent Increase Mobile