Hereinafter Referred to as Grantors, and , a Corporation Organized under the Form

What is the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

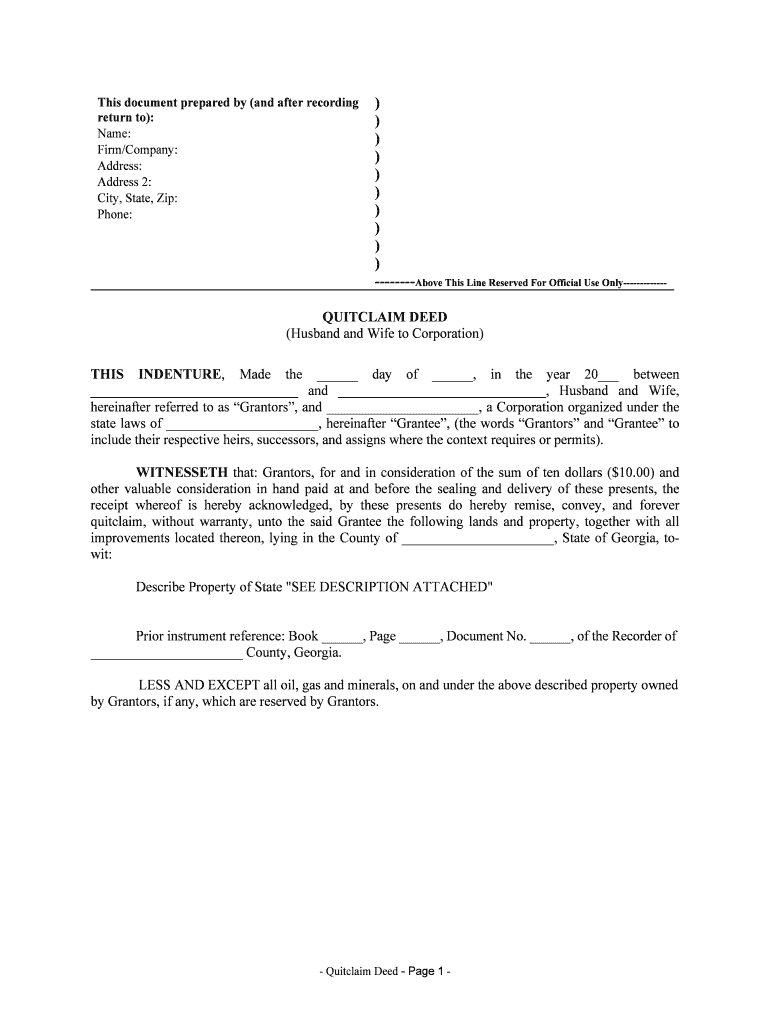

The term "hereinafter referred to as grantors, and a corporation organized under the" typically refers to a legal document that outlines the roles and responsibilities of the parties involved in a contractual agreement. This form is essential for establishing the legal framework within which the grantors, often individuals or entities, grant rights or privileges to a corporation. It is crucial in various legal contexts, including property transfers, business agreements, and compliance with regulatory requirements.

Steps to Complete the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

Completing this form involves several key steps to ensure accuracy and legal compliance. First, identify all parties involved, including the grantors and the corporation. Next, gather necessary information such as names, addresses, and any specific terms of the agreement. Carefully fill in each section of the form, ensuring that all details are correct and complete. After completing the form, review it for any errors or omissions before signing. Finally, submit the form through the appropriate channels, whether online or via mail, to ensure it is processed correctly.

Legal Use of the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

This form must adhere to specific legal standards to be considered valid. It should clearly define the roles of the grantors and the corporation, including any rights being granted. Compliance with relevant laws, such as the Uniform Commercial Code (UCC) and state-specific regulations, is essential. Additionally, the form must be signed by all parties involved, and in certain cases, notarization may be required to enhance its legal standing. Understanding these legal requirements helps ensure that the document serves its intended purpose effectively.

Required Documents for the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

To complete the form accurately, several documents may be required. These typically include identification for all grantors, proof of the corporation's legal status, and any previous agreements related to the grant. Depending on the specific nature of the transaction, additional documentation such as property deeds, financial statements, or corporate resolutions may also be necessary. Gathering these documents beforehand can streamline the completion process and help avoid delays.

Examples of Using the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

This form is commonly used in various scenarios, such as transferring property ownership from individuals to a corporation or granting a corporation the right to use certain intellectual property. For instance, a real estate transaction may involve a homeowner (the grantor) transferring ownership to a corporation for development purposes. Another example could involve a software developer granting a corporation the rights to use their proprietary software under specific terms outlined in the form. These examples illustrate the versatility and importance of the document in legal agreements.

Form Submission Methods for the Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

Submitting this form can be done through various methods, depending on the requirements of the specific jurisdiction. Common submission methods include online filing through a designated government portal, mailing the completed form to the appropriate office, or delivering it in person. Each method may have different processing times and requirements, so it is essential to choose the one that aligns with your needs and ensures timely processing of the form.

Quick guide on how to complete hereinafter referred to as grantors and a corporation organized under the

Effortlessly prepare Hereinafter Referred To As Grantors, And , A Corporation Organized Under The on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Hereinafter Referred To As Grantors, And , A Corporation Organized Under The on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric procedure today.

How to edit and electronically sign Hereinafter Referred To As Grantors, And , A Corporation Organized Under The with ease

- Locate Hereinafter Referred To As Grantors, And , A Corporation Organized Under The and click on Get Form to begin.

- Utilize the tools we provide to fill in your form.

- Emphasize important sections of your documents or obscure sensitive data with tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional signature.

- Review all the details and click on the Done button to save your edits.

- Choose your preferred delivery method for your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, exhausting form searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Hereinafter Referred To As Grantors, And , A Corporation Organized Under The to guarantee outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to be Hereinafter Referred To As Grantors, And , A Corporation Organized Under The?

In legal terms, 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The' typically indicates the parties involved in a contractual agreement. This designation clarifies the roles and responsibilities of each party, ensuring everyone is on the same page. Understanding this definition is crucial for effective document management using airSlate SignNow.

-

How does airSlate SignNow help in managing documents for a corporation?

airSlate SignNow delivers a streamlined eSigning experience that benefits corporations, especially when dealing with legal documents involving entities like 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' Our platform allows quick and secure electronic signatures, ensuring compliance and record-keeping are maintained effortlessly. It's an efficient way for businesses to enhance their document workflows.

-

What are the pricing plans for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, including features essential for 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' Plans typically include essential eSigning features, user support, and integrations, making it a cost-effective solution regardless of your company's size. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for corporations?

Our platform provides extensive features like customizable templates, real-time tracking, and advanced security that cater specifically to 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' These features simplify the eSigning process and enhance collaboration among team members and clients. Explore our tools to see how they can improve your document flow.

-

Is airSlate SignNow easy to integrate with other software tools?

Yes, airSlate SignNow supports various integrations with popular software to ensure a seamless experience for organizations classified as 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' Our tool can connect with CRM and document management systems, allowing efficient workflows and improved productivity. Check our integration options to see what fits your needs.

-

How does airSlate SignNow ensure the security of signed documents?

We prioritize security by implementing advanced encryption and authentication methods, ensuring that all documents signed through airSlate SignNow are safe and tamper-proof for those 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' Compliance with industry standards provides added peace of mind when handling sensitive corporate documents. Trust in our secure platform to protect your data.

-

Can airSlate SignNow help with compliance for legal documents?

Absolutely, airSlate SignNow is designed with compliance in mind, particularly for corporations referred to as 'Hereinafter Referred To As Grantors, And , A Corporation Organized Under The.' Our electronic signatures meet legal requirements, supporting compliance with regulations like ESIGN and UETA. Using our solution ensures your documents carry the same legal weight as traditional signatures.

Get more for Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

- Employee verification from old employer email form

- Advance settlement form

- Form 480 60 ec 20 20 pr

- City of chamblee renewal form

- How to claim rental property on your income tax form

- Form fr77

- Form mo 1040es estimated tax declaration for individuals

- Mo ms corporation allocation and apportionment of income schedule 772045260 form

Find out other Hereinafter Referred To As Grantors, And , A Corporation Organized Under The

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word