JOINT ANSWER of MISSISSIPPI STATE TAX COMMISSION and Form

What is the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

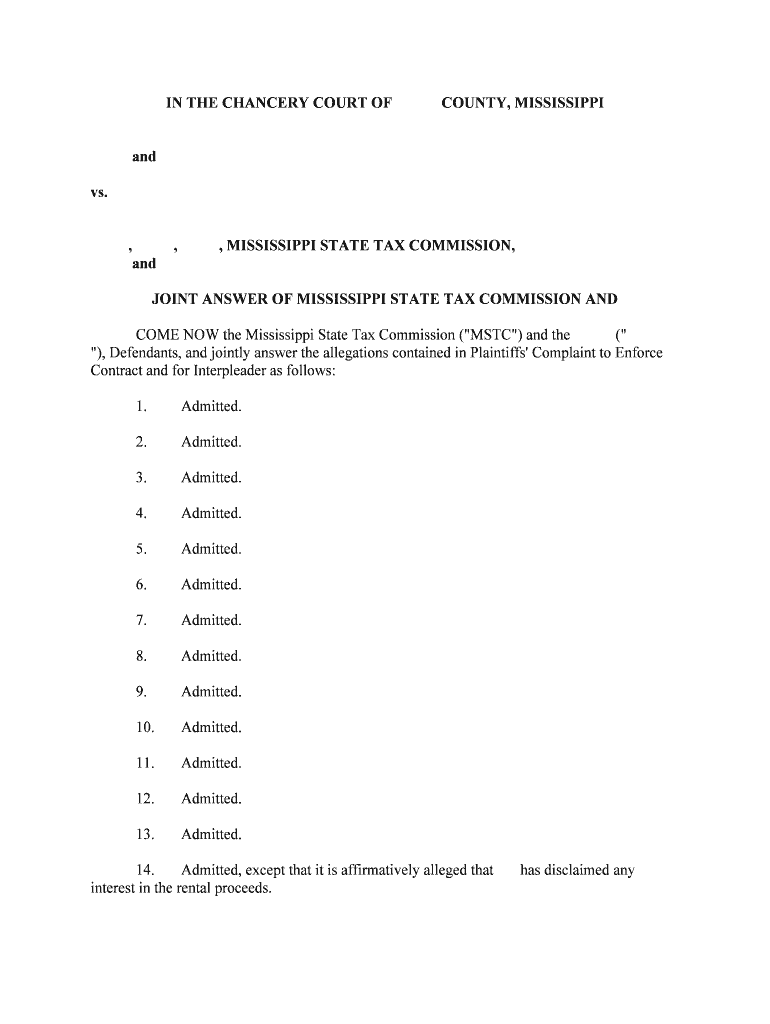

The JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND is a legal document used in tax-related matters within the state of Mississippi. This form is typically utilized when parties involved in a tax dispute seek to present a unified response to the Mississippi State Tax Commission. It serves as a formal means to address issues such as tax assessments, disputes regarding tax liabilities, or other related inquiries. Understanding the purpose and implications of this document is essential for individuals and businesses navigating the state tax system.

Steps to complete the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

Completing the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND requires careful attention to detail. Here are the essential steps:

- Gather necessary information, including tax identification numbers and relevant tax documents.

- Clearly state the reason for the joint answer, outlining the specific issues being addressed.

- Ensure that all parties involved in the dispute sign the document, as their signatures validate the submission.

- Review the completed form for accuracy and completeness before submission.

Legal use of the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

The JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND is legally binding when properly executed. For it to hold legal weight, the document must meet specific requirements set forth by Mississippi law. This includes obtaining signatures from all relevant parties and ensuring that the form is submitted within the designated timeframe. Failure to comply with these legal standards may result in the form being deemed invalid, which could adversely affect the parties involved in the tax dispute.

Key elements of the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

Several key elements must be included in the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND to ensure its effectiveness:

- Identification of all parties involved in the dispute.

- A clear statement of the issues being addressed.

- Supporting documentation that substantiates the claims made in the joint answer.

- Signatures of all parties, along with the date of signing.

How to obtain the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

The JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND can typically be obtained through the Mississippi State Tax Commission's official website or by contacting their office directly. It is important to ensure that you are using the most current version of the form, as regulations and requirements may change over time. Additionally, consulting with a tax professional may provide valuable guidance in obtaining and completing the form correctly.

Form Submission Methods

The JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND can be submitted through various methods:

- Online submission via the Mississippi State Tax Commission's electronic filing system.

- Mailing the completed form to the appropriate address provided by the Tax Commission.

- In-person delivery at designated Tax Commission offices.

Quick guide on how to complete joint answer of mississippi state tax commission and

Effortlessly prepare JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, amend, and eSign your documents quickly without delays. Handle JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based task today.

How to modify and eSign JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND with ease

- Obtain JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

The JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND is a consolidated response from the Mississippi State Tax Commission, addressing common inquiries related to tax processes. It provides clarity on various tax obligations and procedures, ensuring businesses stay compliant.

-

How can airSlate SignNow assist with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

airSlate SignNow simplifies the documentation process, allowing businesses to easily send and eSign documents associated with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND. This can enhance compliance and streamline communication with the tax commission and other stakeholders.

-

What are the pricing options for airSlate SignNow in relation to the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

airSlate SignNow offers competitive pricing with various plans to suit different business needs, which include features beneficial for handling the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND. Each plan is designed to ensure both affordability and functionality for efficient document management.

-

What features of airSlate SignNow are useful for the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

Key features of airSlate SignNow that support the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND include eSignature capabilities, document templates, and secure storage. These features streamline the process of creating, sending, and managing documents necessary for tax compliance.

-

What are the benefits of using airSlate SignNow with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

Using airSlate SignNow in conjunction with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND offers benefits such as improved efficiency, reduced turnaround times, and enhanced document security. This can signNowly increase productivity by eliminating the need for traditional paper processes.

-

Can airSlate SignNow integrate with other platforms to streamline the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND process?

Yes, airSlate SignNow provides integration capabilities with various platforms, allowing seamless workflows that support the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND. This means you can connect it with other tools you use, keeping all your processes aligned and efficient.

-

Is airSlate SignNow suitable for businesses of all sizes when dealing with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND?

Absolutely, airSlate SignNow is designed to cater to businesses of all sizes, making it an ideal choice when dealing with the JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND. Whether you’re a small business or a large corporation, the solution adapts to your needs.

Get more for JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

- Onesys 442843370 form

- Goethe zertifikat b1 pdf form

- Application for subsidized housing regionpeelonca region peel on form

- Programm contract template form

- Programmer contract template form

- Project based contract template form

- Project contract template form

- Project management consultant contract template form

Find out other JOINT ANSWER OF MISSISSIPPI STATE TAX COMMISSION AND

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template