1 Business Discontinued 2019

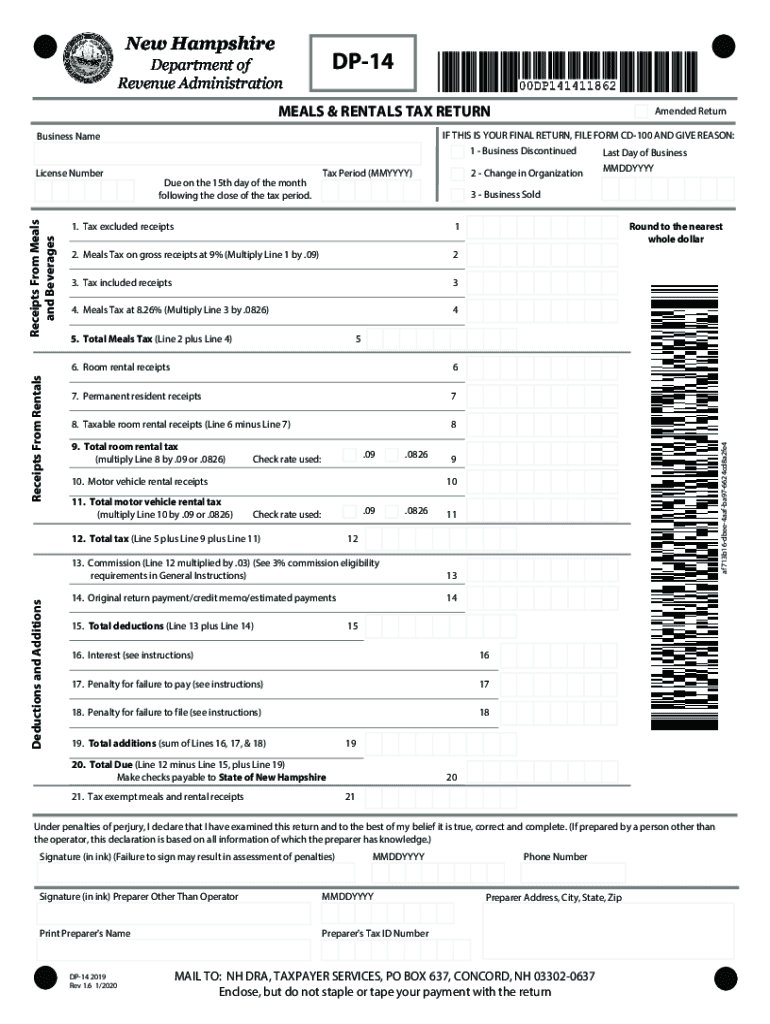

Understanding the NH Room and Meals Tax

The NH room and meals tax is a tax imposed on the rental of rooms and the sale of prepared food and beverages in New Hampshire. This tax is essential for funding state and local services. It is crucial for businesses in the hospitality sector to understand their obligations under this tax. The current rate for the room and meals tax is nine percent, which applies to the total amount charged for lodging and meals. Businesses must ensure they are compliant with this tax to avoid penalties.

Steps to Complete the NH Meals and Rooms Tax Form

Completing the NH meals and rooms tax form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including sales records and receipts.

- Complete the NH form DP-14, ensuring all sections are filled out accurately.

- Calculate the total tax due based on the applicable rates.

- Review the completed form for accuracy before submission.

- Submit the form either online or by mail, ensuring it reaches the NH Department of Revenue by the deadline.

Legal Use of the NH Room and Meals Tax Form

The NH room and meals tax form must be used in compliance with state laws. This form serves as a legal document that reports the tax collected from customers. It is essential for businesses to maintain accurate records and ensure that the form is submitted on time to avoid legal repercussions. Non-compliance can lead to fines and other penalties, making it critical for businesses to understand their responsibilities.

Filing Deadlines for the NH Meals and Rooms Tax

Filing deadlines for the NH meals and rooms tax are typically quarterly. Businesses must submit their tax forms by the last day of the month following the end of each quarter. For example, the deadline for the first quarter, which ends on March 31, is April 30. It is important to mark these dates on your calendar to ensure timely submission and avoid late fees.

Required Documents for NH Meals and Rooms Tax Filing

When filing the NH meals and rooms tax, businesses must prepare several documents. These include:

- Sales records that detail all taxable transactions.

- Receipts for meals and lodging provided.

- Previous tax returns, if applicable, for reference.

Having these documents ready will streamline the filing process and ensure accuracy in reporting.

Penalties for Non-Compliance with NH Room and Meals Tax

Failure to comply with the NH room and meals tax regulations can result in significant penalties. Businesses may face fines based on the amount of tax due, and repeated non-compliance can lead to more severe consequences, including legal action. It is vital for businesses to stay informed about their tax obligations and ensure timely and accurate filings to avoid these penalties.

Quick guide on how to complete 1 business discontinued

Effortlessly prepare 1 Business Discontinued on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage 1 Business Discontinued on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign 1 Business Discontinued without hassle

- Locate 1 Business Discontinued and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form: via email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow streamlines all your document management needs in just a few clicks from any device of your choosing. Edit and eSign 1 Business Discontinued to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 1 business discontinued

Create this form in 5 minutes!

How to create an eSignature for the 1 business discontinued

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

How to make an eSignature for a PDF document on Android devices

People also ask

-

What is nh dor in relation to airSlate SignNow?

The term 'nh dor' refers to essential functionality that allows users to manage document signing efficiently. With airSlate SignNow, 'nh dor' features enable seamless electronic signatures, ensuring compliance and improving turnaround times for businesses.

-

How does airSlate SignNow handle 'nh dor' for document security?

airSlate SignNow prioritizes document security under 'nh dor' by utilizing encryption and compliance with legal standards. This ensures that electronic signatures are not only secure but also legally binding across jurisdictions.

-

What are the pricing plans available for airSlate SignNow focused on 'nh dor'?

airSlate SignNow offers flexible pricing plans tailored for varying business needs related to 'nh dor.' The plans are designed for cost-effectiveness, catering to small businesses as well as larger enterprises looking for an efficient eSignature solution.

-

What features of airSlate SignNow enhance the 'nh dor' experience?

Key features that enhance the 'nh dor' experience with airSlate SignNow include templates for quick document creation, personalized branding options, and automation workflows. These innovations signNowly streamline the signing process and improve productivity.

-

Can airSlate SignNow integrate with other tools to support 'nh dor'?

Yes, airSlate SignNow provides various integrations with popular tools like Salesforce, Google Drive, and more. These integrations enable users to enhance their 'nh dor' capabilities, making it easier to incorporate eSigning into existing workflows.

-

What benefits does airSlate SignNow provide under 'nh dor' for small businesses?

For small businesses, airSlate SignNow offers 'nh dor' benefits such as affordability, ease of use, and quick setup. These aspects ensure that even small teams can effectively utilize eSigning without a steep learning curve or budget constraints.

-

How can I get started with airSlate SignNow’s 'nh dor' features?

Getting started with airSlate SignNow’s 'nh dor' features is simple. You can sign up for a free trial on their website, and once registered, you can explore all the eSigning features immediately, ensuring you can utilize them for your document needs.

Get more for 1 Business Discontinued

- Good faith form

- Jury instruction confession statement multiple defendants form

- Instruction identification form

- Jury instruction acts form

- Jury instruction possession 497334363 form

- Ap gov review pdf form

- Commercial term lending rent roll apartment apartment rent roll 242 mfl form

- Verbal verification of employment for a salaried borrower form

Find out other 1 Business Discontinued

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now