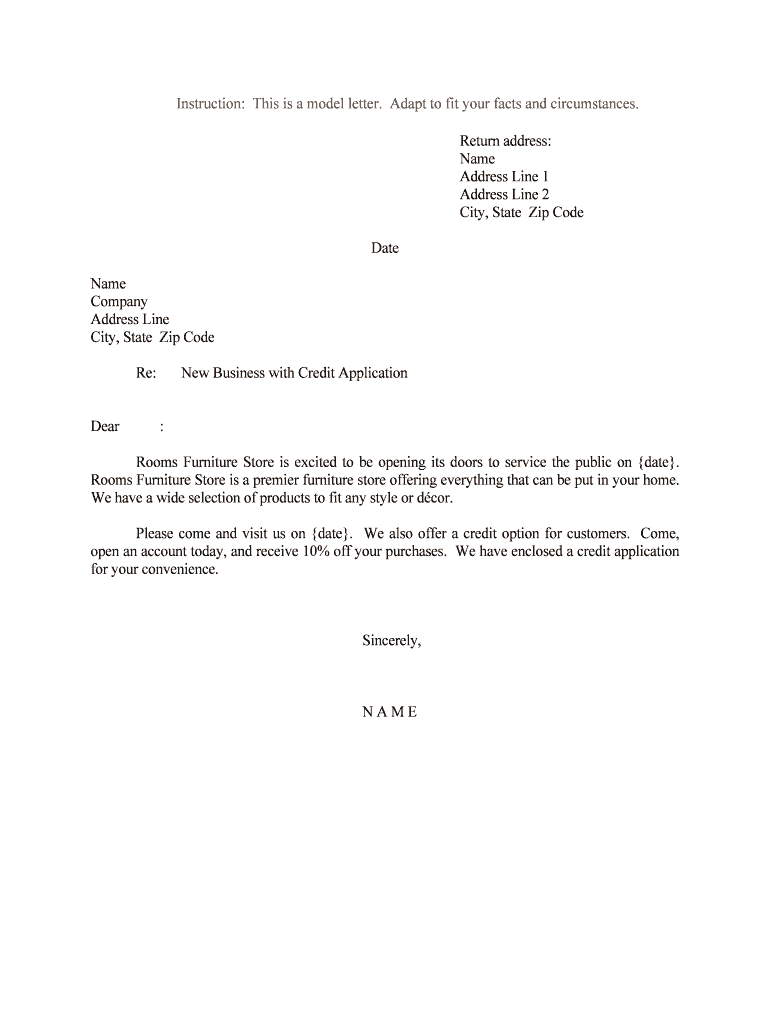

New Business with Credit Application Form

What is the New Business With Credit Application

The New Business With Credit Application is a formal document that allows a new business to apply for credit from suppliers or financial institutions. This application typically requires detailed information about the business, including its legal structure, ownership, financial history, and projected revenue. It serves as a tool for creditors to assess the creditworthiness of the business, helping them make informed lending decisions.

Key elements of the New Business With Credit Application

When filling out the New Business With Credit Application, several key elements must be included to ensure a comprehensive submission. These elements typically include:

- Business Information: Name, address, and contact details of the business.

- Ownership Structure: Details about the owners, including their names and percentages of ownership.

- Financial Information: Current financial statements, projections, and any existing debts.

- Business History: Information about the business's background, including how long it has been operating.

- References: Contact information for other businesses or financial institutions that can vouch for the business's creditworthiness.

Steps to complete the New Business With Credit Application

Completing the New Business With Credit Application involves several steps to ensure accuracy and completeness. Follow these steps for a successful application:

- Gather Required Information: Collect all necessary documents and information about the business.

- Fill Out the Application: Carefully complete each section of the application, ensuring all details are accurate.

- Review the Application: Double-check for any errors or missing information before submission.

- Submit the Application: Send the completed application to the creditor via the preferred submission method.

- Follow Up: Contact the creditor to confirm receipt and inquire about the status of the application.

Legal use of the New Business With Credit Application

The New Business With Credit Application must adhere to legal standards to be considered valid. It is essential to ensure that all information provided is truthful and accurate. Misrepresentation can lead to legal consequences, including denial of credit or potential legal action. Additionally, the application should comply with relevant regulations governing credit applications, such as the Fair Credit Reporting Act (FCRA), which protects consumer information.

How to obtain the New Business With Credit Application

Obtaining the New Business With Credit Application is a straightforward process. Businesses can typically acquire the application from the creditor's website or directly from their office. Some institutions may provide a downloadable PDF version of the application, while others may require businesses to fill it out online. It is advisable to check the specific requirements of the creditor to ensure all necessary documentation is included.

Eligibility Criteria

To successfully complete the New Business With Credit Application, businesses must meet certain eligibility criteria. These criteria often include:

- Established Business: The business should be legally registered and operational.

- Credit History: A positive credit history may be required for approval.

- Financial Stability: The business must demonstrate financial viability through accurate financial statements.

- Ownership Details: Clear documentation of ownership and management structure is necessary.

Quick guide on how to complete new business with credit application

Complete New Business With Credit Application seamlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and electronically sign your documents swiftly without delays. Handle New Business With Credit Application on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign New Business With Credit Application effortlessly

- Find New Business With Credit Application and then click Get Form to begin.

- Utilize the tools we provide to populate your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Edit and electronically sign New Business With Credit Application and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Business With Credit Application?

A New Business With Credit Application is a document that allows potential borrowers to request credit terms and establish a credit line for their business. It typically includes information about the business, financial details, and terms of the requested credit. airSlate SignNow streamlines the process by enabling you to send and eSign these applications quickly and securely.

-

How can airSlate SignNow help with processing New Business With Credit Applications?

airSlate SignNow simplifies the handling of New Business With Credit Applications by providing a user-friendly platform to send, sign, and manage documents digitally. This ensures faster decision-making and reduces the time spent on paper-based processes. With our solution, you can easily track application statuses and reminders.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial for new users interested in processing New Business With Credit Applications. This allows you to explore the features and benefits of our eSigning solution without any commitment. It's a great way to see how our platform can enhance your business's documentation process.

-

What features does airSlate SignNow offer for New Business With Credit Applications?

Key features of airSlate SignNow include customizable templates for New Business With Credit Applications, easy document sharing, real-time status tracking, and secure electronic signatures. Additionally, our platform integrates seamlessly with other business tools, making it an efficient solution for any organization.

-

Are there any integrations available for airSlate SignNow?

Absolutely! airSlate SignNow offers integrations with various platforms such as CRM systems, payment processors, and cloud storage solutions. This makes managing New Business With Credit Applications easier and ensures a seamless workflow throughout your business operations.

-

What are the benefits of using airSlate SignNow for New Business With Credit Applications?

Using airSlate SignNow for New Business With Credit Applications provides numerous benefits, including reduced processing times, improved accuracy, and enhanced customer experience. By digitizing and automating your credit application process, you can focus more on growing your business rather than getting bogged down in paperwork.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to businesses of all sizes. These plans include different levels of features tailored to your needs, especially for processing New Business With Credit Applications. For a detailed breakdown of our pricing, visit our website or contact our sales team for personalized assistance.

Get more for New Business With Credit Application

Find out other New Business With Credit Application

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney