Cancellation of Credit Card Account Form

What is the cancellation of a credit card account?

The cancellation of a credit card account refers to the formal process of terminating a credit card agreement between a cardholder and a financial institution. This action can be initiated by the cardholder for various reasons, such as financial management, dissatisfaction with the card's terms, or a decision to consolidate debt. Understanding the implications of closing a credit card account is crucial, as it can affect credit scores and future borrowing capacity.

Steps to complete the cancellation of a credit card account

To effectively close a credit card account, follow these steps:

- Review the account: Check for any outstanding balance, rewards, or benefits that may be affected by the cancellation.

- Contact the issuer: Reach out to the customer service department of the credit card issuer to express your intent to cancel the account.

- Provide necessary information: Be prepared to verify your identity and provide details such as your account number and personal information.

- Request confirmation: Ask for written confirmation of the account closure to keep for your records.

- Destroy the card: Safely dispose of the physical credit card to prevent unauthorized use.

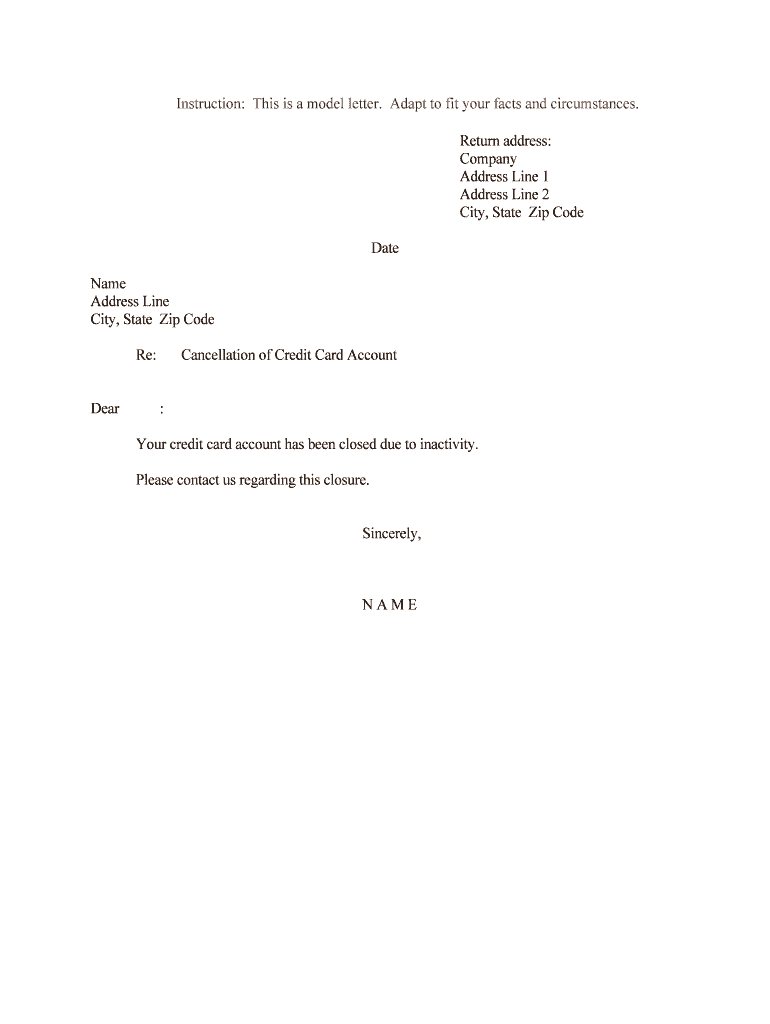

Key elements of the cancellation of a credit card account

When drafting a credit card cancellation letter, include the following key elements:

- Your full name and address

- The credit card issuer's name and address

- Your account number

- A clear statement requesting the cancellation of the credit card

- A request for confirmation of the cancellation

- Your signature and date

Legal use of the cancellation of a credit card account

Legally, the cancellation of a credit card account must follow the terms outlined in the cardholder agreement. Cardholders have the right to cancel their accounts at any time, but it is essential to be aware of any potential fees or penalties that may apply. Additionally, ensuring that the cancellation is documented properly can help protect against future disputes.

Examples of using the cancellation of a credit card account

There are various scenarios where a credit card cancellation letter may be necessary:

- Closing an account due to high-interest rates or fees.

- Canceling a card that is rarely used to simplify finances.

- Ending a corporate credit card agreement when an employee leaves the company.

- Transitioning to a different credit card with better benefits.

Required documents for cancellation of a credit card account

While the cancellation process is generally straightforward, having the following documents ready can facilitate a smoother experience:

- Credit card statement showing the current balance.

- Identification documents for verification purposes.

- Any previous correspondence with the credit card issuer regarding account terms.

Quick guide on how to complete cancellation of credit card account

Effortlessly Prepare Cancellation Of Credit Card Account on Any Device

Digital document management has gained popularity among businesses and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without any delays. Manage Cancellation Of Credit Card Account on any device with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

Seamless Way to Modify and eSign Cancellation Of Credit Card Account

- Find Cancellation Of Credit Card Account and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize important sections of your documents or obscure sensitive data with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Cancellation Of Credit Card Account while ensuring excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit card cancellation letter?

A credit card cancellation letter is a formal document that you send to your credit card issuer to request the cancellation of your credit card. This letter serves as an official record of your request and ensures that your account is closed securely, preventing any potential unauthorized charges.

-

How do I create a credit card cancellation letter using airSlate SignNow?

Creating a credit card cancellation letter with airSlate SignNow is easy. Simply choose a template or start from scratch, fill in your details, and use our eSigning feature to finalize the document. You can then send it electronically to your credit card issuer for a quick and efficient cancellation process.

-

Are there any costs associated with creating a credit card cancellation letter on airSlate SignNow?

There are no hidden costs for creating a credit card cancellation letter on airSlate SignNow. We offer competitive pricing plans that are cost-effective. You can select a plan that best fits your needs, allowing you to prepare documents hassle-free, including your cancellation letter.

-

Can I track the status of my credit card cancellation letter with airSlate SignNow?

Yes, airSlate SignNow provides excellent tracking features for your documents. Once you send your credit card cancellation letter, you can easily track its status to ensure that it has been received and processed by your credit card issuer. This keeps you informed throughout the cancellation process.

-

What are the benefits of using airSlate SignNow for my credit card cancellation letter?

The primary benefit of using airSlate SignNow for your credit card cancellation letter is the ease of use. Our platform allows you to create, sign, and send documents quickly and securely. Additionally, using our service minimizes the risk of delays or errors that can occur with traditional mail.

-

Is my data safe when sending my credit card cancellation letter via airSlate SignNow?

Absolutely, airSlate SignNow prioritizes the security and privacy of your data. Our platform uses advanced encryption technology to ensure that your credit card cancellation letter and personal information remain secure during the signing and transmission process.

-

How can I integrate airSlate SignNow with other applications to manage my credit card cancellation letters?

airSlate SignNow offers seamless integrations with various applications, making it easier to manage your credit card cancellation letters alongside other business processes. You can integrate with your CRM, document management systems, and more, streamlining your workflow and improving efficiency.

Get more for Cancellation Of Credit Card Account

- Sample charlotte county government form

- Dr 99a affidavit for private casual sale of a motor vehicle r0599 form

- 2014 f 7004 form

- Exemption permit 2006 form

- 2010 f 1120 form

- Fl f 1120 instructions 2013 form

- Rt 6 florida administrative code form

- Section i notices of development of proposed rules and negotiated 6967060 form

Find out other Cancellation Of Credit Card Account

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF