New Jersey Amended Resident Income Tax Return, Form 2020

What is the New Jersey Amended Resident Income Tax Return, Form

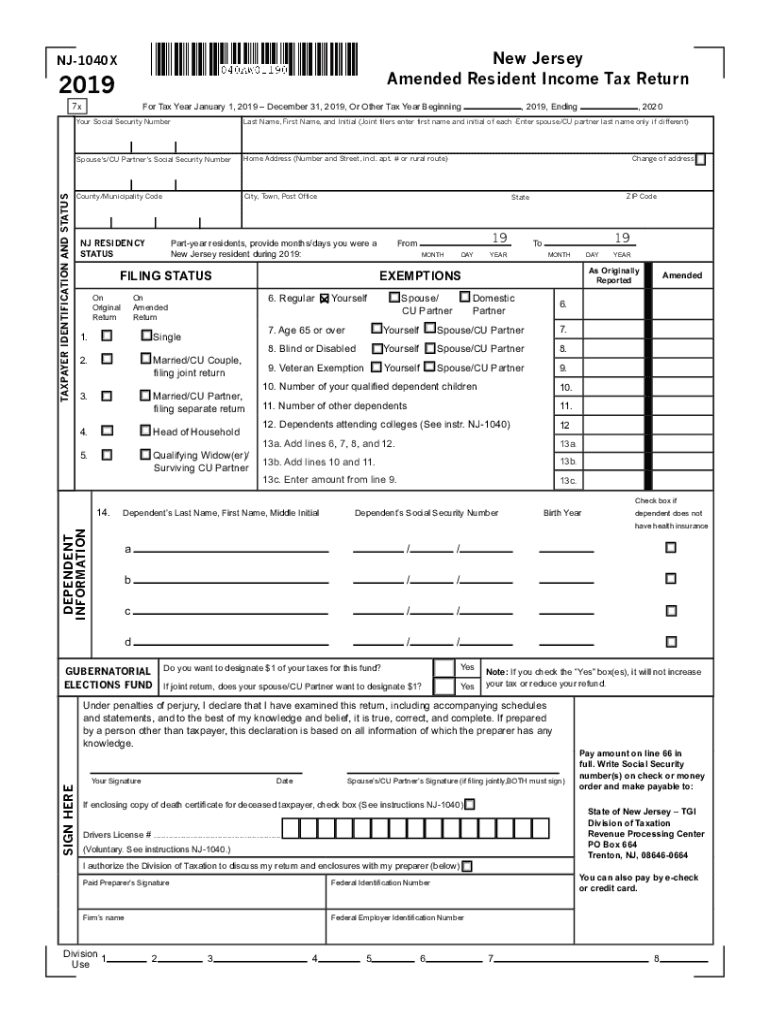

The New Jersey Amended Resident Income Tax Return, Form is a document used by residents of New Jersey to amend their previously filed state income tax returns. This form allows taxpayers to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that your tax records are accurate and reflect your true financial situation.

Steps to complete the New Jersey Amended Resident Income Tax Return, Form

Completing the New Jersey Amended Resident Income Tax Return involves several key steps:

- Gather your original tax return and any relevant documentation that supports the changes you wish to make.

- Obtain the amended form, ensuring you have the correct version for the tax year you are amending.

- Fill out the form, clearly indicating the changes made compared to your original return.

- Attach any necessary schedules or documentation that substantiate your amendments.

- Review the completed form for accuracy before submission.

- Submit the form via your preferred method, whether online, by mail, or in person.

How to obtain the New Jersey Amended Resident Income Tax Return, Form

The New Jersey Amended Resident Income Tax Return, Form can be obtained through the New Jersey Division of Taxation's official website. It is available for download in PDF format, allowing you to print and complete it at your convenience. Additionally, you may request a physical copy through local tax offices or certain public libraries.

Legal use of the New Jersey Amended Resident Income Tax Return, Form

Using the New Jersey Amended Resident Income Tax Return is legally permissible and necessary for correcting previously filed returns. To ensure that your amendments are valid, it is crucial to follow the guidelines set forth by the New Jersey Division of Taxation. Properly completing and submitting this form helps maintain compliance with state tax laws and can prevent potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for the New Jersey Amended Resident Income Tax Return typically align with the state’s tax filing schedule. Generally, amendments should be filed within three years from the original filing date or within two years from the date the tax was paid, whichever is later. It is essential to stay informed about specific deadlines to avoid late fees or interest charges.

Form Submission Methods (Online / Mail / In-Person)

The New Jersey Amended Resident Income Tax Return can be submitted through various methods:

- Online: Use the state’s online tax filing system for electronic submission.

- Mail: Send the completed form to the address specified in the instructions, ensuring it is postmarked by the deadline.

- In-Person: Deliver the form directly to a local tax office for immediate processing.

Quick guide on how to complete 2019 new jersey amended resident income tax return form

Prepare New Jersey Amended Resident Income Tax Return, Form effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents swiftly without delays. Manage New Jersey Amended Resident Income Tax Return, Form on any platform with airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to modify and electronically sign New Jersey Amended Resident Income Tax Return, Form with ease

- Obtain New Jersey Amended Resident Income Tax Return, Form and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign New Jersey Amended Resident Income Tax Return, Form and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 new jersey amended resident income tax return form

Create this form in 5 minutes!

How to create an eSignature for the 2019 new jersey amended resident income tax return form

The way to make an eSignature for a PDF document online

The way to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

How to make an electronic signature right from your smart phone

The way to make an eSignature for a PDF document on iOS

How to make an electronic signature for a PDF on Android OS

People also ask

-

What is the New Jersey Amended Resident Income Tax Return, Form?

The New Jersey Amended Resident Income Tax Return, Form is designed for residents who need to correct their previously filed state income tax returns. This form allows taxpayers to make adjustments to ensure they comply with state tax laws. By using the correct form, taxpayers can avoid penalties and ensure they pay the correct amount of tax.

-

How can airSlate SignNow help with the New Jersey Amended Resident Income Tax Return, Form?

airSlate SignNow provides a seamless platform for filling out and eSigning the New Jersey Amended Resident Income Tax Return, Form. Users can easily upload their documents and use our intuitive interface to ensure accuracy before submitting. Additionally, our platform offers legal validity to your eSignature, enhancing your tax return's credibility.

-

What are the costs associated with using airSlate SignNow for the New Jersey Amended Resident Income Tax Return, Form?

airSlate SignNow offers cost-effective pricing plans that cater to both individuals and businesses needing the New Jersey Amended Resident Income Tax Return, Form. Pricing is competitive, providing value for the features included, such as unlimited eSignatures and secure document storage. You can choose a plan that best fits your needs, with options for monthly or annual billing.

-

Are there any specific features for the New Jersey Amended Resident Income Tax Return, Form provided by airSlate SignNow?

Yes, airSlate SignNow offers features specifically for the New Jersey Amended Resident Income Tax Return, Form, including customizable templates, bulk sending options, and reminders for important deadlines. Our platform also integrates with various third-party applications, making it easier to manage all aspects of your tax preparation and filing process.

-

How secure is airSlate SignNow for filing the New Jersey Amended Resident Income Tax Return, Form?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like the New Jersey Amended Resident Income Tax Return, Form. We use advanced encryption protocols and comply with industry standards to ensure your data remains confidential. Users can trust that their information is protected throughout the entire signing and filing process.

-

Can I integrate airSlate SignNow with other software for the New Jersey Amended Resident Income Tax Return, Form?

Absolutely! airSlate SignNow offers robust integrations with various accounting and tax software applications which is particularly useful for managing the New Jersey Amended Resident Income Tax Return, Form. This allows for streamlined processes and enhanced efficiency when preparing and filing your taxes. Check our integrations page to see compatible software options.

-

What are the benefits of using airSlate SignNow for the New Jersey Amended Resident Income Tax Return, Form?

Using airSlate SignNow for the New Jersey Amended Resident Income Tax Return, Form provides several benefits, including time efficiency, ease of use, and improved accuracy. The platform minimizes the risk of errors and simplifies the eSignature process, ultimately ensuring a stress-free tax filing experience. Additionally, our customer support team is here to assist with any questions you may have.

Get more for New Jersey Amended Resident Income Tax Return, Form

- Janitorial bid proposal template form

- Rd 3560 12 form

- Electricity meter change application online form

- Apex math answer key form

- Mississippi medicaid application online form

- Mc 114 request for review of denied fee waiver and order form

- Forms ibew org

- Dr 2643 affidavit of enrollment level ii drug and alcohol education and treatment if you are using a screen reader or other form

Find out other New Jersey Amended Resident Income Tax Return, Form

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online