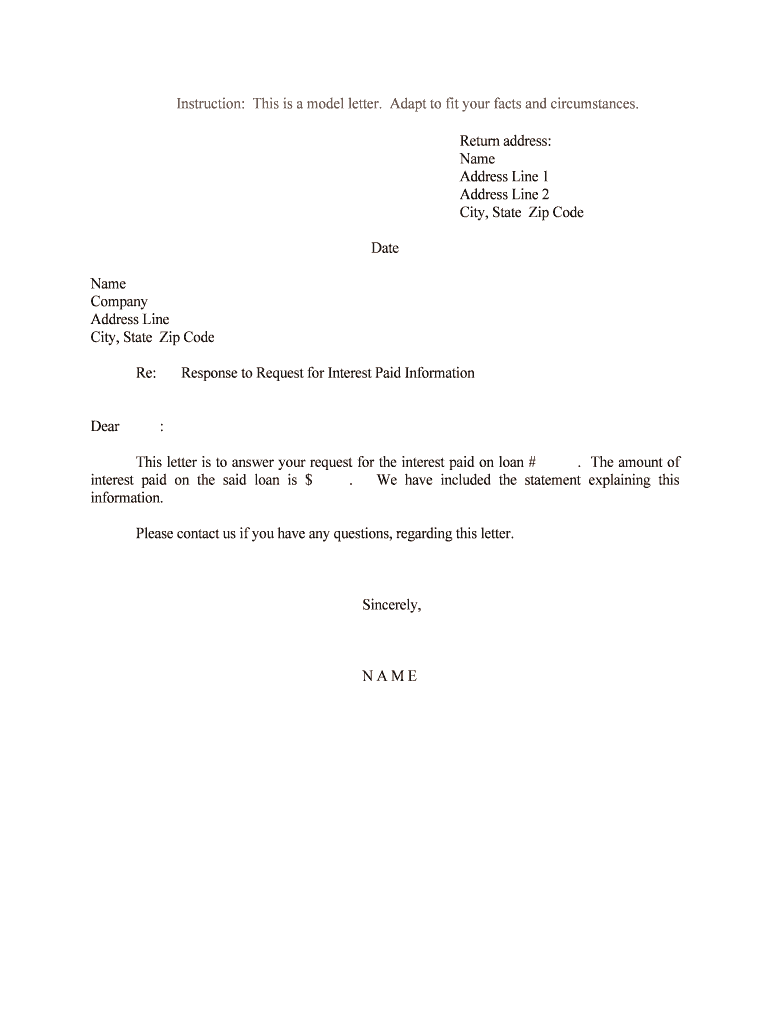

Response to Request for Interest Paid Information

What is the Response To Request For Interest Paid Information

The Response To Request For Interest Paid Information is a document that provides details regarding interest payments made during a specific period. This form is often used by businesses and individuals to report interest income to the Internal Revenue Service (IRS) and to ensure compliance with tax regulations. It serves as a formal acknowledgment of interest received and is essential for accurate tax reporting.

How to use the Response To Request For Interest Paid Information

Using the Response To Request For Interest Paid Information involves filling out the required sections accurately. Users should gather all necessary information, including the amount of interest paid, the payer's details, and any relevant tax identification numbers. Once completed, the form can be submitted to the appropriate entity, such as the IRS or a financial institution, depending on the context of the request.

Steps to complete the Response To Request For Interest Paid Information

Completing the Response To Request For Interest Paid Information involves several key steps:

- Gather all relevant financial documents that detail interest payments.

- Fill in the form with accurate information, including your name, address, and taxpayer identification number.

- Include the total amount of interest paid and any additional information requested.

- Review the completed form for accuracy before submission.

- Submit the form electronically or via mail, following the specific submission guidelines provided.

Legal use of the Response To Request For Interest Paid Information

The legal use of the Response To Request For Interest Paid Information is crucial for maintaining compliance with tax laws. This document must be filled out accurately to avoid penalties or legal issues. It is essential to ensure that all provided information is truthful and complete, as discrepancies can lead to audits or further investigation by tax authorities.

Key elements of the Response To Request For Interest Paid Information

Key elements of the Response To Request For Interest Paid Information include:

- The name and address of the individual or business receiving the interest.

- The total amount of interest paid during the reporting period.

- The name and address of the payer.

- Relevant tax identification numbers for both parties.

- Any additional notes or comments that may be necessary for clarity.

Examples of using the Response To Request For Interest Paid Information

Examples of using the Response To Request For Interest Paid Information include:

- A business reporting interest income received from a bank account.

- An individual documenting interest payments received from a loan.

- A financial institution providing interest payment details to its clients for tax purposes.

Quick guide on how to complete response to request for interest paid information

Complete Response To Request For Interest Paid Information seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the required form and securely archive it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Response To Request For Interest Paid Information on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric workflow today.

The easiest way to modify and eSign Response To Request For Interest Paid Information effortlessly

- Find Response To Request For Interest Paid Information and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Decide how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your preference. Modify and eSign Response To Request For Interest Paid Information and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for requesting interest paid information?

The process to obtain a Response To Request For Interest Paid Information involves submitting a formal inquiry through our easy-to-use platform. Simply navigate to the request section, fill in the necessary details, and we will provide the relevant information quickly and efficiently.

-

How does airSlate SignNow handle document security?

Our platform prioritizes document security when delivering a Response To Request For Interest Paid Information. We employ top-tier encryption protocols and secure access controls to ensure that all sensitive data remains protected throughout the signing process.

-

Are there any costs associated with obtaining interest paid information?

There are no hidden fees involved in requesting a Response To Request For Interest Paid Information through airSlate SignNow. We are committed to providing a cost-effective solution that allows businesses to manage their document needs without breaking the bank.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow comes equipped with a variety of features that enhance document management, such as customizable templates and automated reminders. These features streamline the process of generating a Response To Request For Interest Paid Information, making it simpler for users.

-

Can I integrate airSlate SignNow with other applications?

Yes, airSlate SignNow allows for seamless integration with numerous applications to enhance your workflow. This integration ensures you can quickly retrieve and generate a Response To Request For Interest Paid Information directly from your existing tools.

-

What are the benefits of using airSlate SignNow for documentation?

Choosing airSlate SignNow for your documentation needs provides numerous benefits, including efficiency, ease of use, and cost savings. Our platform simplifies the process of creating a Response To Request For Interest Paid Information, making it accessible to businesses of all sizes.

-

Is there customer support available for assistance?

Absolutely! Our customer support team is always ready to assist you with any questions, including those related to a Response To Request For Interest Paid Information. You can signNow out via chat, email, or phone for prompt and helpful responses.

Get more for Response To Request For Interest Paid Information

- Grey ncb form

- Framing inspections form

- Ccpa chiropractic consent form

- Application for regular premium assistance application for regular premium assistance bcit form

- Mediation intake form

- Cremation certificate sample form

- Form 1 anglais scanned short formdoc petes lbpsb qc

- Rglement concernant la modification form

Find out other Response To Request For Interest Paid Information

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe