Form 10 Sales Tax Nebraska 2011

What is the Form 10 Sales Tax Nebraska

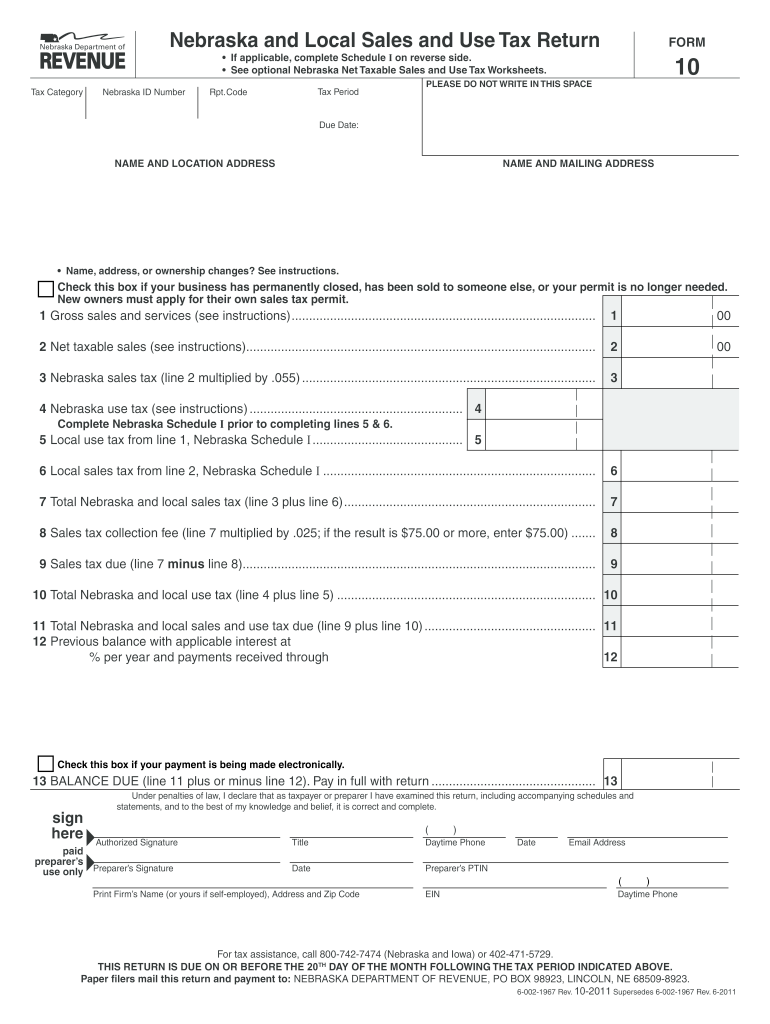

The Form 10 Sales Tax Nebraska is a state-specific tax form used by businesses to report sales tax collected from customers. This form is essential for compliance with Nebraska tax regulations, allowing businesses to accurately report their sales tax obligations to the Nebraska Department of Revenue. The form captures details about taxable sales, exemptions, and the total amount of sales tax due. Understanding this form is crucial for maintaining proper tax records and ensuring timely payments.

How to use the Form 10 Sales Tax Nebraska

Using the Form 10 Sales Tax Nebraska involves several steps to ensure accurate reporting of sales tax. First, gather all necessary sales records, including invoices and receipts. Next, complete the form by entering details such as total sales, taxable sales, and any exemptions. After filling out the form, review it for accuracy to avoid potential penalties. Finally, submit the form according to the filing methods accepted by the state, either online or by mail.

Steps to complete the Form 10 Sales Tax Nebraska

Completing the Form 10 Sales Tax Nebraska requires careful attention to detail. Follow these steps:

- Collect all sales documentation, including receipts and invoices.

- Determine the total sales amount and identify which sales are taxable.

- Fill in the form with the required information, including business details and sales figures.

- Calculate the total sales tax due based on the applicable tax rates.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline.

Legal use of the Form 10 Sales Tax Nebraska

The legal use of the Form 10 Sales Tax Nebraska is governed by state tax regulations. Businesses must ensure that the form is filled out accurately and submitted on time to avoid penalties. This form serves as an official record of sales tax collected and must be retained for auditing purposes. Compliance with the guidelines set by the Nebraska Department of Revenue is essential for legal and financial protection.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10 Sales Tax Nebraska are crucial for compliance. Typically, the form is due on a monthly or quarterly basis, depending on the volume of sales. Businesses should mark their calendars for these deadlines to ensure timely submissions and avoid late fees. It is advisable to check the Nebraska Department of Revenue's website for specific due dates and any changes to the filing schedule.

Form Submission Methods (Online / Mail / In-Person)

The Form 10 Sales Tax Nebraska can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to file electronically through the Nebraska Department of Revenue's online portal.

- Mail: Completed forms can be printed and mailed to the appropriate address for processing.

- In-Person: Businesses may also choose to submit the form in person at designated state offices.

Quick guide on how to complete ne form 10 2011

Your assistance manual on how to prepare your Form 10 Sales Tax Nebraska

If you are seeking to learn how to complete and submit your Form 10 Sales Tax Nebraska, here are some concise pointers on how to simplify the tax submission process.

To begin, you simply need to create your airSlate SignNow profile to revolutionize the way you manage documents online. airSlate SignNow is an extremely intuitive and effective document solution that enables you to modify, draft, and finalize your tax documents effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures and return to adjust responses as necessary. Enhance your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the steps outlined below to complete your Form 10 Sales Tax Nebraska in just a few minutes:

- Create your account and commence working on PDFs within minutes.

- Utilize our directory to find any IRS tax form; browse through versions and schedules.

- Click Obtain form to access your Form 10 Sales Tax Nebraska in our editor.

- Fill in the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to append your legally-binding eSignature (if required).

- Examine your document and rectify any errors.

- Save changes, print your copy, dispatch it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please be aware that filing by paper can lead to increased return errors and delayed reimbursements. Naturally, before electronically filing your taxes, consult the IRS website for submission regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct ne form 10 2011

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

What is the time period to fill out form 10?

Well its a huge mission if you’re going to use a printer forget about it :)I’ve tried all the products and a lot of them you struggle with the mouse cursor to find the space to complete. So I think people can sometimes just get annoyed and use a printer.But the best is Paperjet. Go Paperless which uses field detection and makes the form fillable online immediately.No doubt the easiest and quickest way imho.

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

How can I fill out a form to become a pilot in Nepal?

Obtain the forms. Read the forms. Add correct information.

Create this form in 5 minutes!

How to create an eSignature for the ne form 10 2011

How to create an eSignature for your Ne Form 10 2011 online

How to create an electronic signature for the Ne Form 10 2011 in Chrome

How to create an eSignature for signing the Ne Form 10 2011 in Gmail

How to make an eSignature for the Ne Form 10 2011 straight from your mobile device

How to generate an electronic signature for the Ne Form 10 2011 on iOS devices

How to generate an electronic signature for the Ne Form 10 2011 on Android devices

People also ask

-

What is the Form 10 Sales Tax Nebraska and why is it important?

The Form 10 Sales Tax Nebraska is a document used by businesses to report and remit sales tax in Nebraska. Understanding this form is crucial for compliance with state regulations and ensuring that your business avoids penalties. With airSlate SignNow, you can easily fill out and eSign the Form 10 Sales Tax Nebraska, streamlining your tax filing process.

-

How does airSlate SignNow help with completing the Form 10 Sales Tax Nebraska?

airSlate SignNow offers a user-friendly platform that allows you to efficiently complete the Form 10 Sales Tax Nebraska. Our digital tools simplify the process, enabling you to enter your sales data, sign the document electronically, and submit it without any hassle. This saves you time and ensures that your form is submitted accurately.

-

Is there a cost associated with using airSlate SignNow for the Form 10 Sales Tax Nebraska?

Yes, while airSlate SignNow provides a cost-effective solution for document management, there are subscription plans that may apply depending on your business needs. We offer various pricing tiers that cater to different levels of usage, ensuring you get the best value while managing the Form 10 Sales Tax Nebraska and other documents.

-

Can I integrate airSlate SignNow with my existing accounting software for Form 10 Sales Tax Nebraska?

Absolutely! airSlate SignNow offers integrations with a variety of accounting software, making it easy to manage your financial documents, including the Form 10 Sales Tax Nebraska. This integration helps you maintain accurate records and ensures a seamless workflow between your sales data and tax reporting.

-

What are the benefits of using airSlate SignNow for the Form 10 Sales Tax Nebraska?

Using airSlate SignNow for the Form 10 Sales Tax Nebraska provides numerous benefits, including enhanced accuracy, time savings, and easy collaboration. Our eSigning solution eliminates the need for paper documents, reduces errors, and allows multiple stakeholders to review and sign the form securely from anywhere.

-

Is it safe to eSign the Form 10 Sales Tax Nebraska using airSlate SignNow?

Yes, airSlate SignNow prioritizes the security of your documents, including the Form 10 Sales Tax Nebraska. Our platform employs advanced encryption and security protocols, ensuring that your sensitive information is protected during the signing process. You can confidently eSign your documents knowing they are secure.

-

Can I access the Form 10 Sales Tax Nebraska from my mobile device?

Yes, airSlate SignNow is fully accessible on mobile devices, allowing you to complete and eSign the Form 10 Sales Tax Nebraska on the go. Whether you're in the office or out in the field, you can manage your documents seamlessly from your smartphone or tablet, ensuring you never miss a deadline.

Get more for Form 10 Sales Tax Nebraska

- Day warranty from mechanical defects form

- Grading on the work site as may be required in the judgment of the contractor to form

- Scope of work contractor shall notify builder of excessive defects in the drywall or form

- Designplanning form

- Basement floorthickness form

- Units trucks and trailers to raise lower crib underpin demolish and move or remove form

- Sheathing sub fascia and fascia bridging joist hangers rough framing materials for stair jacks treads form

- Rated exit releases jail and prison locking devices safes vaults and alarm systems form

Find out other Form 10 Sales Tax Nebraska

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure