State and Local Tax Weekly for June 2 and June 9 2022-2026

Understanding the Nebraska Sales Tax Form 10

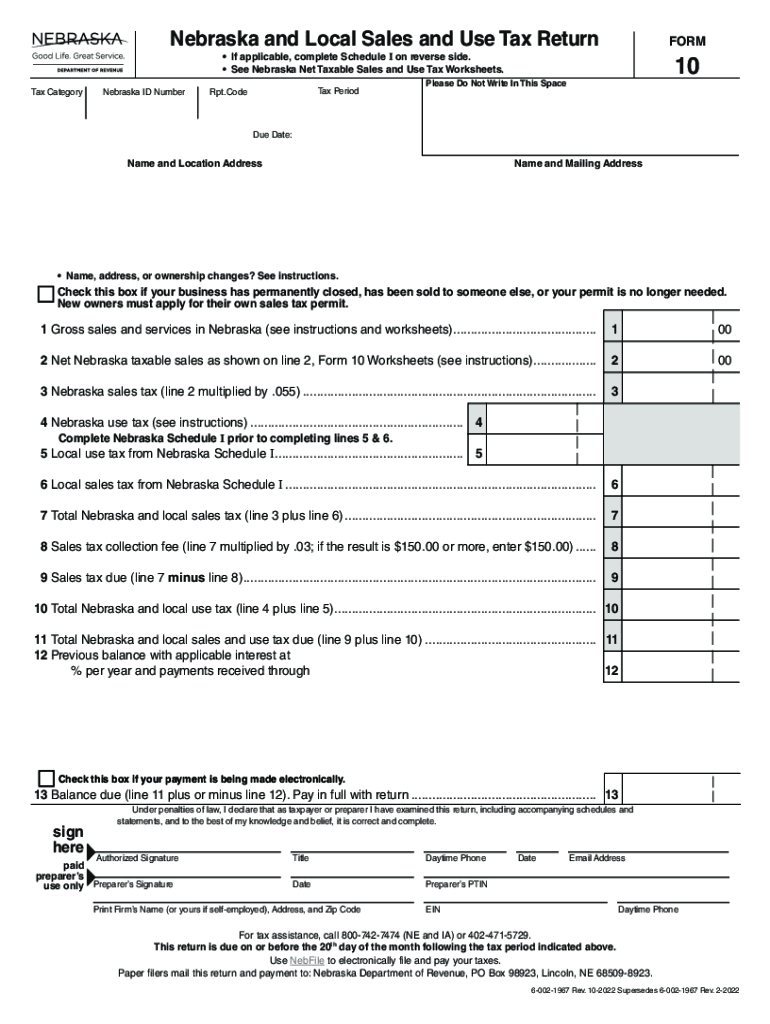

The Nebraska Sales Tax Form 10 is a critical document for businesses operating within the state, used primarily for reporting sales and use tax. This form is essential for ensuring compliance with Nebraska's tax regulations. It allows businesses to report the amount of sales tax collected from customers and remit it to the state. Understanding the purpose and requirements of this form is vital for maintaining good standing with state tax authorities.

Steps to Complete the Nebraska Sales Tax Form 10

Completing the Nebraska Sales Tax Form 10 involves several key steps:

- Gather all necessary sales records, including total sales, exempt sales, and any sales tax collected.

- Fill in the business information section, including the business name, address, and sales tax permit number.

- Report the total sales and the amount of sales tax collected during the reporting period.

- Calculate any adjustments for exempt sales or tax overpayments.

- Review the completed form for accuracy before submission.

Filing Deadlines for the Nebraska Sales Tax Form 10

Timely filing of the Nebraska Sales Tax Form 10 is crucial to avoid penalties. The filing deadlines vary based on the reporting period selected by the business. Generally, businesses may file monthly, quarterly, or annually. It is important to check the specific deadlines relevant to your filing frequency to ensure compliance.

Required Documents for Filing

When submitting the Nebraska Sales Tax Form 10, certain documents may be required to support the information reported. These may include:

- Sales records detailing transactions for the reporting period.

- Invoices or receipts for exempt sales.

- Any documentation related to tax adjustments or credits claimed.

Penalties for Non-Compliance

Failure to file the Nebraska Sales Tax Form 10 on time or inaccuracies in reporting can lead to penalties. These may include fines based on the amount of tax due and interest on late payments. It is essential for businesses to stay informed about their filing obligations to avoid these consequences.

Form Submission Methods

The Nebraska Sales Tax Form 10 can be submitted through various methods. Businesses can file online through the Nebraska Department of Revenue’s website, which offers a streamlined process. Alternatively, forms can be mailed or submitted in person at designated tax offices. Choosing the right submission method can help ensure timely processing of your tax return.

Who Issues the Nebraska Sales Tax Form 10

The Nebraska Department of Revenue is responsible for issuing the Sales Tax Form 10. This state agency oversees tax collection and compliance, providing resources and guidance for businesses to understand their tax obligations. Keeping informed about updates from the Department can help businesses remain compliant with state tax laws.

Quick guide on how to complete state and local tax weekly for june 2 and june 9

Effortlessly prepare State And Local Tax Weekly For June 2 And June 9 on any device

Digital document management has become increasingly favored by both organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your files quickly without delays. Handle State And Local Tax Weekly For June 2 And June 9 on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest way to modify and electronically sign State And Local Tax Weekly For June 2 And June 9 without hassle

- Find State And Local Tax Weekly For June 2 And June 9 and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or inaccuracies that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign State And Local Tax Weekly For June 2 And June 9 and ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct state and local tax weekly for june 2 and june 9

Create this form in 5 minutes!

How to create an eSignature for the state and local tax weekly for june 2 and june 9

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Nebraska sales tax form 10?

The Nebraska sales tax form 10 is a document used by businesses to report and remit sales tax collections to the Nebraska Department of Revenue. This form ensures compliance with state laws and helps businesses track their sales tax obligations efficiently.

-

How can airSlate SignNow help with the Nebraska sales tax form 10?

AirSlate SignNow streamlines the process of completing the Nebraska sales tax form 10 by allowing businesses to electronically fill out and submit the form. Our easy-to-use platform minimizes errors and ensures that all required information is accurately captured.

-

What are the pricing options for using airSlate SignNow to file the Nebraska sales tax form 10?

AirSlate SignNow offers several pricing plans to accommodate businesses of all sizes. Our cost-effective solutions ensure that you can efficiently manage your Nebraska sales tax form 10 submissions without breaking the bank. Visit our pricing page for more details.

-

Is it easy to integrate airSlate SignNow with existing accounting software for the Nebraska sales tax form 10?

Yes, airSlate SignNow can be seamlessly integrated with many popular accounting software platforms. This integration allows for automatic data transfer, making it easier for businesses to prepare their Nebraska sales tax form 10 and maintain accurate records.

-

What are the benefits of using airSlate SignNow for the Nebraska sales tax form 10?

Using airSlate SignNow for the Nebraska sales tax form 10 provides businesses with quick eSigning capabilities, reducing turnaround times signNowly. Additionally, our secure platform ensures that all documents are stored safely, providing peace of mind during the filing process.

-

Can multiple users collaborate on the Nebraska sales tax form 10 with airSlate SignNow?

Absolutely! AirSlate SignNow allows multiple users to collaborate in real time on the Nebraska sales tax form 10. This feature is particularly beneficial for teams working together to ensure all necessary information is correct and submitted on time.

-

How secure is airSlate SignNow when filing the Nebraska sales tax form 10?

Security is a top priority for airSlate SignNow. Our platform employs advanced encryption and security measures, ensuring that your Nebraska sales tax form 10 and other sensitive documents are protected during transmission and storage.

Get more for State And Local Tax Weekly For June 2 And June 9

- Standard one reid state technical college form

- Ui340 form

- Individual forms and publications ides home

- Work permit ma form

- You can download a copy of the waiver form here michigan

- Instructions for completing liquid industrial by product uniform program fee worksheet attachment a to eqp5122

- Deqs transporter form eqp5122a

- Certificate of compliance minnesota workers compensation law form

Find out other State And Local Tax Weekly For June 2 And June 9

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later