Nebraska Sales and Use TaxNebraska Department of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr 2021

Understanding the Nebraska Sales and Use Tax

The Nebraska Sales and Use Tax is a crucial component of the state's revenue system. It applies to the sale of tangible personal property and certain services within Nebraska. The tax is imposed at a state level, with local jurisdictions allowed to levy additional taxes. This means that the total tax rate can vary depending on the location of the sale. Understanding this tax is essential for both consumers and businesses to ensure compliance and proper tax reporting.

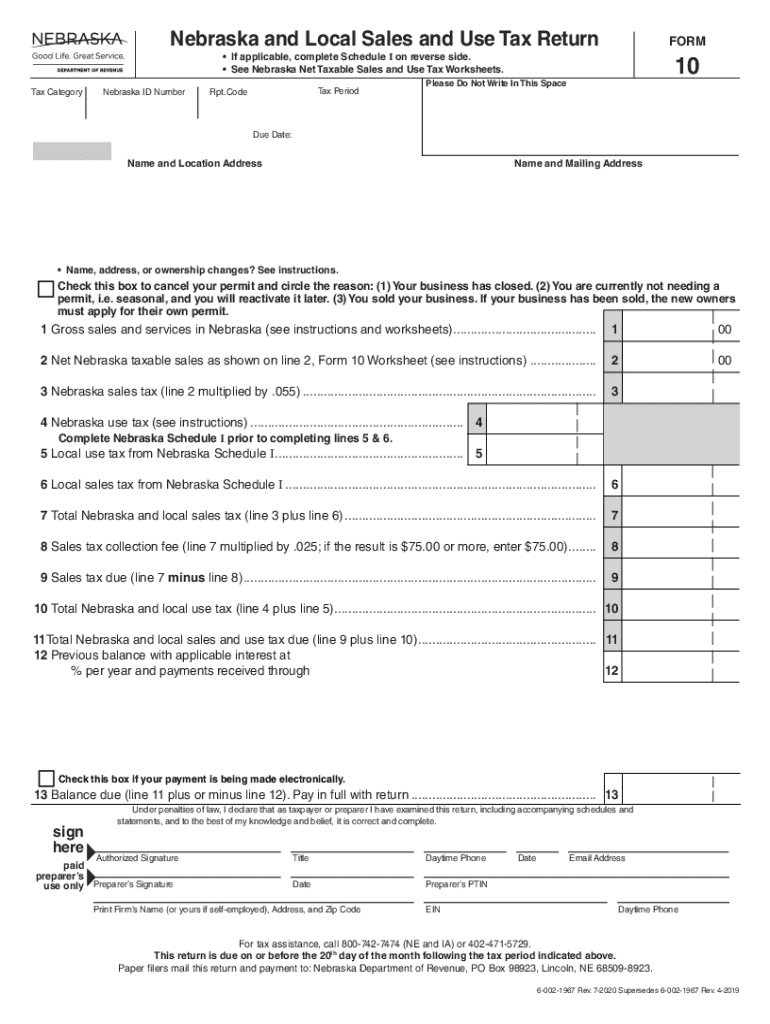

Steps to Complete the Nebraska Sales and Use Tax Form 10

Completing the Nebraska Sales and Use Tax Form 10 involves several key steps. First, gather all necessary documentation, including sales records and any relevant invoices. Next, accurately fill out the form, ensuring that all sales are reported correctly. It's important to calculate the total tax due based on the applicable rates. Once completed, review the form for accuracy before submission. This careful approach helps prevent errors that could lead to penalties.

Legal Use of the Nebraska Sales and Use Tax

The legal framework governing the Nebraska Sales and Use Tax is defined by state law, which outlines the obligations of sellers and buyers. Compliance with these laws ensures that transactions are valid and that tax revenues are properly collected. Businesses must maintain accurate records of sales and taxes collected to demonstrate compliance during audits. Understanding these legal requirements is vital for maintaining good standing with the Nebraska Department of Revenue.

Filing Deadlines for the Nebraska Sales and Use Tax

Filing deadlines for the Nebraska Sales and Use Tax are set by the Nebraska Department of Revenue and typically occur on a monthly or quarterly basis, depending on the volume of sales. It is essential for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can help ensure timely submissions and compliance with state regulations.

Required Documents for Filing Form 10

When filing the Nebraska Sales and Use Tax Form 10, certain documents are necessary to support the information provided. These include sales receipts, invoices, and records of exempt sales. Maintaining organized documentation not only aids in the completion of the form but also serves as evidence in case of an audit. Accurate record-keeping is a best practice for any business subject to sales tax.

Penalties for Non-Compliance with Nebraska Sales and Use Tax

Failure to comply with Nebraska Sales and Use Tax regulations can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. Understanding the consequences of non-compliance emphasizes the importance of timely and accurate filing. Businesses should prioritize tax compliance to avoid these negative outcomes and maintain their operational integrity.

Quick guide on how to complete nebraska sales and use taxnebraska department of revenuesales ampamp use tax forms sales ampamp use tax forms illinoisnebraska

Complete Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the correct form and securely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr on any device with airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr with ease

- Obtain Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure confidential details using tools that airSlate SignNow offers for that specific purpose.

- Create your eSignature with the Sign tool, a process that takes seconds and has the same legal status as a conventional wet ink signature.

- Review all the information and then click the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate issues with lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska sales and use taxnebraska department of revenuesales ampamp use tax forms sales ampamp use tax forms illinoisnebraska

Create this form in 5 minutes!

How to create an eSignature for the nebraska sales and use taxnebraska department of revenuesales ampamp use tax forms sales ampamp use tax forms illinoisnebraska

The best way to create an e-signature for your PDF online

The best way to create an e-signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The way to make an e-signature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

The way to make an e-signature for a PDF on Android

People also ask

-

What is the form 10 nebraska and when do I need it?

The form 10 nebraska is a specific document required for various legal and administrative processes within the state. Typically, you will need it for filing certain business registrations or applications. Understanding when to use it can simplify your compliance and ensure your documents are processed efficiently.

-

How can airSlate SignNow help with completing the form 10 nebraska?

airSlate SignNow provides a user-friendly platform for filling out and eSigning the form 10 nebraska. With its intuitive interface, you can easily input your information, ensuring accuracy and compliance with state requirements. This makes the process quick and efficient, reducing the chances of errors.

-

Is there a cost associated with using airSlate SignNow for form 10 nebraska?

Yes, airSlate SignNow offers various pricing plans that can fit different business needs. We provide a cost-effective solution to streamline eSigning and document management processes, including for the form 10 nebraska. Subscription details and current pricing can be viewed on our website.

-

What features does airSlate SignNow offer for the form 10 nebraska?

airSlate SignNow includes features such as document templates, easy eSigning, workflow automation, and secure storage specifically designed for documents like the form 10 nebraska. These features enhance productivity and ensure that your documents are managed securely and efficiently.

-

Can multiple users collaborate on the form 10 nebraska in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on filling out and signing the form 10 nebraska. This feature is particularly useful for teams, ensuring that all necessary parties can contribute and review the document before final submission.

-

What types of integrations does airSlate SignNow support for processing the form 10 nebraska?

airSlate SignNow supports a wide range of integrations with popular platforms such as Google Drive, Dropbox, and Microsoft Office. These integrations allow for seamless document management and facilitate the completion of the form 10 nebraska directly from your existing workflow.

-

Is it safe to use airSlate SignNow for my form 10 nebraska?

Yes, using airSlate SignNow for your form 10 nebraska is very safe. The platform employs advanced security measures, including encryption and secure access controls, to protect your sensitive information. You can confidently eSign and manage your documents without worrying about data bsignNowes.

Get more for Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr

- Estate planning questionnaire and worksheets connecticut form

- Document locator and personal information package including burial information form connecticut

- Demand to produce copy of will from heir to executor or person in possession of will connecticut form

- No fault uncontested agreed divorce package for dissolution of marriage with adult children and with or without property and 497301427 form

- Bill of sale of automobile and odometer statement district of columbia form

- Bill of sale for automobile or vehicle including odometer statement and promissory note district of columbia form

- Promissory note in connection with sale of vehicle or automobile district of columbia form

- Bill of sale for watercraft or boat district of columbia form

Find out other Nebraska Sales And Use TaxNebraska Department Of RevenueSales & Use Tax Forms Sales & Use Tax Forms IllinoisNebr

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe