Form 10 'Nebraska and Local Sales and Use Tax Return 2020

What is the Form 10 'Nebraska And Local Sales And Use Tax Return

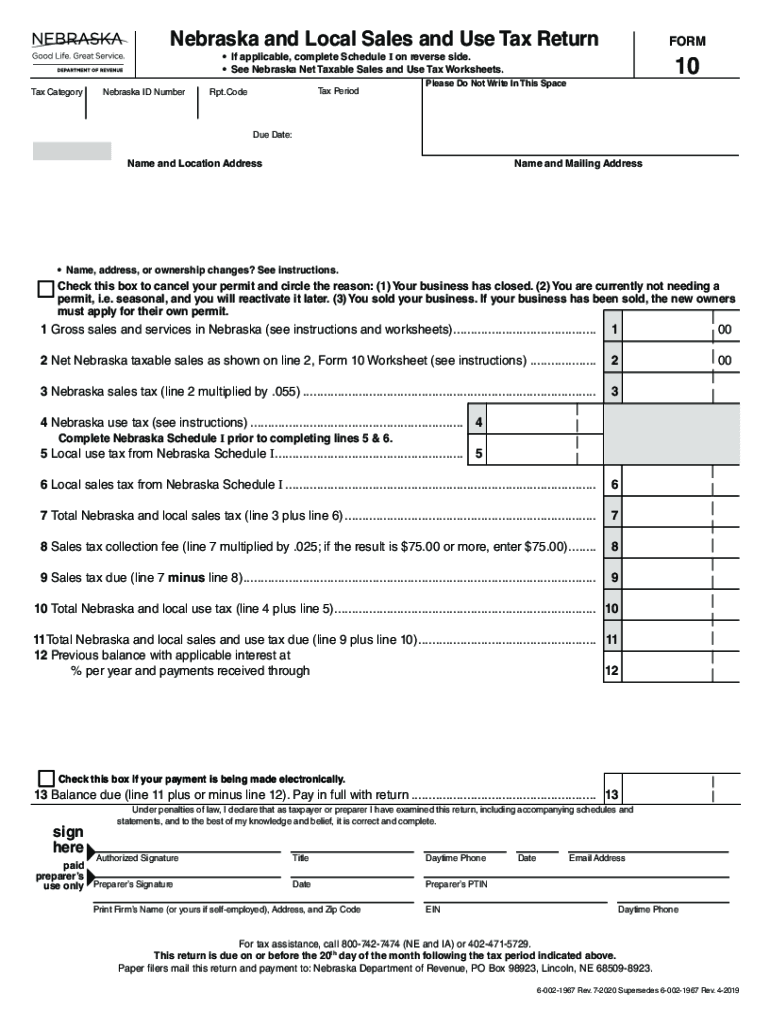

The Form 10, officially known as the Nebraska and Local Sales and Use Tax Return, is a critical document for businesses operating in Nebraska. This form is used to report sales tax collected from customers and to remit the appropriate amount to the state. It applies to various business entities, including retailers, wholesalers, and service providers who sell taxable goods or services. Understanding the purpose of this form is essential for compliance with Nebraska tax laws and regulations.

How to use the Form 10 'Nebraska And Local Sales And Use Tax Return

Using the Form 10 involves several steps to ensure accurate reporting and compliance. First, businesses must gather all relevant sales data for the reporting period, including total sales, exempt sales, and sales tax collected. Next, the form requires the completion of specific sections detailing these figures. After filling out the form, businesses can submit it electronically or via mail, depending on their preference. Utilizing a reliable electronic signature solution can streamline this process, ensuring that the form is both completed and submitted securely.

Steps to complete the Form 10 'Nebraska And Local Sales And Use Tax Return

Completing the Form 10 requires careful attention to detail. Here are the steps involved:

- Gather all sales records for the reporting period, including invoices and receipts.

- Calculate the total sales and the amount of sales tax collected.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically or by mail, depending on your preference.

Legal use of the Form 10 'Nebraska And Local Sales And Use Tax Return

The legal use of the Form 10 is governed by Nebraska tax laws. It is essential for businesses to ensure that the information reported is accurate and complete to avoid penalties. The form must be filed by the designated deadline to maintain compliance. Electronic submissions are legally recognized, provided they meet the requirements set forth by the state. Using a compliant eSignature solution can further validate the submission process.

Filing Deadlines / Important Dates

Filing deadlines for the Form 10 are crucial for compliance. Typically, the form must be submitted on a monthly or quarterly basis, depending on the volume of sales. Businesses should be aware of the specific due dates for their reporting period to avoid late fees. It is advisable to keep a calendar of these dates and set reminders to ensure timely filing.

Form Submission Methods (Online / Mail / In-Person)

The Form 10 can be submitted through various methods, providing flexibility for businesses. Options include:

- Online Submission: Many businesses prefer to file electronically, which can expedite processing times.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some businesses may choose to deliver the form in person at their local tax office.

Quick guide on how to complete form 10 ampquotnebraska and local sales and use tax return

Easily Prepare Form 10 'Nebraska And Local Sales And Use Tax Return on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the necessary form and store it securely online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without holdups. Manage Form 10 'Nebraska And Local Sales And Use Tax Return on any device with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and electronically sign Form 10 'Nebraska And Local Sales And Use Tax Return with ease

- Obtain Form 10 'Nebraska And Local Sales And Use Tax Return and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important portions of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 10 'Nebraska And Local Sales And Use Tax Return and ensure exceptional communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 10 ampquotnebraska and local sales and use tax return

Create this form in 5 minutes!

How to create an eSignature for the form 10 ampquotnebraska and local sales and use tax return

How to generate an electronic signature for your PDF document in the online mode

How to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your mobile device

How to make an electronic signature for a PDF document on iOS devices

The way to generate an electronic signature for a PDF document on Android devices

People also ask

-

What is the process to file Nebraska Form 10 state sales and use tax?

To file Nebraska Form 10 state sales and use tax, you need to complete the form online or offline with accurate sales data. Once done, you can utilize airSlate SignNow to electronically sign and submit it securely. This convenient method ensures compliance and helps avoid any late fees.

-

Are there any fees associated with using airSlate SignNow for filing Nebraska Form 10 state sales and use tax?

airSlate SignNow offers affordable pricing plans that allow businesses to file Nebraska Form 10 state sales and use tax without breaking the bank. The costs depend on the features you choose, but overall, it is a cost-effective solution for electronic signatures and document management.

-

Can I integrate airSlate SignNow with my existing accounting software for filing Nebraska Form 10?

Yes, airSlate SignNow can seamlessly integrate with various accounting software systems, making it easy to file Nebraska Form 10 state sales and use tax. This integration streamlines your workflow by allowing you to pull and populate forms directly from your accounting data.

-

What features of airSlate SignNow assist with filing Nebraska Form 10 state sales and use tax?

airSlate SignNow provides features such as electronic signatures, template creation, and secure cloud storage that facilitate filing Nebraska Form 10 state sales and use tax. These tools simplify the process, saving you time while ensuring your forms are signed and submitted correctly.

-

Is airSlate SignNow compliant with state regulations for filing Nebraska Form 10?

Yes, airSlate SignNow complies with state regulations, including those governing the filing of Nebraska Form 10 state sales and use tax. By using our platform, you can ensure that your documents meet all legal requirements, providing you with peace of mind.

-

What are the benefits of using airSlate SignNow for filing state taxes like Nebraska Form 10?

Using airSlate SignNow for filing Nebraska Form 10 state sales and use tax offers signNow benefits, including faster processing times and reduced paper usage. The digital platform enhances efficiency and allows businesses to manage their tax documentation with ease.

-

Can I track the status of my Nebraska Form 10 after filing with airSlate SignNow?

Absolutely! One of the great features of airSlate SignNow is the ability to track the status of your filed documents, including Nebraska Form 10 state sales and use tax. You'll receive notifications and can view the status online, ensuring you stay informed about your submission.

Get more for Form 10 'Nebraska And Local Sales And Use Tax Return

- Excavation contractor package west virginia form

- Renovation contractor package west virginia form

- Concrete mason contractor package west virginia form

- Demolition contractor package west virginia form

- Security contractor package west virginia form

- Insulation contractor package west virginia form

- Paving contractor package west virginia form

- Site work contractor package west virginia form

Find out other Form 10 'Nebraska And Local Sales And Use Tax Return

- Electronic signature North Carolina Banking Claim Secure

- Electronic signature North Carolina Banking Separation Agreement Online

- How Can I Electronic signature Iowa Car Dealer Promissory Note Template

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Myself

- Electronic signature Iowa Car Dealer Limited Power Of Attorney Fast

- How Do I Electronic signature Iowa Car Dealer Limited Power Of Attorney

- Electronic signature Kentucky Car Dealer LLC Operating Agreement Safe

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple