Nebraska Forms Nebraska Department of RevenueNebraska Form 13 Nebraska Resale or Exempt Sale Certificate for SaNebraska Form 13 2022

Understanding the Nebraska Sales Tax Form 10

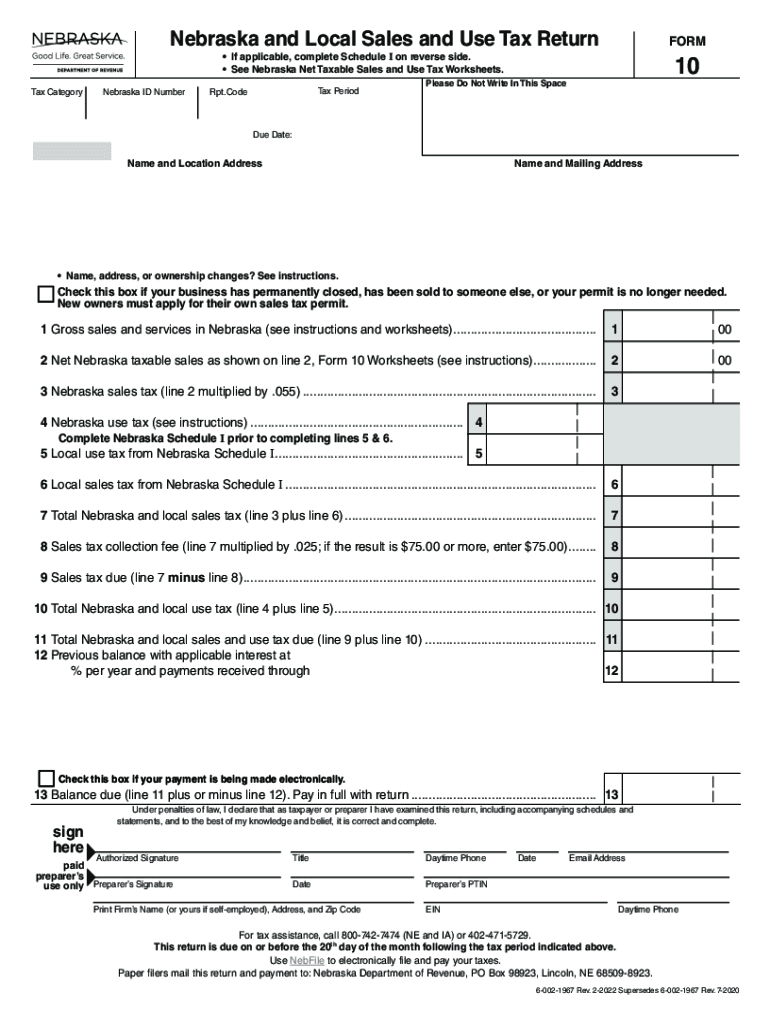

The Nebraska sales tax form 10 is an essential document for businesses operating in Nebraska, allowing them to report and remit sales tax collected from customers. This form is specifically designed for vendors who make taxable sales in the state. It is crucial for compliance with state tax regulations and ensures that businesses fulfill their tax obligations accurately and on time.

Steps to Complete the Nebraska Sales Tax Form 10

Filling out the Nebraska sales tax form 10 involves several key steps:

- Gather necessary information, including your business name, address, and sales tax identification number.

- Calculate the total sales made during the reporting period, including both taxable and exempt sales.

- Determine the amount of sales tax collected from customers based on the applicable tax rate.

- Complete the form by entering the required information accurately, ensuring all calculations are correct.

- Review the form for any errors before submission.

Filing Deadlines for the Nebraska Sales Tax Form 10

It is important to be aware of the filing deadlines for the Nebraska sales tax form 10 to avoid penalties. Generally, the form must be submitted on a monthly, quarterly, or annual basis, depending on your business's sales volume. Ensure that you check the specific due dates for each reporting period to remain compliant with state tax laws.

Legal Use of the Nebraska Sales Tax Form 10

The Nebraska sales tax form 10 serves as a legal document for reporting sales tax. When completed correctly, it provides a record of sales tax collected and demonstrates compliance with Nebraska tax regulations. This form can be used as evidence in case of audits or disputes with the Nebraska Department of Revenue.

Form Submission Methods for the Nebraska Sales Tax Form 10

The Nebraska sales tax form 10 can be submitted through various methods, ensuring convenience for businesses:

- Online submission through the Nebraska Department of Revenue's website.

- Mailing a printed copy of the completed form to the appropriate tax office.

- In-person delivery to a local tax office for immediate processing.

Penalties for Non-Compliance with the Nebraska Sales Tax Form 10

Failure to file the Nebraska sales tax form 10 on time or inaccuracies in reporting can lead to penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is essential for businesses to adhere to filing requirements and ensure accurate reporting to avoid these consequences.

Quick guide on how to complete nebraska forms nebraska department of revenuenebraska form 13 nebraska resale or exempt sale certificate for sanebraska form 13

Effortlessly prepare Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13 on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources you require to create, modify, and electronically sign your documents efficiently and without delays. Manage Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13 on any platform with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The simplest way to modify and electronically sign Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13 with ease

- Locate Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13 and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then select the Done button to preserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misfiled documents, cumbersome form navigation, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Modify and electronically sign Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13 while ensuring clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nebraska forms nebraska department of revenuenebraska form 13 nebraska resale or exempt sale certificate for sanebraska form 13

Create this form in 5 minutes!

People also ask

-

What is the Nebraska sales tax form 10?

The Nebraska sales tax form 10 is the official document used for reporting and remitting sales and use tax in Nebraska. This form is essential for businesses operating in the state to ensure compliance with state tax regulations.

-

How can airSlate SignNow help me with the Nebraska sales tax form 10?

airSlate SignNow provides an easy-to-use platform to generate, fill out, and eSign the Nebraska sales tax form 10. By utilizing our services, you can streamline your tax documentation processes and ensure timely submissions.

-

Is there a cost associated with using airSlate SignNow for the Nebraska sales tax form 10?

Yes, airSlate SignNow offers various pricing plans that include features for managing the Nebraska sales tax form 10. However, our plans are designed to be cost-effective, ensuring that businesses get great value for their investment in document management.

-

What features does airSlate SignNow offer for the Nebraska sales tax form 10?

With airSlate SignNow, you can easily create, fill out, and eSign the Nebraska sales tax form 10. Our platform also allows for document tracking, template management, and integration with other tools to enhance your workflow.

-

Can I integrate airSlate SignNow with other accounting software for the Nebraska sales tax form 10?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easy to manage your Nebraska sales tax form 10 alongside your other financial documents. This integration helps streamline your processes and improves accuracy.

-

What are the benefits of using airSlate SignNow for my Nebraska sales tax form 10?

Using airSlate SignNow for the Nebraska sales tax form 10 offers several benefits, including increased efficiency, reduced paper use, and enhanced compliance. Our platform helps you quickly eSign and share documents, keeping your workflow moving smoothly.

-

Is it possible to access the Nebraska sales tax form 10 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to handle the Nebraska sales tax form 10 anytime and anywhere. This flexibility ensures that you can manage your tax documentation on-the-go.

Get more for Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13

- Quitclaim deed from corporation to llc north carolina form

- Quitclaim deed from corporation to corporation north carolina form

- Nc warranty form

- Quitclaim deed from corporation to two individuals north carolina form

- General warranty deed nc form

- Nc warranty general form

- General warranty deed from husband and wife to a trust north carolina form

- General warranty deed nc 497316801 form

Find out other Nebraska Forms Nebraska Department Of RevenueNebraska Form 13 Nebraska Resale Or Exempt Sale Certificate For SaNebraska Form 13

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free