Public Offering Frequently Asked Questions FAQFINRA Org Form

What is the Public Offering Frequently Asked Questions FAQFINRA org

The Public Offering Frequently Asked Questions FAQFINRA org form serves as a crucial resource for individuals and businesses navigating the complexities of public offerings. This form provides essential information regarding the requirements, processes, and regulations surrounding public offerings in the United States. It aims to clarify common inquiries, ensuring that users understand their rights, obligations, and the steps needed to comply with relevant laws.

How to use the Public Offering Frequently Asked Questions FAQFINRA org

Using the Public Offering Frequently Asked Questions FAQFINRA org form involves several straightforward steps. First, users should familiarize themselves with the questions and answers provided in the document. This will help identify specific areas of interest or concern. Next, users can fill out any required sections, ensuring that all information is accurate and complete. Finally, the completed form can be submitted as instructed, either electronically or through traditional mail, depending on the guidelines provided.

Steps to complete the Public Offering Frequently Asked Questions FAQFINRA org

Completing the Public Offering Frequently Asked Questions FAQFINRA org form requires careful attention to detail. Here are the steps to follow:

- Review the form thoroughly to understand the questions and required information.

- Gather any necessary documents or information needed to answer the questions accurately.

- Fill out the form in a clear and legible manner, ensuring all sections are completed.

- Double-check for accuracy and completeness before submission.

- Submit the form according to the specified instructions, whether online, by mail, or in person.

Legal use of the Public Offering Frequently Asked Questions FAQFINRA org

The legal use of the Public Offering Frequently Asked Questions FAQFINRA org form is essential for ensuring compliance with federal and state regulations governing public offerings. This form helps users understand their legal obligations and provides guidance on how to meet them. It is important to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal repercussions. Consulting with a legal professional may be advisable for complex situations.

Key elements of the Public Offering Frequently Asked Questions FAQFINRA org

The key elements of the Public Offering Frequently Asked Questions FAQFINRA org form include:

- Definitions of terms related to public offerings.

- Guidelines on eligibility and requirements for participation.

- Information on the filing process and deadlines.

- Details regarding compliance with regulatory bodies.

- Resources for further assistance and clarification.

Examples of using the Public Offering Frequently Asked Questions FAQFINRA org

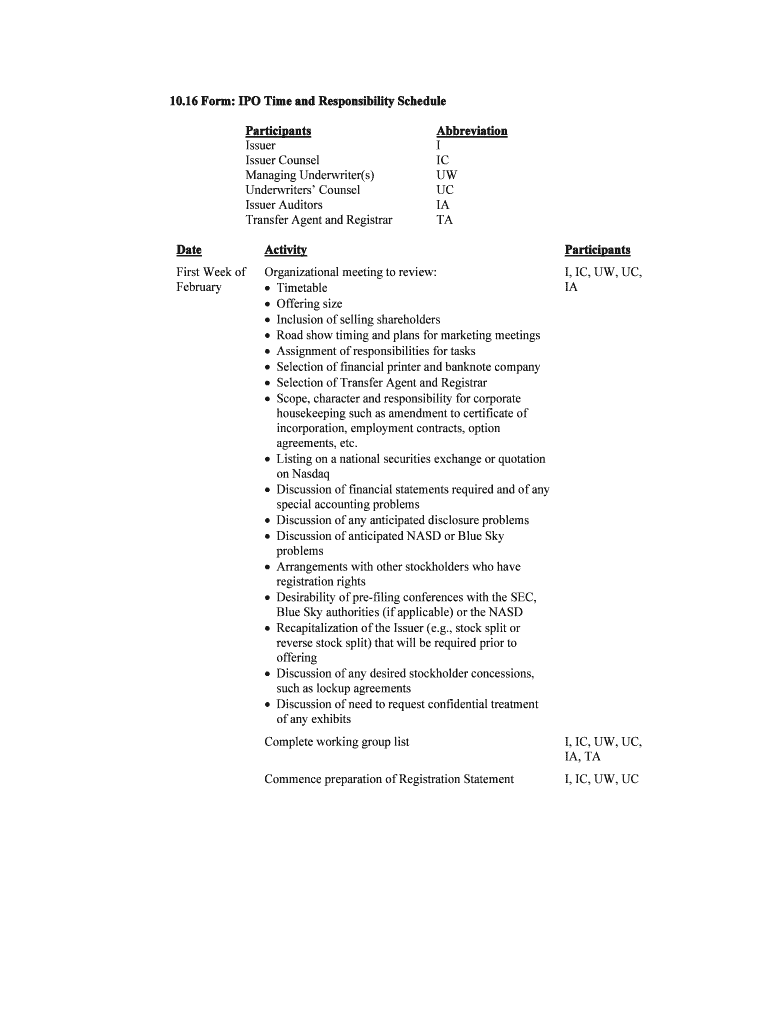

Examples of using the Public Offering Frequently Asked Questions FAQFINRA org form can help illustrate its practical applications. For instance, a startup preparing for an initial public offering (IPO) may refer to this form to understand the necessary disclosures and compliance requirements. Similarly, an investor seeking to participate in a public offering can use the form to clarify eligibility criteria and the process for submitting their interest. These examples highlight the form's utility in real-world scenarios.

Quick guide on how to complete public offering frequently asked questions faqfinraorg

Effortlessly Prepare Public Offering Frequently Asked Questions FAQFINRA org on Any Device

Managing documents online has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Public Offering Frequently Asked Questions FAQFINRA org on any device with the airSlate SignNow Android or iOS applications and simplify any document-based process today.

Easy Steps to Modify and Electronically Sign Public Offering Frequently Asked Questions FAQFINRA org

- Obtain Public Offering Frequently Asked Questions FAQFINRA org and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form – via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs with just a few clicks from any device. Modify and electronically sign Public Offering Frequently Asked Questions FAQFINRA org and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Public Offering Frequently Asked Questions FAQFINRA org?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and sign documents seamlessly. It addresses many queries typically found in the Public Offering Frequently Asked Questions FAQFINRA org by providing essential features for managing document workflows.

-

How can airSlate SignNow help with compliance in public offerings?

Using airSlate SignNow ensures compliance with legal and regulatory requirements, common concerns highlighted in the Public Offering Frequently Asked Questions FAQFINRA org. Our tools help maintain the integrity and security of signed documents, which is critical during public offering processes.

-

What pricing options are available for airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to fit different business needs, making it accessible whether you’re a small company or a large enterprise. For detailed pricing information, consult the Public Offering Frequently Asked Questions FAQFINRA org as it outlines our competitive pricing models.

-

Does airSlate SignNow integrate with other business applications?

Yes, airSlate SignNow seamlessly integrates with various applications such as CRM systems, payment processors, and productivity tools. These integrations address common inquiries found in the Public Offering Frequently Asked Questions FAQFINRA org, making document management more efficient.

-

What benefits does airSlate SignNow provide for businesses?

airSlate SignNow enhances document workflow efficiency, reduces turnaround times, and lowers costs associated with paper-based processes. These advantages resonate with the information often referenced in the Public Offering Frequently Asked Questions FAQFINRA org.

-

Is airSlate SignNow suitable for international businesses?

Absolutely! airSlate SignNow is designed for businesses around the globe, supporting various languages and compliance standards. This feature is crucial, as many queries in the Public Offering Frequently Asked Questions FAQFINRA org pertain to global operations and compliance.

-

What security measures does airSlate SignNow implement?

Security is a priority for airSlate SignNow, featuring advanced encryption and secure storage for all documents. This commitment to security addresses concerns often found in the Public Offering Frequently Asked Questions FAQFINRA org, ensuring your data remains protected.

Get more for Public Offering Frequently Asked Questions FAQFINRA org

- Recreation vehicle service technician ita bc form

- Recreation vehicle service form

- Terminal illness medical service canada forms

- Isp 2502a form

- Pdf fin 900 candidate profile and declaration for governing boards form

- Forms for ahcip and blue crossalbertaca

- Agriculture submission forms province of manitoba

- Oas direct deposit form sc isp 1011

Find out other Public Offering Frequently Asked Questions FAQFINRA org

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document