Affidavit of Payment Prior to Sale or RefinanceIndividual Form

What is the affidavit for payment?

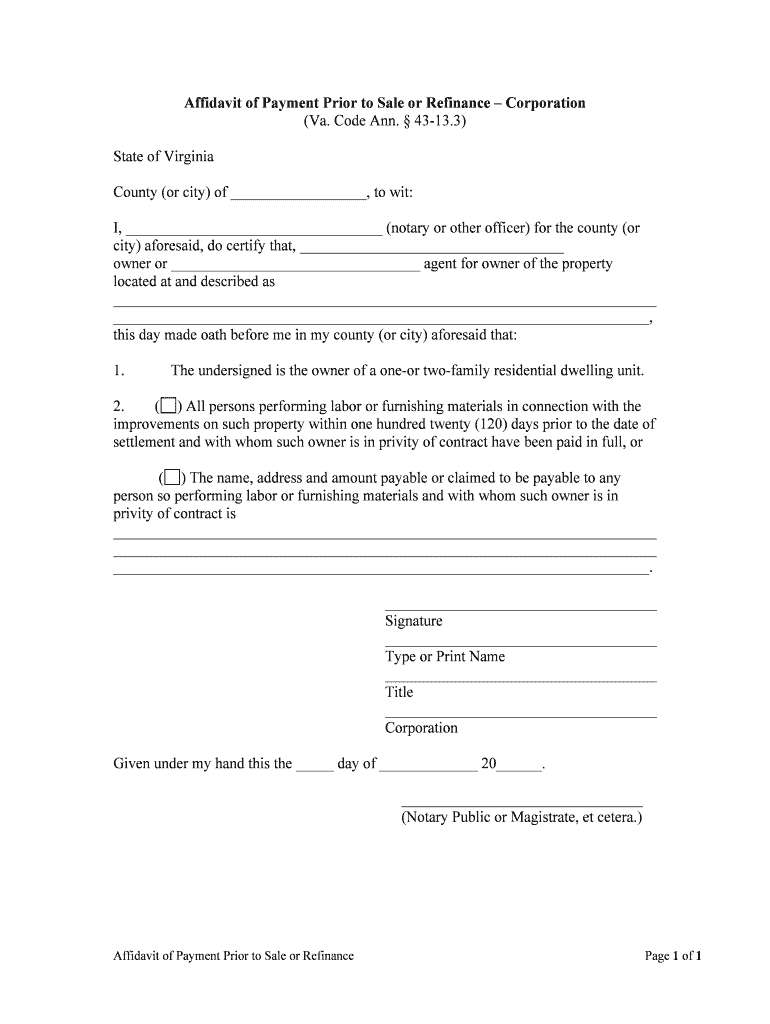

The affidavit for payment is a legal document used to confirm that a payment has been made or will be made regarding a specific transaction. This form is often utilized in real estate transactions, particularly before the sale or refinance of a property. It serves as a declaration by the affiant, typically the seller or borrower, affirming that all financial obligations related to the property have been settled. This affidavit is crucial for protecting the interests of all parties involved by ensuring that no outstanding debts or liens exist that could affect the transaction.

How to use the affidavit for payment

Using the affidavit for payment involves several key steps. First, the individual responsible for the payment must accurately fill out the form, providing necessary details such as the names of the parties involved, the amount paid, and any relevant transaction dates. Once completed, the document must be signed in the presence of a notary public to ensure its legal validity. After notarization, the affidavit can be submitted to the appropriate parties, such as lenders or title companies, as part of the closing process for a sale or refinance.

Key elements of the affidavit for payment

Several key elements must be included in the affidavit for payment to ensure its effectiveness and legal standing. These elements typically include:

- Affiant Information: The full name and address of the person making the affidavit.

- Recipient Information: The name and address of the individual or entity receiving the payment.

- Payment Details: A clear description of the payment made, including the amount and purpose.

- Transaction Date: The date on which the payment was made or is scheduled to be made.

- Notarization: A section for the notary public to sign and seal, confirming the identity of the affiant.

Steps to complete the affidavit for payment

Completing the affidavit for payment involves a systematic approach to ensure accuracy and compliance. The following steps should be followed:

- Gather necessary information, including payment details and party names.

- Obtain the affidavit form, which can often be found online or through legal resources.

- Fill out the form carefully, ensuring all information is accurate and complete.

- Sign the affidavit in the presence of a notary public to validate the document.

- Distribute copies of the signed affidavit to all relevant parties involved in the transaction.

Legal use of the affidavit for payment

The affidavit for payment is legally binding when executed properly. It is important to adhere to state-specific laws and regulations regarding notarization and submission. This document can be used in various legal contexts, such as real estate transactions, loan agreements, or any situation where proof of payment is required. By providing a formal declaration, the affidavit helps to mitigate disputes and clarifies the financial responsibilities of the parties involved.

State-specific rules for the affidavit for payment

Each state in the U.S. may have different rules governing the use and requirements of the affidavit for payment. It is essential to consult local laws to ensure compliance. Some states may require additional documentation or specific wording in the affidavit. Understanding these nuances can help prevent legal issues and ensure that the affidavit is accepted by all parties involved in the transaction.

Quick guide on how to complete affidavit of payment prior to sale or refinanceindividual

Prepare Affidavit Of Payment Prior To Sale Or RefinanceIndividual effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents quickly and without delays. Manage Affidavit Of Payment Prior To Sale Or RefinanceIndividual on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and electronically sign Affidavit Of Payment Prior To Sale Or RefinanceIndividual without hassle

- Find Affidavit Of Payment Prior To Sale Or RefinanceIndividual and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and then click the Done button to preserve your updates.

- Select your preferred method of sending your form, whether by email, text (SMS), invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Affidavit Of Payment Prior To Sale Or RefinanceIndividual and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an affidavit for payment?

An affidavit for payment is a legal document that serves as a sworn statement affirming that a payment has been made. It is often used in financial transactions to provide proof that funds have been transferred. airSlate SignNow allows you to create, sign, and manage affidavits for payment quickly and efficiently.

-

How does airSlate SignNow support the creation of affidavits for payment?

airSlate SignNow provides an intuitive platform for drafting affidavits for payment with customizable templates. Users can easily fill in the necessary details and utilize eSignature capabilities for faster processing. This streamlines the whole process, ensuring that all parties have an official record of the payment.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans designed to fit different business needs, including options for individual users and teams. Each plan includes features such as the ability to create affidavits for payment. You can visit our pricing page to find detailed information on the most suitable plan for you.

-

Is airSlate SignNow secure for handling legal documents like affidavits for payment?

Yes, airSlate SignNow prioritizes the security of your documents, including affidavits for payment. The platform uses advanced encryption methods and complies with industry standards to protect your sensitive information. This ensures that your documents are safe from unauthorized access.

-

What features does airSlate SignNow offer for managing affidavits for payment?

airSlate SignNow offers features such as customizable templates, bulk sending, and tracking for affidavits for payment. Users can easily edit documents, request signatures, and monitor the status of each affidavit in real-time. This efficiency enhances workflows and reduces the time spent on paperwork.

-

Can I integrate airSlate SignNow with other software for handling affidavits for payment?

Yes, airSlate SignNow offers seamless integrations with various applications, such as CRMs and project management tools. This allows you to incorporate affidavits for payment into your existing workflows easily. By leveraging integrations, you can enhance your overall document management strategy.

-

What are the benefits of using airSlate SignNow for affidavits for payment?

Using airSlate SignNow for affidavits for payment offers multiple benefits, including increased efficiency, reduced turnaround time, and improved accuracy in documentation. The platform also helps minimize errors associated with manual processing and ensures that all signatures are obtained promptly. Overall, it's a cost-effective solution for businesses.

Get more for Affidavit Of Payment Prior To Sale Or RefinanceIndividual

- Disability insurance provisions brochure de 2515 rev 67 12 20 form

- Instructions for completing the quarterly contribution and wage adjustment form de 9adj de 9adj i

- Completed copies of the claim forms may be mailed to the division of workers compensation p

- Driver license or identification card application form

- California 540 2ez forms ampamp instructions 2019 personal income tax booklet california 540 2ezforms ampamp instructions 2019

- 0648 0711 expiration date 04302022 form

- Noaa form 370 fisheries certificate of origin

- Complete forms at homesuperior court of california

Find out other Affidavit Of Payment Prior To Sale Or RefinanceIndividual

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF

- Can I Sign Michigan Banking PDF

- Help Me With Sign Minnesota Banking Word

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation