Colorado Individual Form

What is the Colorado Individual Form

The Colorado Individual Form is a legal document used for various purposes, including tax filings and personal declarations. This form is essential for individuals residing in Colorado to report their income, claim deductions, and ensure compliance with state regulations. It serves as a means for the state to assess individual tax liabilities and maintain accurate records of taxpayers.

How to use the Colorado Individual Form

Using the Colorado Individual Form involves several key steps. First, individuals must gather all necessary financial documents, such as W-2s, 1099s, and any relevant receipts for deductions. Next, the form should be filled out accurately, ensuring that all information corresponds with the supporting documents. Once completed, the form can be submitted electronically or via traditional mail, depending on the individual's preference and state guidelines.

Steps to complete the Colorado Individual Form

Completing the Colorado Individual Form requires attention to detail. Here are the steps to follow:

- Gather all necessary documentation, including income statements and deduction receipts.

- Fill out personal information, such as name, address, and Social Security number.

- Report income accurately, ensuring all sources are included.

- Claim eligible deductions and credits, providing necessary details for each.

- Review the form for accuracy and completeness.

- Submit the form electronically or by mail, following the state’s submission guidelines.

Legal use of the Colorado Individual Form

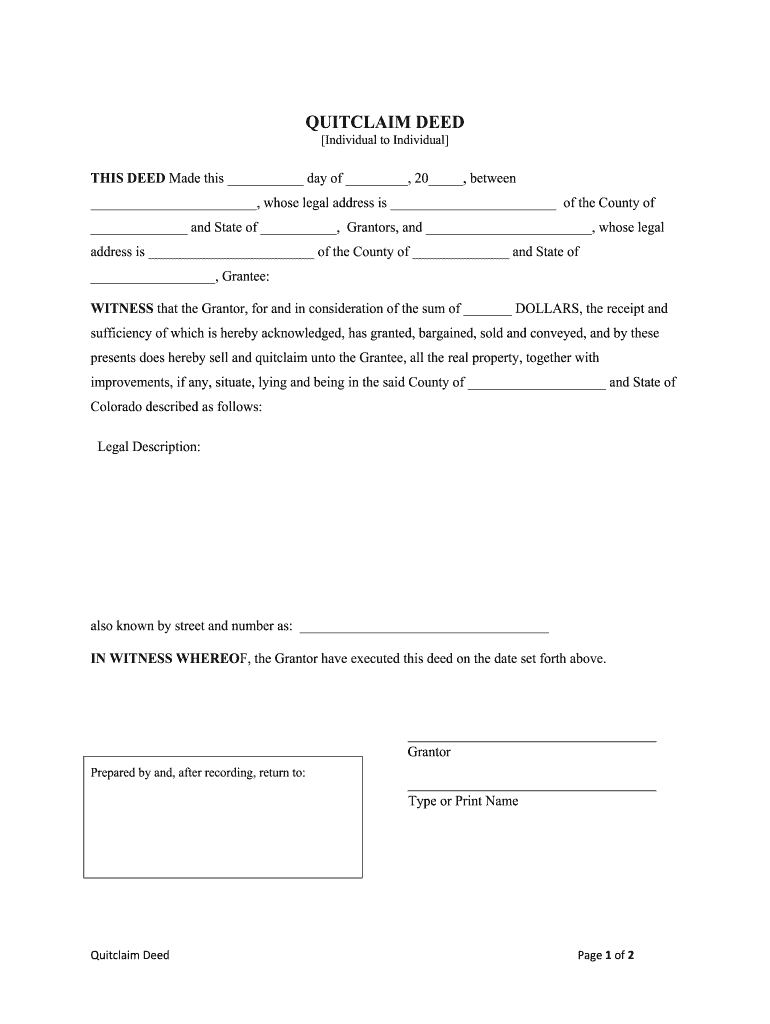

The Colorado Individual Form is legally binding when filled out and submitted according to state laws. It must be signed by the individual to validate the information provided. Compliance with the state's legal requirements ensures that the form is recognized by the Colorado Department of Revenue and can be used for tax assessment and other legal purposes.

Key elements of the Colorado Individual Form

Several key elements must be included in the Colorado Individual Form to ensure its validity:

- Personal Information: Name, address, and Social Security number.

- Income Reporting: Detailed accounts of all income sources.

- Deductions and Credits: Information on any deductions or credits claimed.

- Signature: A signature is required to confirm the accuracy of the information.

State-specific rules for the Colorado Individual Form

Colorado has specific rules governing the use of the Individual Form. These include deadlines for submission, eligibility criteria for various deductions, and compliance with state tax laws. It is essential for individuals to stay informed about any changes to these rules to ensure proper filing and avoid penalties.

Quick guide on how to complete colorado individual form

Accomplish Colorado Individual Form smoothly on any gadget

Web-based document management has become increasingly favored among companies and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as it allows you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents quickly without interruptions. Manage Colorado Individual Form on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The easiest method to modify and eSign Colorado Individual Form effortlessly

- Acquire Colorado Individual Form and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize essential parts of the documents or obscure sensitive information with tools offered by airSlate SignNow specifically for that function.

- Generate your eSignature with the Sign tool, which takes mere moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or errors that necessitate printing additional copies. airSlate SignNow manages all your document management needs in just a few clicks from any device you prefer. Modify and eSign Colorado Individual Form and guarantee effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the colorado individual form used for?

The colorado individual form is designed to facilitate the signing and management of important documents for individuals in Colorado. This form streamlines the process of obtaining signatures legally and securely, ensuring all parties can execute documents without hassle.

-

How much does it cost to use the colorado individual form on airSlate SignNow?

Using the colorado individual form on airSlate SignNow is part of our subscription plans, which offer competitive pricing based on your business needs. We provide various packages to accommodate individuals and businesses, ensuring you find a cost-effective solution for your document signing requirements.

-

What features does the colorado individual form offer?

The colorado individual form includes features such as customizable templates, audit trails, and secure cloud storage. With these features, users can easily manage their documents, track changes, and ensure compliance with Colorado state regulations effectively.

-

Can I integrate the colorado individual form with other tools?

Yes, the colorado individual form can be integrated with various popular applications, including CRM systems and cloud storage services. These integrations enhance workflow efficiency and allow you to manage your documents seamlessly across platforms.

-

What are the benefits of using the colorado individual form on airSlate SignNow?

The colorado individual form provides several benefits, including enhanced security, reduced paperwork, and faster turnaround times for document signing. This not only simplifies the signing process but also improves productivity for individuals and businesses alike.

-

Is the colorado individual form legally binding?

Absolutely! The colorado individual form meets all legal standards for electronic signatures in Colorado, ensuring that your signed documents are legally binding and enforceable. This gives users peace of mind when conducting business or personal transactions.

-

How can I get started with the colorado individual form?

Getting started with the colorado individual form is easy! Simply sign up for an account on airSlate SignNow, choose the appropriate subscription plan, and start creating and sending your forms. Our intuitive interface makes the process quick and straightforward.

Get more for Colorado Individual Form

- Possession with intent to manufacture form

- 9a114 113 form

- Criminal casesnorth carolina judicial branch form

- Fillable online duke barrington apartments fax email print form

- North carolina in the general court of justice county form

- Additional accommodation bondsman form

- State of north carolina gregory m byrd attorney at law form

- Amprxqw form

Find out other Colorado Individual Form

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast