Nys Ct 3 Fillable Form 2023

What is the NYS CT-3 Fillable Form

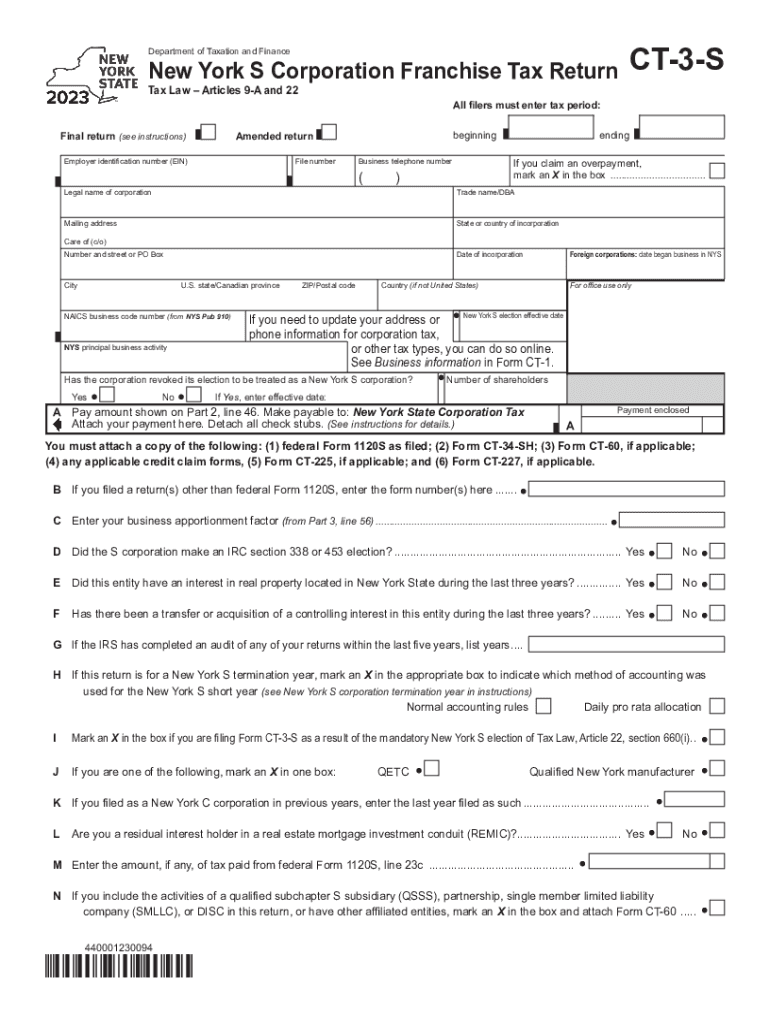

The NYS CT-3 Fillable Form, also known as the CT-3 S 2020, is a tax form used by corporations in New York State to report their income, deductions, and tax liability. This form is specifically designed for S corporations, allowing them to file their taxes in a streamlined manner. The CT-3 form is essential for ensuring compliance with state tax regulations and is a critical component of the tax filing process for eligible businesses.

How to Use the NYS CT-3 Fillable Form

Using the NYS CT-3 Fillable Form involves several steps to ensure accurate completion. First, businesses should download the form from a reliable source or access it through tax software that supports New York State tax forms. Once obtained, the form can be filled out digitally, allowing for easy corrections and edits. It is important to gather all necessary financial documents, such as income statements and expense records, to accurately complete the form. After filling it out, review the information for accuracy before submission.

Steps to Complete the NYS CT-3 Fillable Form

Completing the NYS CT-3 Fillable Form involves a series of methodical steps:

- Begin by entering basic information about the corporation, including its name, address, and federal employer identification number (EIN).

- Report total income and any applicable deductions in the designated sections of the form.

- Calculate the tax owed based on the income reported, following the instructions provided with the form.

- Ensure all calculations are accurate and that all necessary schedules and attachments are included.

- Sign and date the form, certifying that the information provided is true and complete.

Filing Deadlines / Important Dates

It is crucial for businesses to be aware of the filing deadlines associated with the NYS CT-3 Fillable Form. Generally, the form is due on the fifteenth day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this typically means a due date of March 15. Missing this deadline can result in penalties and interest on unpaid taxes.

Required Documents

To successfully complete the NYS CT-3 Fillable Form, businesses need to gather several key documents:

- Income statements detailing all sources of revenue.

- Expense reports that outline deductible business expenses.

- Previous year’s tax returns, if applicable, to provide context for current filings.

- Any additional schedules or forms that pertain to specific deductions or credits being claimed.

Form Submission Methods

The NYS CT-3 Fillable Form can be submitted through various methods, providing flexibility for businesses. Options include:

- Online submission through the New York State Department of Taxation and Finance website.

- Mailing a printed copy of the completed form to the appropriate tax office address.

- In-person delivery at designated tax offices, if preferred.

Quick guide on how to complete nys ct 3 fillable form

Effortlessly Prepare Nys Ct 3 Fillable Form on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Nys Ct 3 Fillable Form on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related tasks today.

How to Modify and Electronically Sign Nys Ct 3 Fillable Form with Ease

- Obtain Nys Ct 3 Fillable Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize essential sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Select how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs with just a few clicks from any device of your choosing. Modify and electronically sign Nys Ct 3 Fillable Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nys ct 3 fillable form

Create this form in 5 minutes!

How to create an eSignature for the nys ct 3 fillable form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form ct3 new?

Form ct3 new is a specific form required for businesses to report their income and calculate taxes. Using airSlate SignNow can streamline the process of filling out and signing form ct3 new, ensuring accuracy and compliance. Our platform simplifies document management so you can focus on growing your business.

-

How does airSlate SignNow help with form ct3 new submissions?

AirSlate SignNow allows you to easily create, edit, and eSign your form ct3 new documents. With our intuitive interface, you can ensure that your submissions are timely and accurate. Plus, the electronic signature feature eliminates the need for printing and scanning.

-

What are the pricing options for airSlate SignNow when using form ct3 new?

AirSlate SignNow offers flexible pricing plans that cater to various business needs when managing documents like form ct3 new. We provide a cost-effective solution that can scale with your operations. Visit our pricing page to explore options that best fit your requirements.

-

Can I integrate airSlate SignNow with other tools while working on form ct3 new?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your ability to manage form ct3 new. Integrations with tools like Google Drive, Dropbox, and CRM systems help centralize your document workflows. This boosts overall efficiency in your operations.

-

What are the benefits of using airSlate SignNow for form ct3 new?

Using airSlate SignNow for your form ct3 new provides numerous benefits, including enhanced security, faster processing times, and an intuitive user experience. It ensures that all signatures are legally binding and stored securely. Our platform also helps reduce paper usage, aligning with eco-friendly practices.

-

Is it easy to track the status of my form ct3 new with airSlate SignNow?

Absolutely! AirSlate SignNow features real-time tracking for your form ct3 new documents, allowing you to see who has signed and any pending actions. This transparency ensures you stay informed about your document's status and can follow up as needed.

-

What support does airSlate SignNow offer for form ct3 new users?

AirSlate SignNow provides comprehensive support for users handling form ct3 new. Our help center offers tutorials, FAQs, and customer service assistance. Whether you're a new user or need specific guidance, our team is here to help you navigate any challenges.

Get more for Nys Ct 3 Fillable Form

- Quitclaim deed from individual to two individuals in joint tenancy utah form

- Ut lien form

- Quitclaim deed by two individuals to husband and wife utah form

- Warranty deed from two individuals to husband and wife utah form

- Ut llc company 497427395 form

- Utah disclaimer 497427396 form

- Cancellation of lien by individual utah form

- Quitclaim deed by two individuals to llc utah form

Find out other Nys Ct 3 Fillable Form

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure

- eSignature California Banking Warranty Deed Later

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy