Form it 209 Claim for Noncustodial Parent New York State Earned Income Credit Tax Year 2023

What is the Form IT 209?

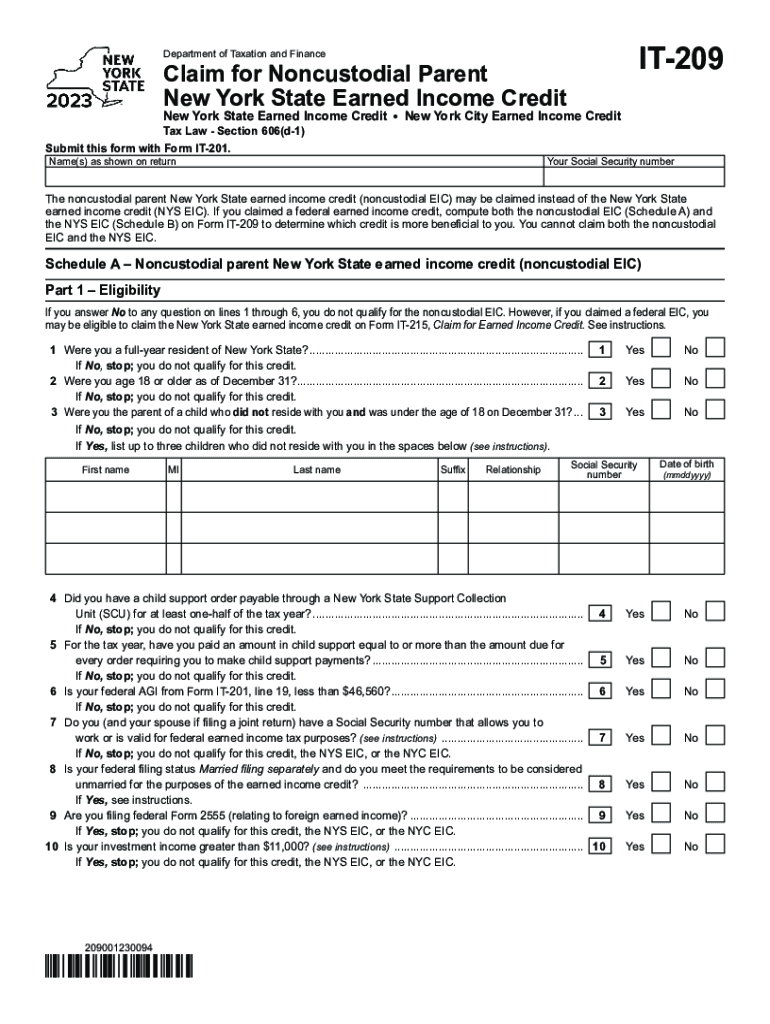

The Form IT 209 is a tax document used by noncustodial parents in New York State to claim the Earned Income Credit (EIC) for the tax year. This form allows eligible individuals to receive a credit that can reduce their tax liability. The EIC is designed to assist low to moderate-income workers, providing financial relief and encouraging employment. Noncustodial parents must meet specific criteria to qualify for this credit, which can significantly impact their overall tax return.

Eligibility Criteria for Form IT 209

To qualify for the Form IT 209, noncustodial parents must meet several requirements. These include:

- Having a qualifying child who resides with the custodial parent.

- Meeting income thresholds set by New York State for the tax year.

- Filing a New York State tax return.

- Not being claimed as a dependent by another taxpayer.

Understanding these criteria is essential for ensuring that the claim is valid and that the applicant receives the appropriate credit.

Steps to Complete the Form IT 209

Completing the Form IT 209 involves several steps to ensure accuracy and compliance. Here’s a simplified process:

- Gather necessary documents, including your tax return and information about your qualifying child.

- Fill out the personal information section of the form, including your name, address, and Social Security number.

- Provide information about your qualifying child, including their name and Social Security number.

- Calculate your earned income and determine your eligibility for the credit using the provided tables.

- Review the completed form for accuracy before submission.

Following these steps can help ensure that the application is processed smoothly.

How to Obtain the Form IT 209

The Form IT 209 can be obtained through various means. It is available for download from the New York State Department of Taxation and Finance website. Additionally, physical copies can be requested from local tax offices or obtained at select libraries and community centers. Ensuring you have the correct and most recent version of the form is crucial for accurate filing.

Form Submission Methods

Once the Form IT 209 is completed, it can be submitted in several ways:

- Online through the New York State Department of Taxation and Finance e-filing system.

- By mail, sending the completed form to the appropriate address listed on the form.

- In-person at designated tax offices, which may offer assistance and guidance.

Choosing the right submission method can facilitate a quicker processing time for your claim.

Key Elements of the Form IT 209

The Form IT 209 includes several key elements that applicants must be aware of:

- Personal identification information.

- Details about the qualifying child.

- Income calculations and eligibility criteria.

- Signature and date fields to certify the accuracy of the information provided.

Being familiar with these elements can help streamline the completion process and minimize errors.

Quick guide on how to complete form it 209 claim for noncustodial parent new york state earned income credit tax year

Effortlessly Prepare Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year on Any Device

Managing documents online has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the right form and securely save it online. airSlate SignNow provides all the tools you need to create, edit, and eSign your documents quickly and efficiently. Handle Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year with Ease

- Locate Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year and select Get Form to start.

- Utilize the tools we offer to fill out your document.

- Emphasize signNow sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your alterations.

- Choose how you would like to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year and ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 209 claim for noncustodial parent new york state earned income credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 209 claim for noncustodial parent new york state earned income credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to it 209?

airSlate SignNow is a powerful e-signature solution that simplifies document management for businesses. With features that align with it 209 compliance, SignNow ensures secure and legally binding signatures, making it ideal for industries requiring adherence to regulatory standards.

-

How much does airSlate SignNow cost for businesses seeking to meet it 209 requirements?

The pricing of airSlate SignNow is competitive and offers flexible plans that cater to various business sizes. By choosing SignNow, companies can ensure that they not only adhere to it 209 but also gain a cost-effective solution for their document signing needs.

-

What features of airSlate SignNow support it 209 compliance?

SignNow offers features such as audit trails, secure storage, and customizable workflows that help ensure compliance with it 209 standards. These features provide businesses with the confidence that their document processes meet necessary regulations.

-

Can airSlate SignNow integrate with other tools while addressing it 209?

Yes, airSlate SignNow can seamlessly integrate with various third-party applications like Salesforce and Google Workspace, enhancing workflow efficiency. These integrations ensure that businesses can manage their documents in line with it 209 requirements without disruption.

-

What benefits does airSlate SignNow provide for businesses in relation to it 209?

By utilizing airSlate SignNow, businesses can streamline their document signing processes, signNowly reduce turnaround times, and enhance security—all crucial for it 209 compliance. Additionally, the user-friendly interface help teams adopt the tool quickly and efficiently.

-

Is airSlate SignNow easy to use for new users looking for it 209 solutions?

Absolutely! airSlate SignNow provides an intuitive platform designed for users of all skill levels. This ease of use is particularly beneficial for companies trying to implement it 209, as it ensures quick adoption without the need for extensive training.

-

What are the security measures in place for it 209 compliance with airSlate SignNow?

airSlate SignNow employs state-of-the-art security measures, including data encryption and two-factor authentication, to protect sensitive information. These security features ensure that businesses can remain compliant with it 209 while maintaining client confidentiality.

Get more for Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

- Certificate form

- Chc checklist form

- Weekly cash flow projection form

- Incident report for johnshopkins form

- Self request for records employment security home esd wa form

- Church souvenir booklet ad samples 78773361 form

- Annual commercial accountability registration form

- Confirmation worship notes worship at church date todays scripture readings was fpcallentown form

Find out other Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document