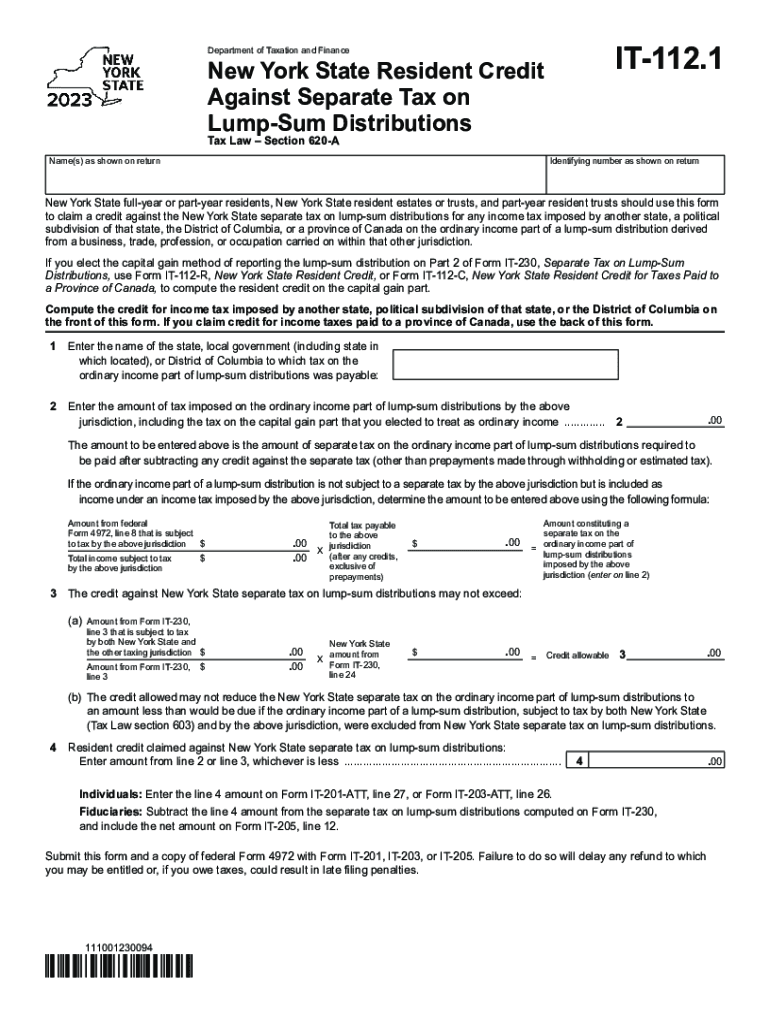

Form it 112 1 New York State Resident Credit Against 2023

Understanding Form IT-230

Form IT-230 is a New York State tax form used to claim a credit against personal income tax for residents. This form is specifically designed for individuals who qualify for the New York State Resident Credit, which helps alleviate the tax burden for eligible taxpayers. The credit is aimed at residents who have paid taxes to other jurisdictions, ensuring that they are not taxed twice on the same income.

How to Complete Form IT-230

Filling out Form IT-230 requires careful attention to detail. Taxpayers need to provide personal information, including their name, address, and Social Security number. Additionally, it is essential to report income accurately and detail any taxes paid to other jurisdictions. The form includes specific sections where taxpayers must indicate the amount of credit being claimed, which should correspond to the taxes paid to other states or localities.

Eligibility Criteria for Form IT-230

To qualify for the New York State Resident Credit using Form IT-230, taxpayers must meet certain criteria. Primarily, applicants must be full-time residents of New York State and have paid income taxes to another state or locality during the tax year. It is crucial to ensure that the income for which the credit is being claimed is not also subject to New York State tax. Taxpayers should review their tax situation carefully to confirm eligibility before submitting the form.

Required Documentation for Form IT-230

When submitting Form IT-230, taxpayers must include supporting documentation to validate their claim. This typically includes copies of tax returns filed with other states or localities, along with proof of payment for the taxes claimed. Additional documents may be required depending on individual circumstances, so it is advisable to consult the instructions provided with the form for a complete list of necessary documentation.

Filing Methods for Form IT-230

Form IT-230 can be submitted through various methods, providing flexibility for taxpayers. Individuals can file the form electronically using approved tax software or through the New York State Department of Taxation and Finance website. Alternatively, taxpayers may choose to print the completed form and mail it to the appropriate address designated for tax submissions. In-person submissions may also be available at local tax offices.

Common Mistakes to Avoid with Form IT-230

When completing Form IT-230, it is vital to avoid common pitfalls that could delay processing or result in a denied claim. Some frequent mistakes include inaccurate reporting of income, failing to include all required documentation, and not signing the form before submission. Taxpayers should double-check their entries and ensure all information is complete and accurate to facilitate a smooth filing process.

Quick guide on how to complete form it 112 1 new york state resident credit against

Complete Form IT 112 1 New York State Resident Credit Against seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form IT 112 1 New York State Resident Credit Against on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form IT 112 1 New York State Resident Credit Against effortlessly

- Find Form IT 112 1 New York State Resident Credit Against and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and then click on the Done button to save your changes.

- Select your preferred method to share your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Form IT 112 1 New York State Resident Credit Against and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form it 112 1 new york state resident credit against

Create this form in 5 minutes!

How to create an eSignature for the form it 112 1 new york state resident credit against

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is it 230, and how does it work with airSlate SignNow?

It 230 is a powerful feature within airSlate SignNow that allows users to automate document workflows efficiently. With it 230, you can set up templates and streamline the eSignature process, ensuring all necessary signatures are captured seamlessly.

-

What are the pricing options for airSlate SignNow with it 230?

AirSlate SignNow offers several pricing tiers, which include access to the it 230 feature. Each plan provides various levels of functionality, ensuring you find the right fit for your business needs, whether you're a small startup or a large corporation.

-

How can I benefit from using it 230 in my business?

Utilizing it 230 within airSlate SignNow enhances your document management by reducing turnaround time for signatures. This feature not only saves time but also increases productivity by allowing your team to focus on core tasks while automating repetitive processes.

-

What features does it 230 include?

The it 230 feature encompasses several functionalities such as document templates, real-time tracking, and security options. These robust features ensure that users can manage their documents efficiently while keeping sensitive information protected.

-

Can I integrate it 230 with other applications?

Yes, it 230 can be integrated with various third-party applications to enhance your workflow. AirSlate SignNow supports numerous integrations, allowing you to sync data and processes across platforms, making it a versatile choice for businesses.

-

Is it 230 suitable for small businesses?

Absolutely! It 230 is designed to cater to businesses of all sizes, including small enterprises. The easy-to-use interface and cost-effective pricing make it an excellent choice for small businesses looking to streamline their document signing processes.

-

How secure is the it 230 feature within airSlate SignNow?

Security is a top priority for airSlate SignNow, and the it 230 feature conforms to industry standards. With encryption and compliance measures in place, you can trust that your documents and data are safeguarded throughout the signing process.

Get more for Form IT 112 1 New York State Resident Credit Against

- Minor work permit ca7 16 amp 17 year olds form

- Office discipline referral minor form

- Hdfc lifeamp39s the little book of legacy gettingyourich form

- Uss constitution lottery form

- Reiki infinite healer level 1 form

- Speaking card 10 fashion and clothing form

- A pain process for writing your about page form

- Revenue alabama govwp contentuploadstemporary tag application form

Find out other Form IT 112 1 New York State Resident Credit Against

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template