Revocable Trust Form

What is a revocable trust?

A revocable trust, often referred to as a living trust, is a legal arrangement that allows an individual, known as the grantor, to retain control over their assets during their lifetime. The grantor can modify or revoke the trust at any time, making it a flexible estate planning tool. Upon the grantor's death, the assets held in the trust are distributed to the beneficiaries without going through probate, which can save time and reduce legal costs. This type of trust is particularly useful for individuals looking to manage their estate efficiently while maintaining the ability to change their plans as needed.

Steps to complete a revocation trust

Completing a revocation trust involves several key steps to ensure it is legally binding and effective. First, the grantor must clearly identify the assets they wish to place in the trust. Next, they should draft the trust document, specifying the terms, beneficiaries, and any conditions for distribution. It is advisable to consult with an attorney to ensure compliance with state laws. Once the document is finalized, the grantor must sign it in the presence of a notary public. Finally, transferring ownership of the assets to the trust is crucial, which may involve changing titles or deeds to reflect the trust as the new owner.

Legal use of the revocation trust

The legal use of a revocation trust is primarily for estate planning purposes. It allows the grantor to manage their assets during their lifetime while specifying how those assets should be distributed after death. This trust can help avoid probate, streamline the transfer of assets, and maintain privacy regarding the estate's contents. Additionally, it can provide instructions for asset management in the event the grantor becomes incapacitated. Understanding the legal framework surrounding revocable trusts is essential for ensuring they are utilized effectively and in accordance with state regulations.

Key elements of the revocation trust

Key elements of a revocation trust include the trust's name, the grantor's information, the designation of a trustee, and the identification of beneficiaries. The trust document should outline the powers granted to the trustee, including the authority to manage and distribute assets. It is also important to include provisions for revocation or amendment of the trust, ensuring the grantor retains control. Additionally, clear instructions regarding the management of assets, tax implications, and any specific conditions for distribution can enhance the trust's effectiveness and clarity.

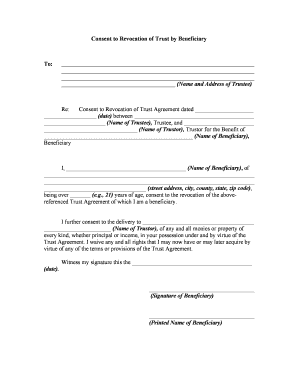

Required documents for a revocation trust

To establish a revocation trust, several documents are typically required. These include the trust agreement itself, which outlines the terms and conditions of the trust. Identification documents, such as a driver's license or passport, may also be necessary to verify the grantor's identity. If real estate or other titled assets are involved, deeds or titles reflecting the transfer to the trust will be required. It is advisable to consult with a legal professional to ensure all necessary documentation is prepared and compliant with state laws.

Examples of using a revocation trust

Examples of using a revocation trust include individuals who want to ensure their assets are distributed according to their wishes without the delays of probate. For instance, a parent may create a revocable trust to manage their assets for their minor children, specifying how and when the children will receive their inheritance. Another example is a couple who wishes to simplify the transfer of their shared assets upon the death of one spouse, allowing for a smoother transition without court involvement. These scenarios illustrate the versatility and practical benefits of a revocation trust in estate planning.

Quick guide on how to complete revocable trust

Prepare Revocable Trust effortlessly on any device

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, enabling you to obtain the appropriate form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without hurdles. Manage Revocable Trust on any platform with airSlate SignNow Android or iOS applications and enhance any document-focused task today.

The easiest way to adjust and eSign Revocable Trust without hassle

- Obtain Revocable Trust and then click Get Form to commence.

- Employ the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to secure your changes.

- Choose your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form retrieval, or mistakes that necessitate printing fresh copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and eSign Revocable Trust and guarantee exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a revocable trust and how does it work?

A revocable trust is a legal document that allows you to manage your assets during your lifetime and specify how they will be distributed after your death. You can change or revoke the trust at any time, providing flexibility. This type of trust helps avoid probate, ensuring a smooth transition of your assets to beneficiaries.

-

What are the benefits of using a revocable trust?

Using a revocable trust provides numerous benefits, such as asset management during your lifetime, avoidance of probate, and privacy in the distribution of your assets. It allows for the seamless transfer of assets, helping to reduce legal complications for your loved ones. Additionally, you maintain control over the assets as the trustee.

-

How does airSlate SignNow support the creation of a revocable trust?

airSlate SignNow simplifies the creation of a revocable trust by allowing users to eSign documents securely and efficiently. Our platform provides templates and tools to guide you through the trust-setting process. With seamless document management and signing features, you can easily handle your revocable trust paperwork.

-

What is the pricing structure for airSlate SignNow's trust management features?

airSlate SignNow offers competitive pricing plans tailored to meet different business needs, including those needing to manage a revocable trust. You can choose from various subscription levels based on the features you require. Each plan includes access to essential tools for document management and eSigning.

-

Can I integrate airSlate SignNow with other software for managing a revocable trust?

Yes, airSlate SignNow can be integrated with various third-party applications, enhancing your ability to manage a revocable trust effectively. These integrations allow for a seamless flow of information between platforms, improving efficiency. Check our integrations directory for specific software compatibility.

-

How do I ensure the security of my revocable trust documents with airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including those related to a revocable trust. We employ advanced encryption methods to protect your data during transmission and storage. Additionally, our platform includes features like user authentication and audit trails to enhance document security.

-

Is it easy to make changes to a revocable trust using airSlate SignNow?

Absolutely! Making changes to a revocable trust is straightforward with airSlate SignNow. Our platform allows you to edit and re-sign documents quickly, ensuring that updates to your trust can be made efficiently. This flexibility is one of the primary advantages of a revocable trust.

Get more for Revocable Trust

- Hawaii pre incorporation agreement shareholders agreement and confidentiality agreement hawaii form

- Hawaii bylaws form

- Hi corporations form

- Hawaii llc form

- Limited liability company llc operating agreement hawaii form

- Hi llc form

- Hawaii renunciation and disclaimer of property from will by testate hawaii form

- Hawaii lien form

Find out other Revocable Trust

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent