Mastering Form 8867 a Guide to Maximize Tax Credits 2024-2026

Understanding Form 8867

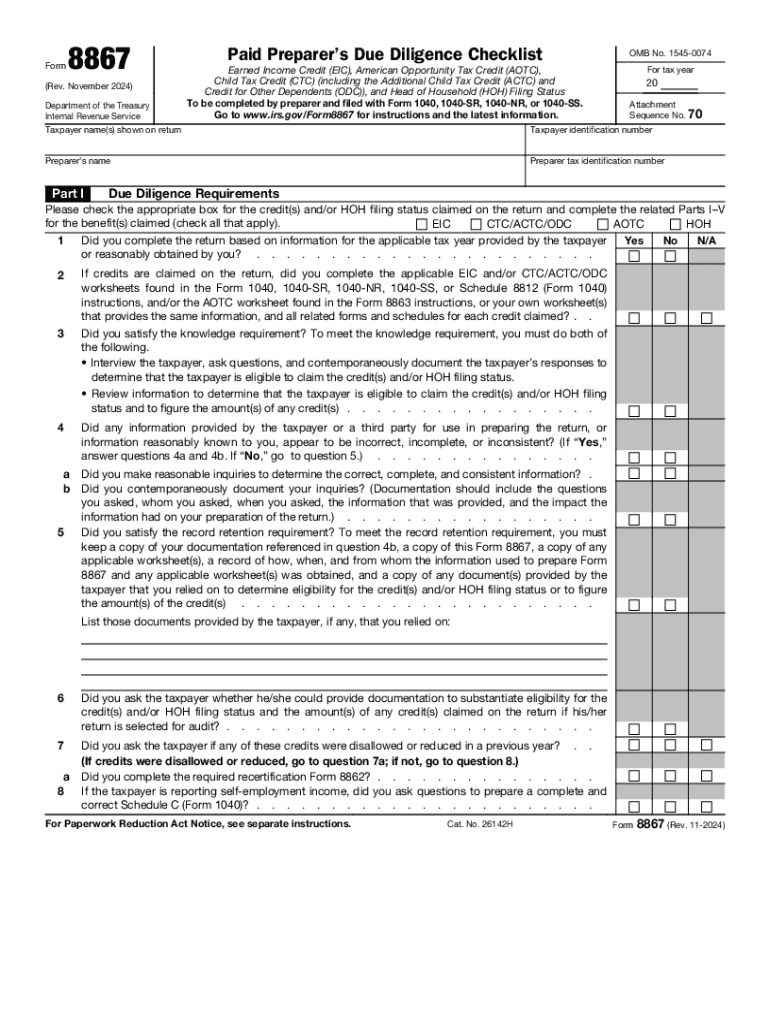

The IRS Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is essential for tax preparers to ensure compliance when claiming the Earned Income Tax Credit (EITC), Child Tax Credit (CTC), American Opportunity Tax Credit (AOTC), and other credits. This form helps preparers document their due diligence in verifying a taxpayer's eligibility for these credits. Utilizing Form 8867 is crucial for accurate tax filing and avoiding potential penalties.

Steps to Complete Form 8867

Completing Form 8867 involves several key steps:

- Gather necessary documentation from the taxpayer, including income statements, Social Security numbers, and proof of residency.

- Verify the taxpayer's eligibility for the credits claimed by reviewing their information against IRS guidelines.

- Complete each section of Form 8867 accurately, ensuring all required fields are filled out.

- Sign and date the form to certify that due diligence was performed.

- Retain a copy of the completed form along with the taxpayer's records for future reference.

IRS Guidelines for Form 8867

The IRS provides specific guidelines for using Form 8867. Tax preparers must ensure they understand the eligibility criteria for the credits being claimed. The IRS requires that preparers maintain documentation that supports the claims made on the form. This includes verifying the taxpayer's identity and eligibility for each credit. Non-compliance can lead to penalties, making adherence to these guidelines critical.

Required Documents for Form 8867

When preparing Form 8867, certain documents are necessary to support the claims made. These include:

- Proof of income, such as W-2 forms or 1099 forms.

- Social Security cards or ITINs for all individuals listed on the tax return.

- Documentation supporting residency, such as utility bills or lease agreements.

- Any other relevant records that substantiate the eligibility for the credits.

Penalties for Non-Compliance

Failure to comply with the requirements of Form 8867 can result in significant penalties for tax preparers. The IRS may impose fines for each failure to meet due diligence requirements. Additionally, if a preparer claims a credit without proper documentation, they may face further repercussions, including the potential loss of their ability to prepare tax returns. Understanding these penalties emphasizes the importance of meticulous record-keeping and compliance.

Eligibility Criteria for Credits on Form 8867

Eligibility for the credits claimed on Form 8867 is determined by several factors, including income level, number of dependents, and filing status. For the EITC, taxpayers must meet specific income thresholds and have qualifying children or meet certain criteria if they do not have children. The Child Tax Credit and other credits also have their own eligibility requirements. Tax preparers must be familiar with these criteria to ensure accurate claims.

Create this form in 5 minutes or less

Find and fill out the correct mastering form 8867 a guide to maximize tax credits

Create this form in 5 minutes!

How to create an eSignature for the mastering form 8867 a guide to maximize tax credits

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 8867 and why is it important?

Form 8867 is a crucial document used by tax preparers to ensure compliance with the Earned Income Tax Credit (EITC) requirements. It helps verify eligibility and prevents fraudulent claims. Understanding form 8867 is essential for tax professionals to provide accurate services to their clients.

-

How can airSlate SignNow help with form 8867?

airSlate SignNow streamlines the process of preparing and signing form 8867 by providing an easy-to-use platform for document management. Users can quickly send, eSign, and store form 8867 securely, ensuring compliance and efficiency in tax preparation. This simplifies the workflow for tax professionals.

-

What features does airSlate SignNow offer for managing form 8867?

airSlate SignNow offers features such as customizable templates, secure eSigning, and real-time tracking for form 8867. These tools enhance productivity and ensure that all necessary steps are completed accurately. Additionally, users can collaborate seamlessly with clients and colleagues.

-

Is there a cost associated with using airSlate SignNow for form 8867?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs, including those focused on managing form 8867. The pricing is competitive and designed to provide value for tax professionals looking for efficient document solutions. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for form 8867?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage form 8867 alongside your existing tools. This integration helps streamline your workflow and ensures that all documents are easily accessible and organized.

-

What are the benefits of using airSlate SignNow for form 8867?

Using airSlate SignNow for form 8867 offers numerous benefits, including enhanced security, improved efficiency, and reduced turnaround times. The platform allows for quick eSigning and document sharing, which can signNowly speed up the tax preparation process. This ultimately leads to better client satisfaction.

-

How secure is airSlate SignNow when handling form 8867?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive information related to form 8867. Users can trust that their documents are safe and secure throughout the signing process. This commitment to security is essential for maintaining client confidentiality.

Get more for Mastering Form 8867 A Guide To Maximize Tax Credits

Find out other Mastering Form 8867 A Guide To Maximize Tax Credits

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT