Form IRS 1040 Schedule R Fill Online, Printable 2024-2026

What is the IRS 1040 Schedule R?

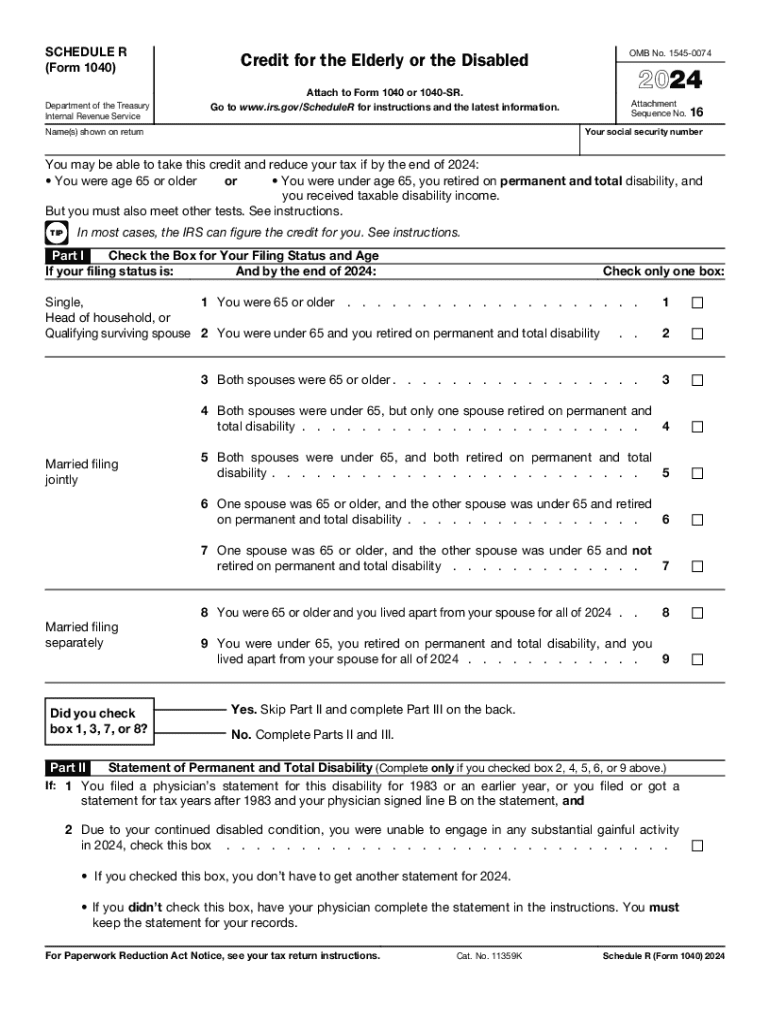

The IRS 1040 Schedule R is a tax form specifically designed for elderly and disabled taxpayers to claim a credit. This form allows eligible individuals to receive a tax benefit based on their age or disability status. The credit aims to provide financial relief by reducing the overall tax liability for those who qualify. Understanding the purpose and function of this form is essential for maximizing potential tax benefits.

Eligibility Criteria for the IRS 1040 Schedule R

To qualify for the IRS 1040 Schedule R, taxpayers must meet specific criteria. Generally, individuals must be age sixty-five or older, or they must be permanently and totally disabled. Additionally, the taxpayer's income must fall within certain limits to be eligible for the credit. It is important to review the eligibility requirements carefully to ensure compliance and maximize the potential benefits.

Steps to Complete the IRS 1040 Schedule R

Completing the IRS 1040 Schedule R involves several key steps:

- Gather necessary information, including income details and any relevant documentation regarding age or disability.

- Obtain the IRS 1040 Schedule R form, which can be filled out online or printed for manual completion.

- Fill in personal information, including your name, Social Security number, and filing status.

- Calculate the credit amount based on the provided instructions, ensuring all figures are accurate.

- Review the completed form for errors before submission.

How to Obtain the IRS 1040 Schedule R

The IRS 1040 Schedule R can be obtained easily through various methods. Taxpayers can download the form directly from the IRS website, where it is available in a printable format. Alternatively, individuals may also request a physical copy by contacting the IRS directly. Ensuring you have the correct and most recent version of the form is crucial for accurate filing.

Key Elements of the IRS 1040 Schedule R

Several key elements are essential to understand when working with the IRS 1040 Schedule R. These include:

- Filing Status: Indicate whether you are filing as single, married filing jointly, or married filing separately.

- Credit Calculation: Follow the instructions carefully to determine the amount of credit you are eligible to claim.

- Signature: Ensure the form is signed and dated to validate the submission.

Filing Deadlines for the IRS 1040 Schedule R

Taxpayers must be aware of the filing deadlines associated with the IRS 1040 Schedule R. Typically, the deadline for submitting tax forms, including the Schedule R, aligns with the annual tax return deadline, which is usually April fifteenth. However, extensions may be available under certain circumstances. It is advisable to stay informed about any changes to deadlines to avoid penalties.

Create this form in 5 minutes or less

Find and fill out the correct form irs 1040 schedule r fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form irs 1040 schedule r fill online printable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to IRS R?

airSlate SignNow is a powerful eSignature solution that enables businesses to send and eSign documents efficiently. It is particularly useful for IRS R-related documents, ensuring compliance and security in your transactions. With its user-friendly interface, you can streamline your document management process while adhering to IRS R requirements.

-

How much does airSlate SignNow cost for IRS R document management?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those focused on IRS R documentation. The cost-effective solutions ensure that you can manage your IRS R-related documents without breaking the bank. You can choose from monthly or annual subscriptions, depending on your usage and budget.

-

What features does airSlate SignNow offer for IRS R compliance?

airSlate SignNow includes features specifically designed to enhance IRS R compliance, such as secure eSigning, document tracking, and audit trails. These features help ensure that your IRS R documents are handled securely and in accordance with regulatory standards. Additionally, the platform allows for easy integration with other tools to further streamline your compliance processes.

-

Can airSlate SignNow integrate with other software for IRS R processes?

Yes, airSlate SignNow seamlessly integrates with various software applications that are essential for managing IRS R processes. This includes popular tools like CRM systems, cloud storage services, and accounting software. These integrations help you maintain a smooth workflow while ensuring that your IRS R documentation is easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for IRS R documentation?

Using airSlate SignNow for IRS R documentation offers numerous benefits, including increased efficiency, reduced paper usage, and enhanced security. The platform allows you to quickly send, sign, and store IRS R documents, saving you time and resources. Additionally, the electronic signature process is legally binding, ensuring that your IRS R documents are valid and enforceable.

-

Is airSlate SignNow secure for handling IRS R documents?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for handling IRS R documents. The platform employs advanced encryption and security protocols to protect your sensitive information. With features like two-factor authentication and secure cloud storage, you can trust that your IRS R documentation is safe from unauthorized access.

-

How does airSlate SignNow simplify the eSigning process for IRS R?

airSlate SignNow simplifies the eSigning process for IRS R by providing an intuitive interface that guides users through each step. You can easily upload your IRS R documents, add signers, and send them out for signatures in just a few clicks. This streamlined process reduces the time it takes to finalize IRS R documentation, allowing you to focus on your core business activities.

Get more for Form IRS 1040 Schedule R Fill Online, Printable

Find out other Form IRS 1040 Schedule R Fill Online, Printable

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast