Prior Year Products IRS Tax Forms2020 Schedule R Form and Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart 2022

Understanding the 2A Schedule Form

The 2A Schedule Form is an essential document for U.S. taxpayers, particularly those who qualify for a simplified tax filing process. This form allows individuals to report income, claim deductions, and determine their tax liability efficiently. The 1040A is designed for taxpayers with straightforward financial situations, such as those who do not itemize deductions and have a limited number of income sources. It is important to understand the specific eligibility criteria for using this form, as well as the benefits it offers in terms of ease of completion and filing.

Steps to Complete the 2A Schedule Form

Completing the 2A Schedule Form involves several key steps that ensure accurate reporting of your financial information. Start by gathering all necessary documents, including W-2 forms, 1099 forms, and any other relevant income statements. Follow these steps for a smooth completion:

- Begin with your personal information, including your name, address, and Social Security number.

- Report your income in the appropriate sections, ensuring all figures are accurate and supported by documentation.

- Claim any eligible deductions, such as the standard deduction or certain credits, as applicable.

- Calculate your total tax liability based on the information provided.

- Review the form for accuracy before submission to avoid any potential issues.

Legal Use of the 2A Schedule Form

The 2A Schedule Form is legally binding once completed and signed. It is crucial to ensure that all information reported is truthful and accurate, as providing false information can lead to penalties or legal repercussions. When submitting the form electronically, using a reliable eSignature solution can enhance the security and legality of your submission. Compliance with IRS regulations is essential, and understanding the legal implications of the information provided on this form is vital for all taxpayers.

Filing Deadlines and Important Dates

Filing deadlines for the 2A Schedule Form are critical to avoid penalties. Typically, the deadline for filing individual tax returns is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may be available, allowing additional time for submission. Keeping track of these important dates ensures compliance and helps avoid unnecessary fees.

Required Documents for the 2A Schedule Form

To complete the 2A Schedule Form accurately, taxpayers must gather specific documents that support their income and deductions. Commonly required documents include:

- W-2 forms from employers, detailing wages and withheld taxes.

- 1099 forms for other income sources, such as freelance work or interest income.

- Records of any deductible expenses, including educational costs or mortgage interest statements.

- Any additional documentation that may support claims for credits or deductions.

Eligibility Criteria for the 2A Schedule Form

Eligibility for the 2A Schedule Form is determined by several factors. Taxpayers must meet specific criteria to use this simplified form, including:

- Filing status must be single, married filing jointly, or head of household.

- Taxable income must be below a certain threshold, which varies based on filing status.

- Taxpayers cannot claim itemized deductions, but they may claim certain credits.

- Income must come from allowable sources, such as wages, salaries, and pensions.

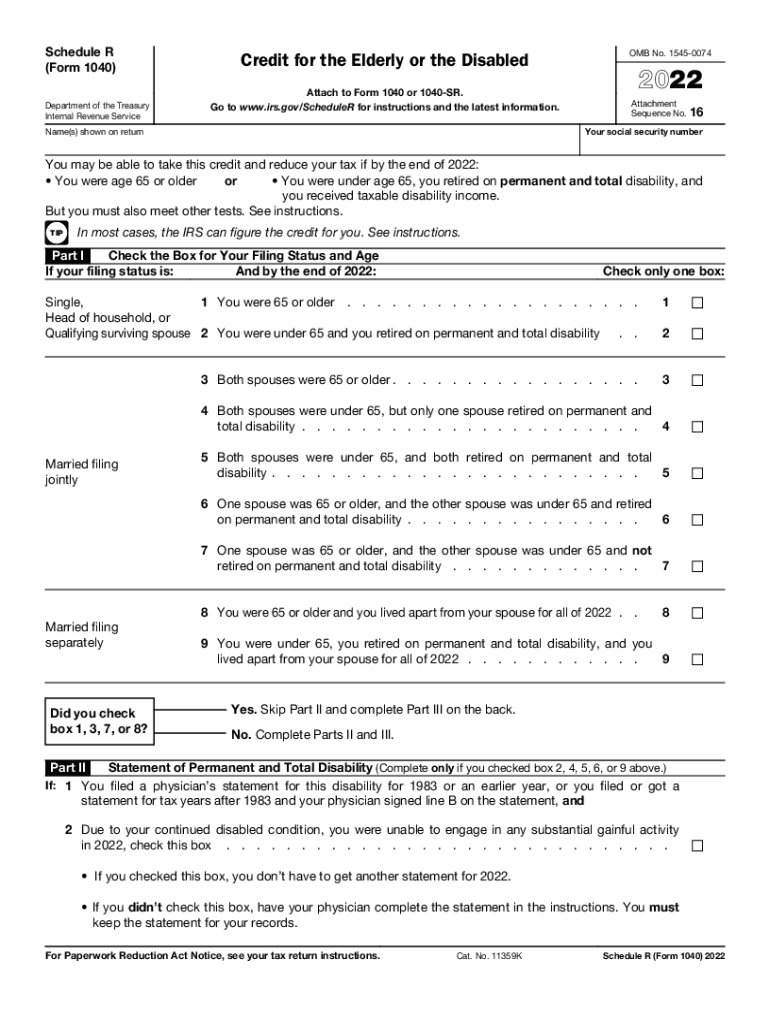

Quick guide on how to complete prior year products irs tax forms2020 schedule r form and instructions form 1040federal form 1040 schedule r instructions

Effortlessly prepare Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, edit, and eSign your documents swiftly without delays. Manage Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart with ease

- Obtain Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart and click Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you prefer. Edit and eSign Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct prior year products irs tax forms2020 schedule r form and instructions form 1040federal form 1040 schedule r instructions

Create this form in 5 minutes!

People also ask

-

What is the 2017 1040a schedule form used for?

The 2017 1040a schedule form is used by taxpayers to report their income and claim deductions without the complexity of a full 1040 form. This simplified version allows for an easy filing process for those with straightforward tax situations. It is essential for ensuring accurate reporting and maximizing potential refunds.

-

How can airSlate SignNow help with filling out the 2017 1040a schedule form?

airSlate SignNow offers a user-friendly platform that allows you to easily fill out, sign, and send your 2017 1040a schedule form electronically. With our intuitive interface, you can efficiently manage all your tax documents, ensuring you complete them accurately and on time. The electronic signature feature simplifies the signing process, reducing time and hassle.

-

Is there a cost associated with using airSlate SignNow for the 2017 1040a schedule form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different needs and budgets. Our cost-effective solution allows you to efficiently manage your documents, including the 2017 1040a schedule form, without overspending. You can choose a plan that best suits your requirements.

-

What features does airSlate SignNow offer for managing my 2017 1040a schedule form?

airSlate SignNow provides a variety of features to simplify the management of your 2017 1040a schedule form. These include drag-and-drop document uploads, automatic reminders for deadlines, and secure cloud storage. Our platform also supports seamless collaboration, allowing you to share your forms with accountants or tax professionals easily.

-

Can I integrate airSlate SignNow with other tools for managing my 2017 1040a schedule form?

Yes, airSlate SignNow integrates with several popular tools and applications to streamline your workflows. Whether you need integration with cloud storage services, CRM systems, or project management tools, our solution ensures that you can manage your 2017 1040a schedule form alongside other necessary applications effectively. This integration enhances productivity and organization.

-

What are the benefits of using airSlate SignNow for my tax documents, including the 2017 1040a schedule form?

Using airSlate SignNow for your tax documents, including the 2017 1040a schedule form, provides numerous benefits such as enhanced security, reliability, and ease of use. Our platform ensures that your documents are stored securely and are easily accessible anywhere. Additionally, you can save time and reduce the stress of tax season with our streamlined electronic signature process.

-

How do I ensure my 2017 1040a schedule form is filed correctly using airSlate SignNow?

To ensure your 2017 1040a schedule form is filed correctly using airSlate SignNow, follow our guided steps and utilize our built-in checklist features. Make sure to review all the information you input and verify that all required fields are completed. Additionally, you can collaborate with tax professionals through our sharing options to avoid any mistakes.

Get more for Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart

- Amendment to prenuptial or premarital agreement ohio form

- Financial statements only in connection with prenuptial premarital agreement ohio form

- Revocation of premarital or prenuptial agreement ohio form

- Oh divorce form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497322110 form

- Ohio corporation form

- Oh corporation online form

- Ohio confidentiality 497322113 form

Find out other Prior Year Products IRS Tax Forms2020 Schedule R Form And Instructions Form 1040Federal Form 1040 Schedule R Instructions ESmart

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template

- eSign Nebraska Finance & Tax Accounting Business Letter Template Online

- eSign Nevada Finance & Tax Accounting Resignation Letter Simple

- eSign Arkansas Government Affidavit Of Heirship Easy

- eSign California Government LLC Operating Agreement Computer

- eSign Oklahoma Finance & Tax Accounting Executive Summary Template Computer

- eSign Tennessee Finance & Tax Accounting Cease And Desist Letter Myself

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later