Schedule R Form 1040 or 1040 SR Internal Revenue 2020

What is the Schedule R Form 1040 or 1040 SR?

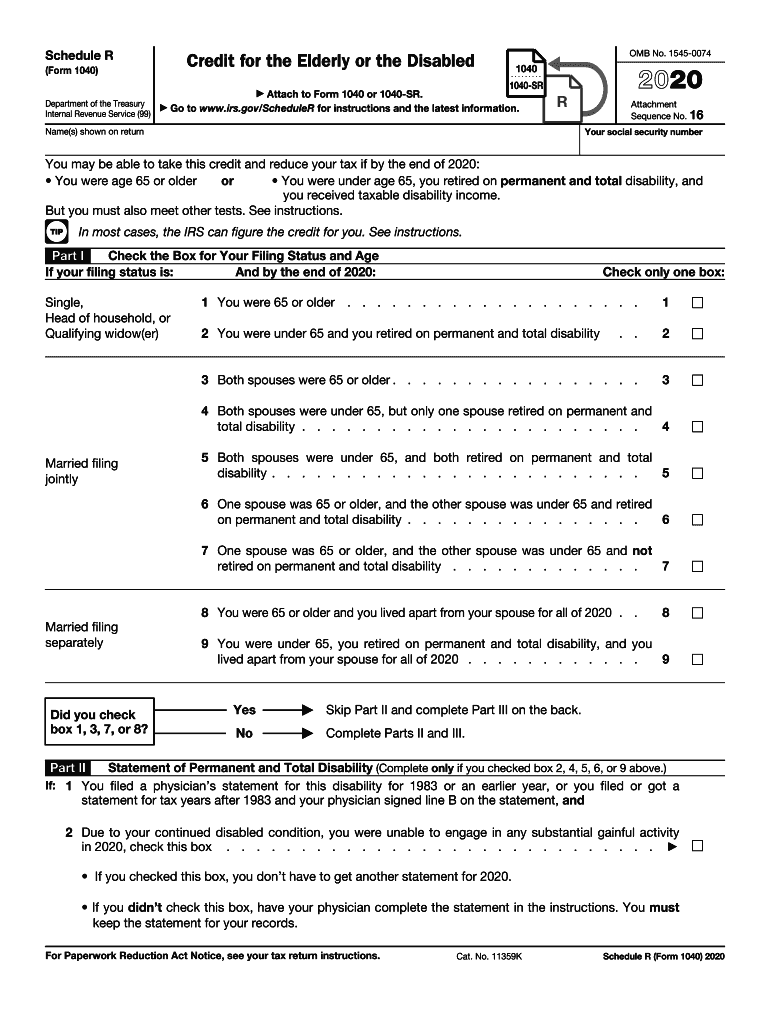

The Schedule R form is a supplemental tax form used by eligible taxpayers to claim the Credit for the Elderly or the Disabled. This form is attached to the standard Form 1040 or Form 1040 SR when filing your federal income tax return. The Schedule R allows individuals aged sixty-five or older, or those who are retired on permanent and total disability, to potentially reduce their tax liability. Understanding this form is essential for those who qualify, as it can provide significant financial benefits.

Steps to Complete the Schedule R Form 1040 or 1040 SR

Completing the Schedule R form involves several key steps:

- Gather necessary documents, including your Form 1040 or 1040 SR, Social Security information, and any other income sources.

- Determine your eligibility based on age or disability status.

- Fill out the required sections of the Schedule R, including personal information and income details.

- Calculate the credit amount based on the instructions provided with the form.

- Attach the completed Schedule R to your Form 1040 or 1040 SR before submission.

Following these steps ensures that you accurately report your eligibility and claim any credits you may be entitled to.

How to Obtain the Schedule R Form 1040 or 1040 SR

The Schedule R form can be obtained through several methods:

- Visit the official IRS website to download a printable version of the form.

- Request a physical copy by calling the IRS or visiting a local IRS office.

- Access tax preparation software that includes the Schedule R form as part of its filing process.

Having the correct form is crucial for ensuring that you can accurately report and claim any eligible credits.

Key Elements of the Schedule R Form 1040 or 1040 SR

Several important elements must be included in the Schedule R form:

- Personal Information: This includes your name, Social Security number, and filing status.

- Income Details: Report all sources of income, including pensions and Social Security benefits.

- Credit Calculation: Follow the IRS guidelines to determine the amount of credit you may claim.

- Signature: Ensure that you sign and date the form before submission.

Each of these elements plays a critical role in the accuracy and validity of your tax return.

IRS Guidelines for Filing Schedule R

The IRS provides specific guidelines for filing the Schedule R form. It is important to review the instructions carefully to ensure compliance:

- Check eligibility requirements based on age or disability.

- Be aware of any income limitations that may affect your credit amount.

- Understand the filing deadlines to avoid penalties.

Following these guidelines helps ensure that your tax return is filed correctly and on time.

Filing Deadlines for Schedule R

Filing deadlines for the Schedule R form align with the general tax return deadlines. Typically, the deadline for submitting your federal income tax return is April fifteenth of each year. If you require additional time, you may file for an extension, but it is essential to ensure that any taxes owed are paid by the original deadline to avoid penalties. Be aware of any changes in deadlines that may occur due to special circumstances or IRS announcements.

Quick guide on how to complete 2020 schedule r form 1040 or 1040 sr internal revenue

Complete Schedule R Form 1040 Or 1040 SR Internal Revenue effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Manage Schedule R Form 1040 Or 1040 SR Internal Revenue on any gadget using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Schedule R Form 1040 Or 1040 SR Internal Revenue with ease

- Locate Schedule R Form 1040 Or 1040 SR Internal Revenue and click on Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow has designed specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Schedule R Form 1040 Or 1040 SR Internal Revenue and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule r form 1040 or 1040 sr internal revenue

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule r form 1040 or 1040 sr internal revenue

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the 2018 1040a schedule and how does it work?

The 2018 1040a schedule is a simplified tax form used by taxpayers to report income, deductions, and credits. It is designed for individuals with simpler tax situations. Using the 2018 1040a schedule allows you to file your federal tax return quickly and efficiently.

-

How can airSlate SignNow help with signing the 2018 1040a schedule?

airSlate SignNow provides a streamlined solution for electronically signing your 2018 1040a schedule and other tax documents. Our platform ensures that you can easily send, sign, and store your forms securely, making tax season less stressful.

-

Are there any costs associated with using airSlate SignNow for my 2018 1040a schedule?

airSlate SignNow offers a cost-effective solution for eSigning documents, including the 2018 1040a schedule. We provide various pricing plans to suit different business needs without compromising on features, ensuring you get great value.

-

Can I integrate airSlate SignNow with other applications for my 2018 1040a schedule?

Yes, airSlate SignNow easily integrates with multiple applications, allowing you to manage your 2018 1040a schedule and other documents seamlessly. This compatibility helps streamline your workflow and enhances productivity.

-

What features does airSlate SignNow offer to assist with tax documents like the 2018 1040a schedule?

With airSlate SignNow, you can enjoy features like document templates, advanced security options, and real-time tracking for your 2018 1040a schedule. These tools help simplify the eSigning process and ensure compliance with tax regulations.

-

Is it safe to use airSlate SignNow for my 2018 1040a schedule?

Absolutely! airSlate SignNow uses advanced encryption and security protocols to protect your documents, including the 2018 1040a schedule. You can trust our platform to keep your sensitive information secure.

-

Can I access my signed 2018 1040a schedule on multiple devices?

Yes, airSlate SignNow is cloud-based, which means you can access your signed 2018 1040a schedule from any device with internet access. This flexibility allows you to manage your documents on the go.

Get more for Schedule R Form 1040 Or 1040 SR Internal Revenue

- 1 form for certificate for structural design sufficiency to be submitted before issue of planning permission with respect to

- 1377 lawrence avenue east form

- Ps3 form

- Pndt form f new format 2022

- Printable career interest inventory form

- Hfs 2538b form

- Form 511b request for excursion approval by bb deca ontario

- U s navy fleet bands audition application form

Find out other Schedule R Form 1040 Or 1040 SR Internal Revenue

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast

- eSignature Wyoming Education Quitclaim Deed Easy

- eSignature Alaska Government Agreement Fast