Colorado Corporation Llc Form

What is the Colorado Corporation LLC?

The Colorado Corporation LLC is a legal entity that combines the benefits of a corporation and a limited liability company (LLC). It provides personal liability protection to its owners, known as members, while allowing for flexible management structures and pass-through taxation. This means that profits and losses can be reported on the members' personal tax returns, avoiding double taxation typically associated with corporations. Establishing a Colorado Corporation LLC is a popular choice for entrepreneurs and small business owners seeking to protect their personal assets while enjoying operational flexibility.

Steps to Complete the Colorado Corporation LLC

Completing the Colorado Corporation LLC involves several key steps to ensure compliance with state regulations. First, choose a unique name for your LLC that complies with Colorado naming requirements. Next, designate a registered agent who will receive legal documents on behalf of the LLC. After that, file the Articles of Organization with the Colorado Secretary of State, providing essential information such as the LLC name, registered agent details, and the management structure. Once approved, obtain any necessary business licenses and permits, and consider drafting an operating agreement to outline the management and operational procedures of the LLC.

Legal Use of the Colorado Corporation LLC

The Colorado Corporation LLC can be used for various legal and business purposes. It is suitable for small businesses, startups, and even larger enterprises looking to limit personal liability. As a legal entity, it can enter contracts, own property, and sue or be sued in its own name. Additionally, it provides a formal structure that can enhance credibility with clients and investors. However, it is crucial to adhere to state regulations, including filing annual reports and maintaining proper records, to ensure the LLC remains in good standing.

Required Documents

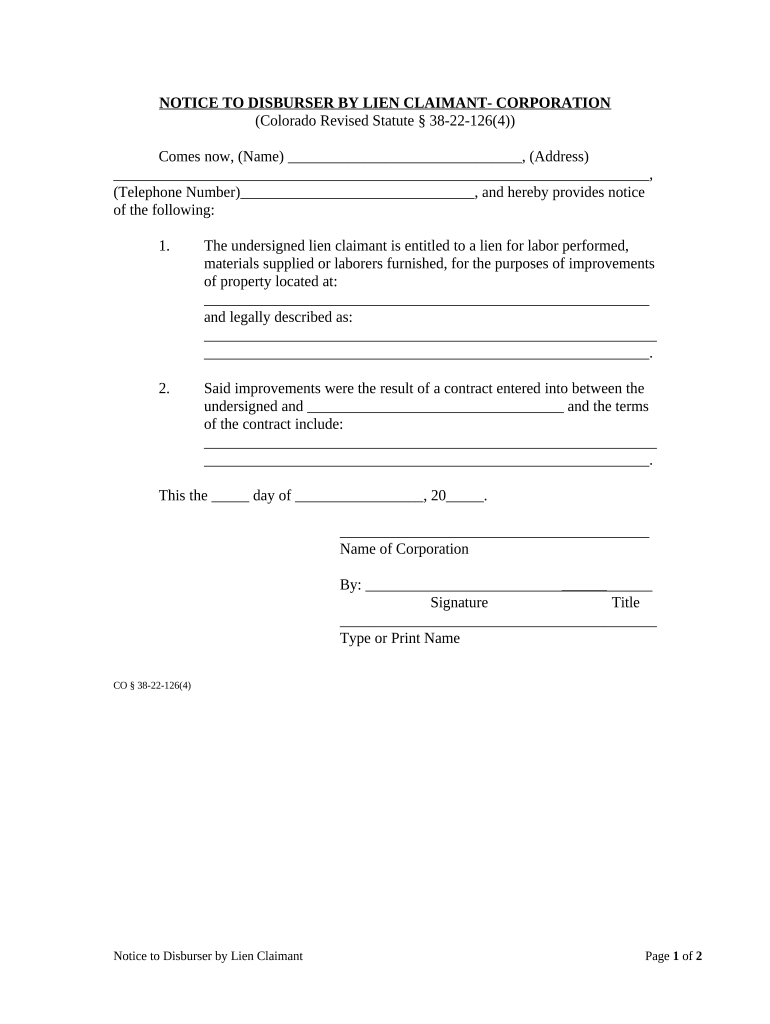

To establish a Colorado Corporation LLC, several documents are required. The primary document is the Articles of Organization, which must be filed with the Colorado Secretary of State. This document includes the LLC's name, registered agent information, and management structure. Additionally, you may need to prepare an operating agreement, although it is not mandatory, it is highly recommended to outline the roles and responsibilities of members. Depending on your business type, you may also need to obtain specific licenses or permits to operate legally within your industry.

Eligibility Criteria

To form a Colorado Corporation LLC, the members must meet certain eligibility criteria. There are no restrictions on the number of members, and they can be individuals, corporations, or other LLCs. However, at least one member must be designated as a registered agent with a physical address in Colorado. Additionally, the chosen name for the LLC must be distinguishable from existing entities registered in the state. It is also essential to comply with any industry-specific regulations that may apply to your business type.

Form Submission Methods

Submitting the Colorado Corporation LLC formation documents can be done through various methods. The most efficient way is to file online through the Colorado Secretary of State's website, which allows for immediate processing. Alternatively, you can submit the Articles of Organization by mail or in person at the Secretary of State's office. If filing by mail, ensure that you include the appropriate filing fee and any additional required documents. Online submission is generally recommended for its speed and convenience.

Quick guide on how to complete colorado corporation llc 497299966

Effortlessly prepare Colorado Corporation Llc on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can easily find the correct template and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents promptly without any interruptions. Work on Colorado Corporation Llc using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The simplest method to edit and electronically sign Colorado Corporation Llc without effort

- Find Colorado Corporation Llc and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and electronically sign Colorado Corporation Llc and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado corporation LLC?

A Colorado corporation LLC is a type of business entity that combines the benefits of a corporation and a limited liability company. It allows for personal asset protection while also providing flexibility in management and taxation. This structure is ideal for entrepreneurs looking to establish a business in Colorado.

-

How do I form a Colorado corporation LLC?

To form a Colorado corporation LLC, you'll need to file Articles of Organization with the Colorado Secretary of State. This includes providing necessary details about your business, such as its name, address, and management structure. Once filed, you must comply with ongoing regulations to maintain your status as a recognized Colorado corporation LLC.

-

What are the costs associated with a Colorado corporation LLC?

Forming a Colorado corporation LLC involves certain costs, including filing fees for Articles of Organization and annual renewal fees. The initial filing fee is typically around $50, while annual reports cost approximately $10. Additionally, it’s wise to consider any legal or consulting fees if you seek professional assistance.

-

What are the tax advantages of a Colorado corporation LLC?

A Colorado corporation LLC offers pass-through taxation, meaning business profits are only taxed at the individual level, avoiding double taxation. This is beneficial for many small business owners. Additionally, Colorado allows various tax deductions that LLCs can take advantage of, improving overall profitability.

-

What features does airSlate SignNow offer for Colorado corporation LLCs?

airSlate SignNow provides a versatile eSignature platform that is perfect for Colorado corporation LLCs. Features include easy document signing, real-time collaboration, and secure storage. This ensures you can manage your legal documents efficiently and comply with state regulations seamlessly.

-

Can I integrate airSlate SignNow with other software for my Colorado corporation LLC?

Yes, airSlate SignNow supports integration with various applications to enhance functionality for your Colorado corporation LLC. Whether it's CRM systems, cloud storage solutions, or productivity tools, integration helps streamline your workflow and manage documents effectively across platforms.

-

How does airSlate SignNow improve document security for Colorado corporation LLCs?

Security is a top priority for airSlate SignNow, especially for Colorado corporation LLCs handling sensitive documents. The platform employs industry-standard encryption and complies with regulations like GDPR. Regular audits and secure access controls further ensure your documents remain protected.

Get more for Colorado Corporation Llc

- Annual crane inspection form pdf

- Navy voluntary statement form

- Padi emergency action plan form

- Nj paad application form

- Jim d harlan memorial scholarship for graduating high wocut form

- Arkansas quit claim deed pdf form

- Notice of claim against the state of arizona claim form

- Cv 035 subpoena trial hrng dep rev 06 14 form

Find out other Colorado Corporation Llc

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple

- eSignature West Virginia Sale of Shares Agreement Later

- Electronic signature Kentucky Affidavit of Service Mobile

- How To Electronic signature Connecticut Affidavit of Identity