Current Individual Income Tax FormsState Tax Commission 2022

Understanding the Idaho Form 39NR

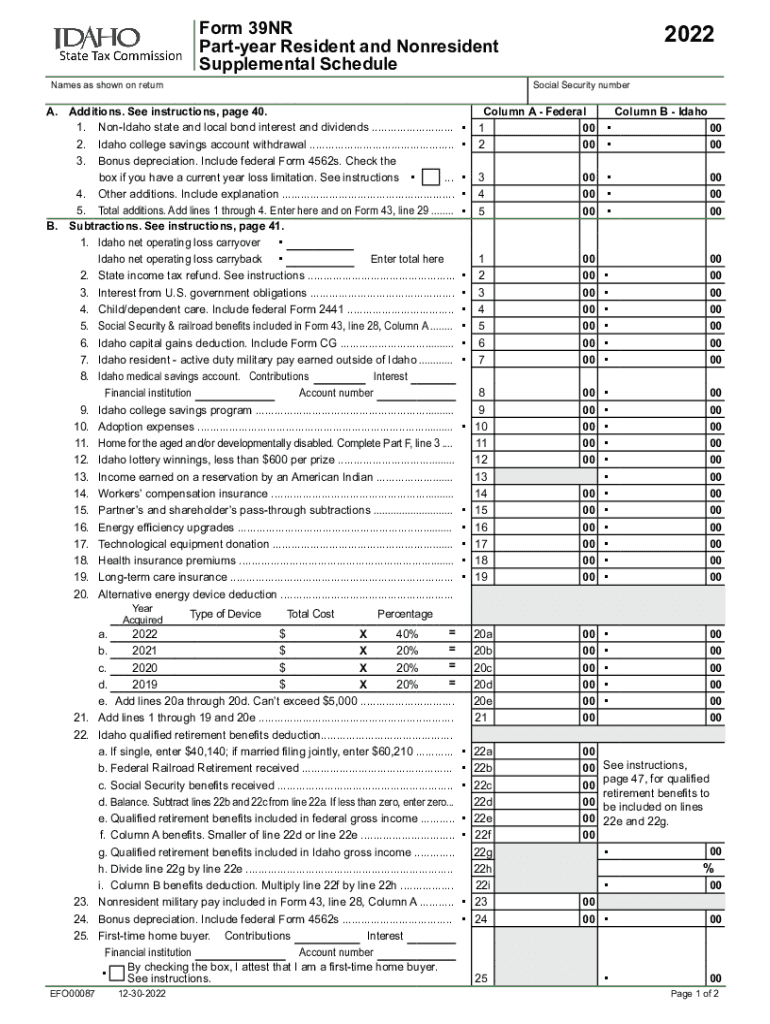

The Idaho Form 39NR is a tax form specifically designed for non-residents who earn income in Idaho. This form allows individuals to report their income and calculate the taxes owed to the state. It is crucial for non-residents to understand the requirements and implications of filing this form, as it ensures compliance with Idaho tax laws. The form is part of the state’s efforts to accurately assess tax liabilities for individuals who do not reside in Idaho but have earned income within its borders.

Steps to Complete the Idaho Form 39NR

Completing the Idaho Form 39NR involves several key steps:

- Gather necessary documentation, including W-2 forms, 1099s, and any other income statements.

- Fill out the personal information section, ensuring accuracy in your name, address, and Social Security number.

- Report your total income earned in Idaho, including wages, dividends, and any other sources of income.

- Calculate your Idaho tax liability based on the income reported, applying any applicable deductions or credits.

- Review the completed form for accuracy before submission.

Legal Use of the Idaho Form 39NR

The Idaho Form 39NR is legally binding when completed accurately and submitted on time. It is essential that individuals understand the legal implications of filing this form, as it serves as an official declaration of income and tax liability to the state. Failure to file or inaccuracies in the form can lead to penalties or audits by the Idaho State Tax Commission. Utilizing digital tools to complete and submit the form can enhance security and ensure compliance with legal standards.

Filing Deadlines for the Idaho Form 39NR

Filing deadlines for the Idaho Form 39NR are critical for avoiding penalties. Typically, the form must be submitted by April 15 of the year following the tax year in question. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is important for non-residents to mark their calendars and ensure timely submission to avoid interest and penalties on unpaid taxes.

Form Submission Methods for the Idaho Form 39NR

Non-residents can submit the Idaho Form 39NR through various methods:

- Online submission through the Idaho State Tax Commission’s e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the Idaho State Tax Commission.

- In-person submission at designated tax offices, although this method may require an appointment.

Key Elements of the Idaho Form 39NR

Understanding the key elements of the Idaho Form 39NR is essential for accurate completion:

- Personal Information: Includes your name, address, and Social Security number.

- Income Reporting: Details all income earned in Idaho, including wages and other sources.

- Tax Calculation: Provides a breakdown of how tax liability is determined based on reported income.

- Deductions and Credits: Lists any applicable deductions or credits that may reduce tax liability.

Eligibility Criteria for the Idaho Form 39NR

To file the Idaho Form 39NR, individuals must meet specific eligibility criteria. Primarily, the form is intended for non-residents who earn income in Idaho. This includes individuals working in Idaho but residing in another state. Additionally, those who have received income from Idaho sources, such as rental properties or business operations, may also be required to file this form. Understanding these criteria is vital for compliance and accurate tax reporting.

Quick guide on how to complete current individual income tax formsstate tax commission

Effortlessly prepare Current Individual Income Tax FormsState Tax Commission on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Current Individual Income Tax FormsState Tax Commission on any platform with airSlate SignNow's Android or iOS apps and enhance any document-focused process today.

The easiest way to edit and eSign Current Individual Income Tax FormsState Tax Commission with ease

- Find Current Individual Income Tax FormsState Tax Commission and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight necessary parts of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your preference. Edit and eSign Current Individual Income Tax FormsState Tax Commission and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct current individual income tax formsstate tax commission

Create this form in 5 minutes!

How to create an eSignature for the current individual income tax formsstate tax commission

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Idaho Form 39NR used for?

The Idaho Form 39NR is designed for non-residents to report income earned in Idaho. This form is crucial for complying with Idaho tax laws, ensuring that all non-resident earnings are correctly reported and taxed. Using airSlate SignNow to eSign your Idaho Form 39NR streamlines the process, making it easy and efficient.

-

How can I complete the Idaho Form 39NR online?

You can complete the Idaho Form 39NR online using airSlate SignNow’s user-friendly platform. Our service allows you to fill out the form digitally, ensuring accuracy and convenience. Additionally, you can easily eSign and send the form directly to the Idaho State Tax Commission from anywhere.

-

What features does airSlate SignNow offer for managing the Idaho Form 39NR?

airSlate SignNow offers a variety of features to effectively manage the Idaho Form 39NR, including document templates, eSigning capabilities, and real-time tracking of document status. Our platform is built to simplify the workflow, providing you with a seamless experience for document handling and submission. With our integrations, you can even automate parts of the filing process.

-

Is there a cost to use airSlate SignNow for the Idaho Form 39NR?

Yes, there is a cost associated with using airSlate SignNow, but our pricing is budget-friendly and provides great value for businesses. We offer various subscription plans tailored to different needs, making it affordable to eSign documents like the Idaho Form 39NR. Check our pricing page to find the best plan for you.

-

Can I use airSlate SignNow to store my Idaho Form 39NR documents?

Absolutely! airSlate SignNow includes secure cloud storage for your Idaho Form 39NR and other important documents. This feature ensures that all your documents are safely stored, easily accessible, and organized, which is essential for annual tax filing and record-keeping.

-

What are the benefits of using airSlate SignNow for the Idaho Form 39NR?

Using airSlate SignNow for your Idaho Form 39NR offers numerous benefits, including enhanced efficiency, improved accuracy, and reduced paperwork. Our platform eliminates the hassles of traditional methods and provides fast turnaround times. You'll also benefit from better document tracking and management.

-

Does airSlate SignNow integrate with other software for filing the Idaho Form 39NR?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software solutions, making it easy to file your Idaho Form 39NR. This integration helps streamline your workflow, ensuring that all your financial data aligns perfectly for faster processing. You can connect with popular tools to enhance your filing experience.

Get more for Current Individual Income Tax FormsState Tax Commission

Find out other Current Individual Income Tax FormsState Tax Commission

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template

- How To Electronic signature Kentucky Investment Contract

- Electronic signature Tennessee Consulting Agreement Template Fast

- How To Electronic signature California General Power of Attorney Template

- eSignature Alaska Bill of Sale Immovable Property Online

- Can I Electronic signature Delaware General Power of Attorney Template

- Can I Electronic signature Michigan General Power of Attorney Template

- Can I Electronic signature Minnesota General Power of Attorney Template

- How Do I Electronic signature California Distributor Agreement Template

- eSignature Michigan Escrow Agreement Simple